WHAT IS A SPREAD?

⇒ Warning. Any strategy does not guarantee profit on every trade. Strategy is an algorithm of actions. Any algorithm is a systematic work. Success in trading is to adhere to systematic work.

A spread is the difference between the best bid and ask.

In other words, the spread is the distance between:

- the highest price a buyer is ready to pay;

- the lowest price at which the seller is ready to part with a financial asset (futures contract, stock or cryptocurrency).

Spreads can be narrow or wide. If someone talks about fixed spreads, it is most likely a forex broker who does not place clients’ orders on a real exchange.

Spreads are usually narrow in popular exchange markets with a large number of buyers and sellers. For example, the price step is 1 cent in the oil market. The spread is practically zero because there are a lot of buyers at $77.15, but at the same time, there are a lot of sellers at $77.16.

Wide spreads occur if there are few buyers and sellers in the market.

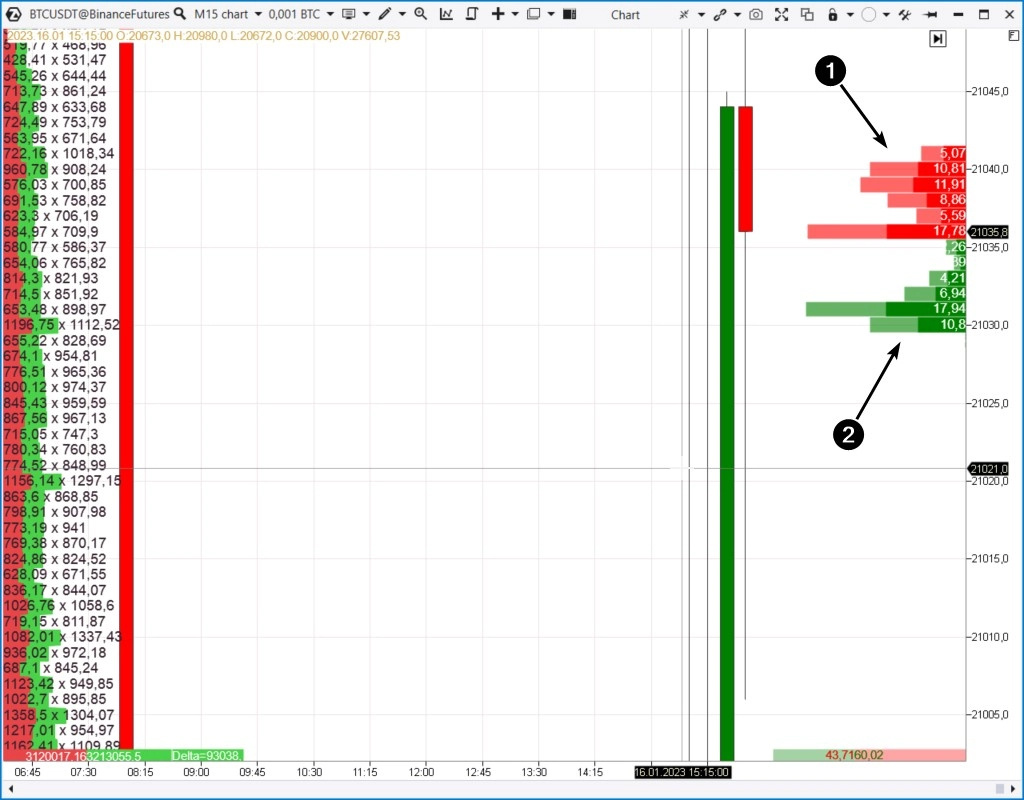

It is easy to monitor the spread, asks (1) and bids (2) in the ATAS platform using the Depth of Market indicator or a specialized Smart DOM module.

HOW TO IDENTIFY WIDENING SPREADS

To identify the widening spread in real time, you can use the market depth indicator in the ATAS platform. The only downside is that monitoring spread changes can seem too tedious and monotonous.

However, identifying the spread on a historical chart seems like a more interesting task. Try switching to non-standard chart types. For example, range charts. When the spread exceeds the range value, you will see characteristic gaps.

You can also try tick charts. Below you see a bitcoin futures chart. A small tick is selected for illustrative purposes, the classic ATR indicator is also added to the chart.

On the left side of the chart, you can see that the price rose steadily in a gradual uptrend. There were no price spikes between adjacent trades.

Then the amplitude of fluctuations increased. The tick chart began to draw wide candles. As if a seismologist detected an earthquake. It is likely that the spread was widening at that moment, therefore, there were price spikes between adjacent trades.

ATR helps visually recognize this moment.

Market context aside, it can be assumed that the balance of supply and demand changed. There was a trend reversal. The amplitude returned to normal (more or less), but the price plunged down.

And here is another example of a tick chart with the ATR indicator. This is DAX index futures.

The arrows point at the indicator spikes at night. This can be explained by the widening spread – trading activity decreases and the DOM gets “empty”.

DANGEROUS FEATURES OF THE WIDENING SPREAD

The widening spread means that the risk is increasing. If you buy during the wide spread, you can only make money if the price passes the entire spread’s width.

Wide spread = more chances that:

- a stop-loss will be activated;

- an order will not be executed at the desired price;

- you will make a mistake because the decision must be made quickly (unless we are talking about the widening spread occurring at night in an unpopular market).

HOW TO USE THE WIDENING SPREAD IN TRADING

The example above shows how the widening spread can indicate a trend reversal. But how accurate is this signal? Does a reversal always occur?

First you need to carefully analyze the history and characteristics of the market. Due to the difference in order matching algorithms and the unique features of each market, spread widening patterns can have a different look. Moreover, spreads may not widen at all or widen very rarely.

The examples below can provide some food for thought, as well as ideas for building your own strategies.

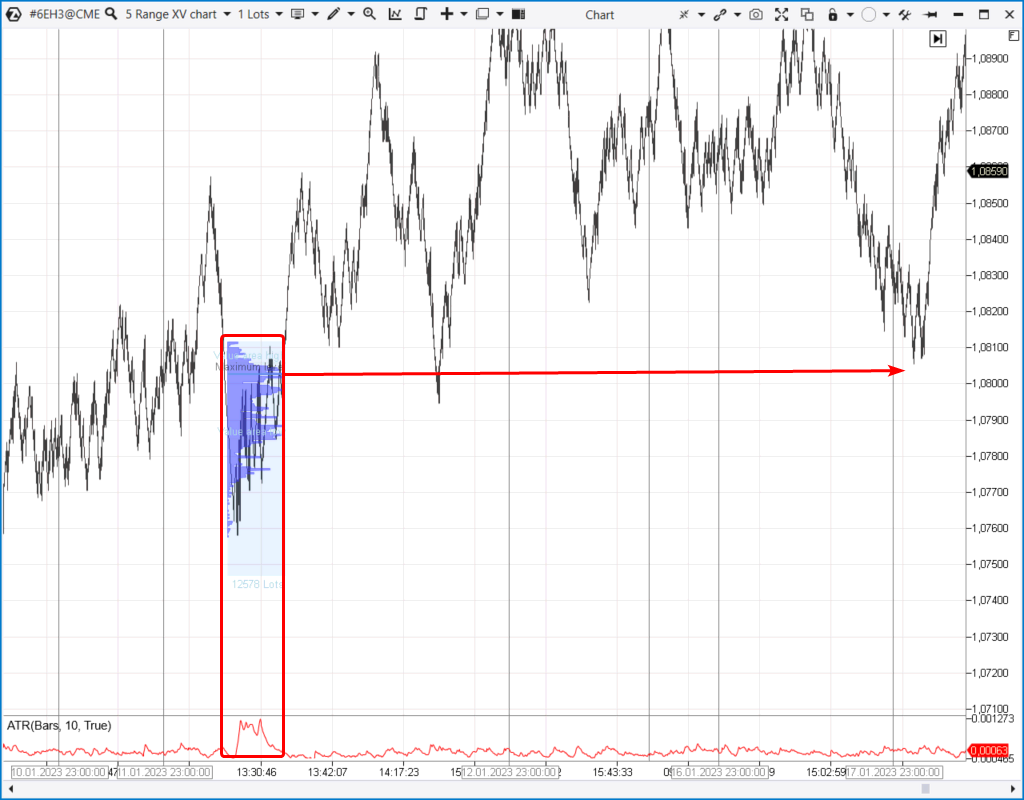

Example 1. Euro futures

This is a range chart. At some point, the candles became wider than the set range size. The ATR indicator signals a key moment when the spread must have been widened. It seems that after a period of growth, a sharp decline in the price led to some panic.

It is likely that the spread widened during the panic. This can be seen from the ATR indicator.

The price went up after a spike on the ATR indicator — this gives reason to believe that weak buyers were “thrown out”, and the mood remained bullish.

It can be applied in practice in the following ways:

- build a profile for a wide-spread zone;

- find high volume levels on the profile;

- track bounces (tests) from this level using additional signals on lower time frames.

Example 2. Gold futures

The widening spread on the tick chart in this example is an omen of a bearish reversal.

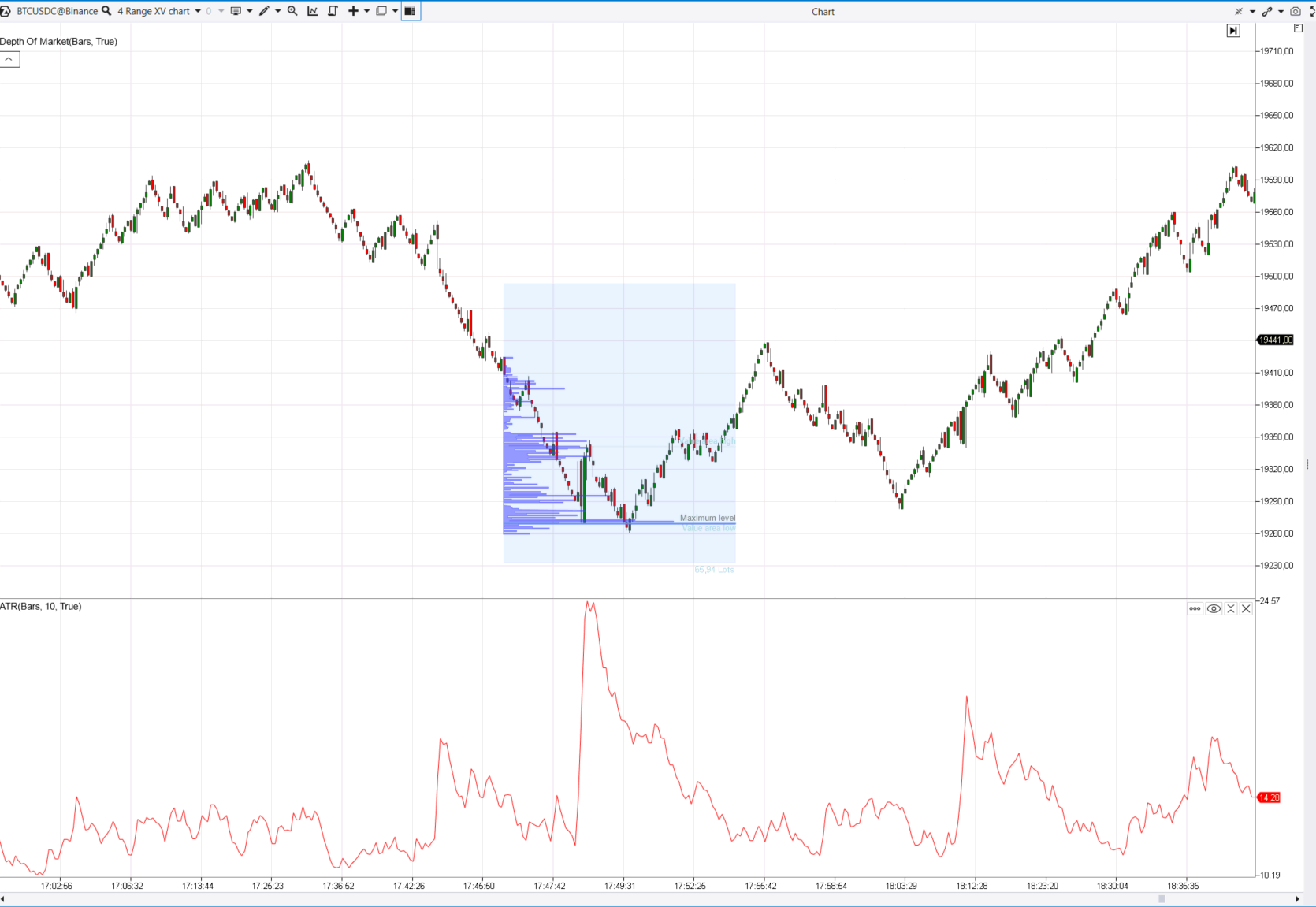

Example 3. Bitcoin futures

Data from the Binance exchange.

The chart suggests that there was a widening spread around 17:48 after the price fell below the 19300 level. Perhaps there was a cluster of stop-losses.

Market sell orders were matched with limit buy orders. Market buy orders were executed at the best selling prices. Since the spread between the best prices is wider than usual, the candles’ height significantly exceeds the usual range size.

The market profile* allows us to see that there was a lot of activity at the 19275 level. The price bounced up from it, therefore, timely buys near this level could increase the crypto trader’s account.

*press F3 and build a profile for any area on the chart

Example 4. Another futures from a cryptocurrency exchange

Let’s have a look at a range chart of meme cryptocurrency futures.

The chart allows you to read the following history.

There was a cluster of sellers’ stop-losses above the 8.46 level.

When the price exceeded the 8.46 level, a cascade occurred: all the sellers’ stop-losses (formally, pending buy orders) queued for execution one after another.

Therefore, we see growth without any pullbacks (number 1). The exchange algorithm looks for a counter sell limit order for each stop-loss. If all sell limit orders are exhausted at the current level (the level gets “empty”), the algorithm moves to a higher level. Buy limit orders do not have time to fill the void from below, this is how the spread widens.

When there are no more stop-losses to be executed, it is time to execute sell orders. However, there was a wide spread (the DOM “emptied”), the best buy price was significantly lower than the price at which the last stop-loss was executed. Therefore, we can see a price spike (2) on the chart, which indicates a wide spread in those moments.

In retrospect, we can see that it was a turning point. It is likely that a major trader used a series of triggered sell stop-losses to set up a short position himself in the weakening meme cryptocurrency market.

We hope these examples were helpful.

BT

![]()