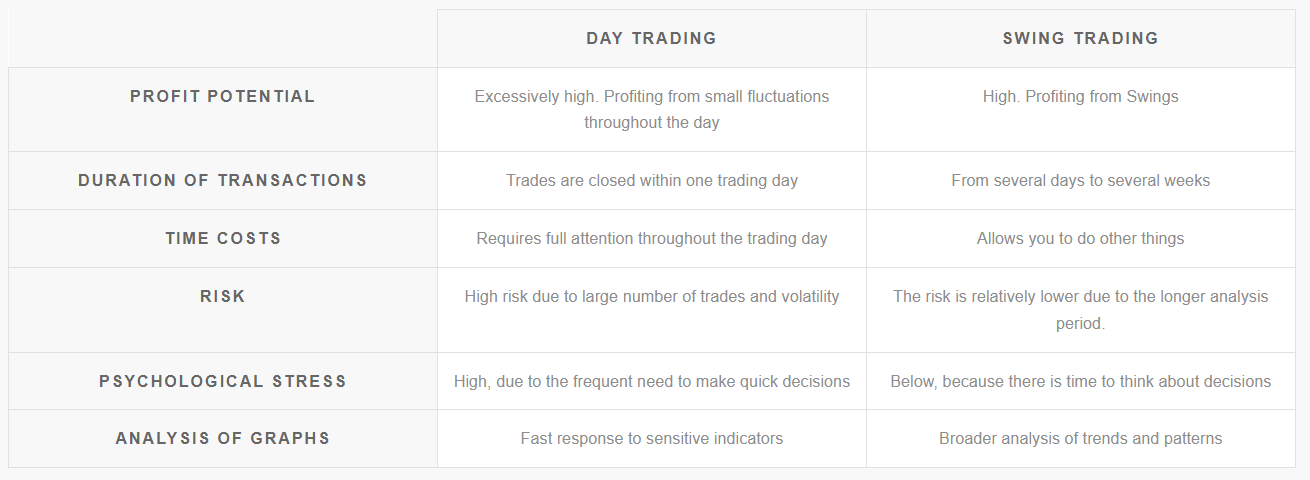

Swing trading (swing trading, свинговая торговля) is a method of trading on financial markets that involves holding a position for several days or even weeks. It aims to profit from expected “swings” – price fluctuations that form longer trends than intraday impulses. This usually happens against the backdrop of significant news.

The concept of swing trading was introduced by J. Douglas Taylor in his book “The Taylor Trading Technique” (1950). Taylor analyzed the directional movements of the market, breaking the sequence of candles into individual cycles.

He described his theory of the “three-day cycle,” highlighting buying and selling days, which became the foundation for swing trading.Swing trading does not guarantee profit, but it can enhance your experience in financial markets if active intraday trading does not suit you for some reason.

Swing trading allows traders to find a unique balance between the frequency of trades, commission costs, emotional stress, the number of instruments tracked, and the time spent on analysis.Swing trading involves higher risks as it requires wider stop-losses to account for volatility. A swing trader may also face the need for a higher starting deposit to hold positions overnight.

Who is swing trading suitable for?

Swing trading is suitable for those who want to maintain an active presence in various markets without dedicating all their working time to it. Let’s list several categories for whom this type of trading is optimal:

Busy professionals

Swing trading does not require constant market monitoring throughout the day, allowing traders to combine trading with their primary job. For example, Dr. Alexander Elder successfully combined his career as a psychologist with trading.

Beginner traders

Swing trading is less stressful compared to day trading and does not require quick decision-making. This trading style allows beginners to gradually assimilate the basic principles of analysis and learn to manage risks, which is optimal for newcomers.

Investors

For instance, if you hold a long-term position in cryptocurrencies but observe signs of weakness near a significant resistance level, anticipating a correction in the coming days, you can open a swing short position without selling your long-term position. Thus, swing trading enables more efficient use of capital compared to long-term investments.

Enthusiasts of various analysis methods

Swing trading allows traders to combine technical analysis (such as chart patterns) and fundamental analysis (the reaction of prices to important news releases).

Do you want to understand if swing trading is suitable for you? Then keep reading – we will analyze the pros and cons of this trading style and explore the most effective strategies through examples.