Types of Wave Market Analysis Elliott Wave

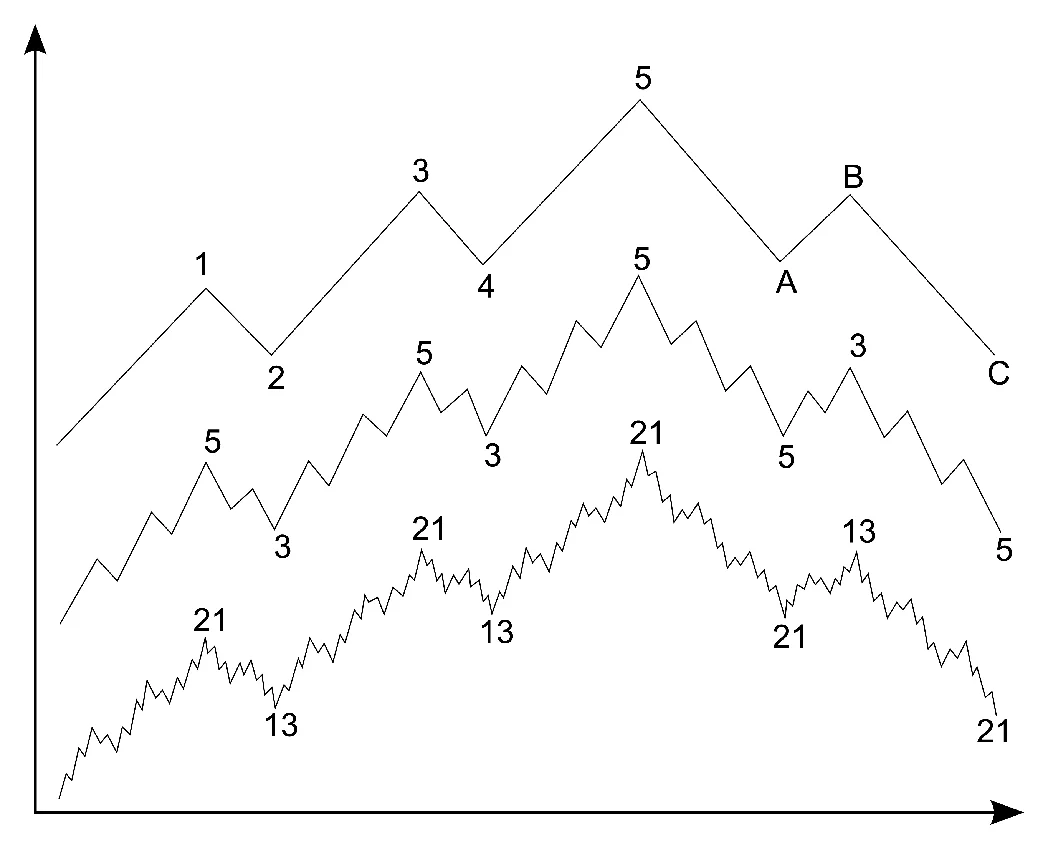

Theory, created by Ralph Nelson Elliott in the 1930s, is the most well-known theory of wave analysis in trading. It is based on the assumption that market prices evolve in repetitive cycles that reflect the collective psychological state of market participants.

According to the theory, price movements in financial markets form patterns known as “waves,” following a specific structure. Five waves in the direction of the main trend (impulse waves 1-2-3-4-5) and three corrective waves (A-B-C) together form an eight-wave cycle. The wave structure conforms to the principle of fractality (self-similarity) and Fibonacci proportions, which is characteristic of many wave analysis-based methodologies.

Wolfe Waves – This market analysis method is based on identifying specific geometric formations on the price chart. Traders look for patterns consisting of five wave sequences, which show the natural rhythm of market prices and forecast future price equilibrium.

Kondratieff Waves (or K-Waves) focus on long-term economic cycles identified by Nikolai Kondratiev. They are more commonly referred to in economic analysis than in day-to-day trading. Although some traders use these cycles to understand broader market trends.

Weis Waves – A modification of traditional wave analysis developed by David Weis, a renowned expert in the Richard Wyckoff method of trading. The main goal of the method is to simplify the process of understanding market trends and trading volumes by integrating them into logical wave movements. This helps better understand the true intentions of the market and the actions of large players.

Let’s delve into the basics of wave analysis according to the Weis method using the tools available on the ATAS platform.

Wave and Volume Analysis According to the Weis Method

Weis Waves focuses on trading volume and price movements, combining them for visual representation of how volume is distributed during price movement. Wave analysis of the market according to the Weis method does not consider each price step individually. Instead, it aggregates price movements into waves until the direction changes and compares the overall trading volume with these aggregated movements.

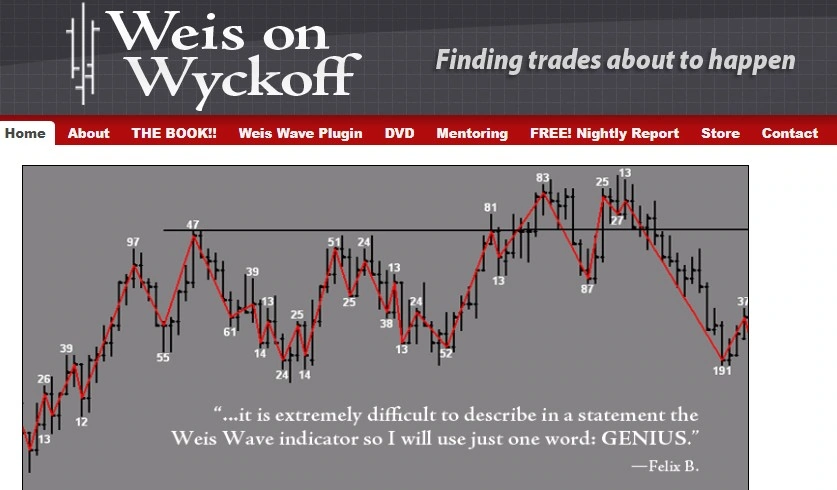

Above is a chart from David Weis’s website, where you can see:

- Price bars in black color.

- A line chart in red color, representing waves. All up bars are summed into upward waves, while all down bars are summed into downward waves.

- White numbers displaying the volume sum on bars within each wave.

The basics of wave analysis according to the Weis method involve studying “up waves” and “down waves” considering trading volume. For example:

- If an up wave has cumulatively high volume, it may indicate strong buying interest and potential continuation of the uptrend.

- If a down wave has low volume amidst a bullish market, it may suggest potential for the uptrend to resume.

Thus, by analyzing changes in volume and wave direction, traders can forecast future price movements, considering volume-wave ratios, and make more informed trading decisions.

WAVE ANALYSIS. EXAMPLES ON A CHART

Let’s provide examples of wave analysis. To obtain such charts:

- Download, install, and launch the ATAS platform.

- Open a chart through the tool manager.

- Switch the chart to non-standard time frame mode; for example, we recommend RangeXV, as it allows for better visualization of wave structures and avoids distortion due to varying trading intensity at different times within the day.

- Add the WeisWave wave analysis indicator – in ATAS, it is displayed as a histogram below the price area. While bullish candles appear on the chart, the indicator sums their volumes (cumulative principle) into a green-colored histogram. Similarly, for bearish candles.

Example: Wave Analysis of the Dollar

Let’s conduct market analysis of the futures market on the dollar index using the Weis method. Open the chart using “DX” – the ticker for the dollar index futures.

How to Analyze Weis Waves?

The subjective reasoning of an analyst in this case may look as follows:

The first arrow indicates a sharp increase in volumes – this could be the culmination of a growing trend with the price exceeding the psychological level of 104.00.

The second arrow indicates that volumes on the upward waves are gradually decreasing. Even considering the weak activity of the Asian session, this could be a sign of demand exhaustion.

The third arrow points to a surge in volumes on the downward wave. Perhaps sellers are trying to seize the initiative amid depleted demand. Therefore, the level of 104.00 is acting as resistance.

Thus, the trader concludes the advisability of trading on the downside, focusing on local bearish reversals, resistance tests, and/or breaks of minor supports.

Example: Wave Analysis of USD/JPY

Here’s another example – wave analysis of the futures market on the Japanese yen. To open it in the tool manager, enter the ticker 6J.

In the chart below, the Scale parameter is set to a value of 5. This allows for a wide enough view, covering February 2024 and the beginning of March.

Additionally, the ZigZag Pro indicator has been added to the chart, which displays statistics (volume, time, price) for each line (essentially – waves). While not a classic wave analysis indicator, ZigZag Pro helps evaluate waves according to the Weis method, covering larger price movements on the chart.

Wave analysis helps the trader track the chronology of bullish reversals.

Number 1 – a downward wave. A volume of 273 thousand contracts pushed the price down by 54 ticks. Number 2 – a downward wave. A volume of 109 thousand contracts pushed the price down by 32 ticks.

Between them, there is another downward wave, with 279 thousand contracts and a decrease of 34 ticks – it fits into the proportions of a downtrend. However, the wave with number 3 does not fit. The indicator shows a large volume of 669 thousand contracts but only a decrease of 21 ticks. This indicates a depletion of bearish pressure.

Then we see a sharp surge of buyers – the Weis Wave indicator forms the highest green bar. The price reacts swiftly – by 26 ticks.

Next comes a weak selling wave (the first black arrow) and a new surge of buyer activity (the second black arrow).

Considering the price and volume dynamics on the waves, plotted using the ZigZag Pro indicator, the trader has enough evidence (facts of selling exhaustion and buying activation) to predict an increase in the contract price.

Example: Wave Analysis of Cryptocurrencies

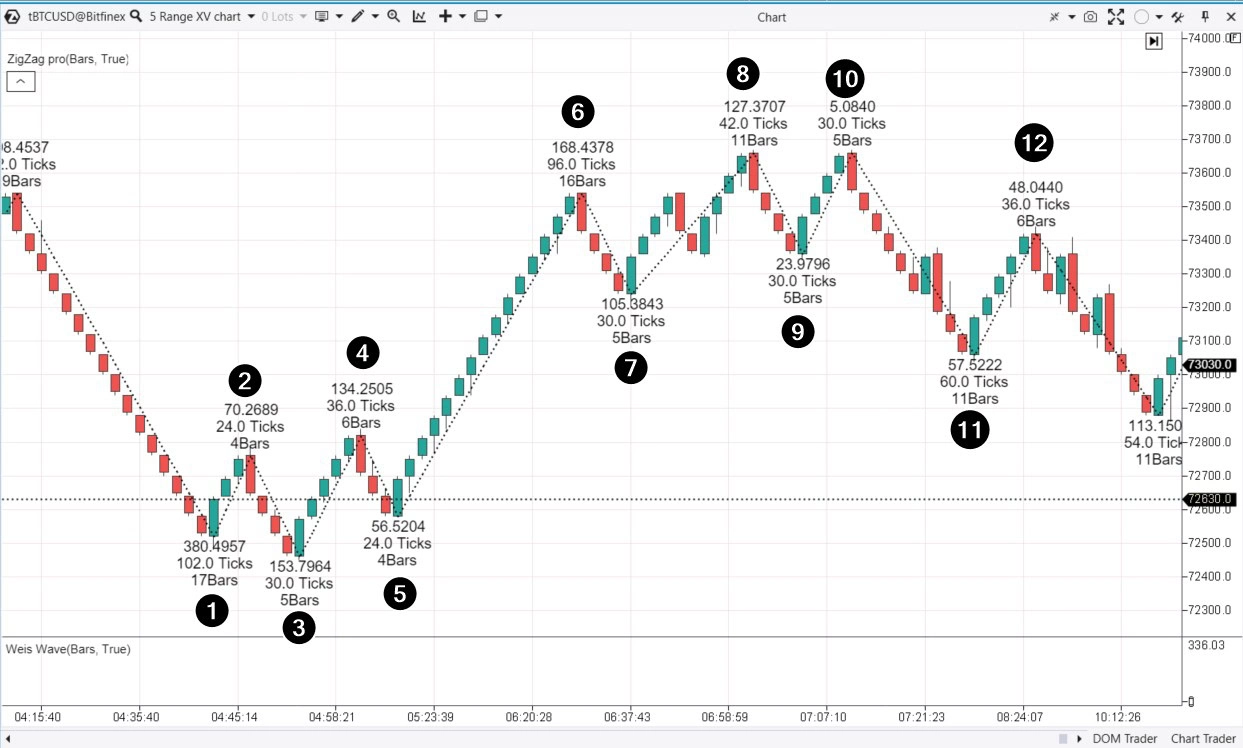

Let’s conduct wave analysis of the Bitcoin market. We’ll use data from the Bitfinex exchange – they load faster. We’ll keep the RangeXV mode but set the Scale parameter to a value of 100 to analyze waves within the day.

- Downward wave. Large volume, significant progress (in ticks and duration of the wave). Sellers control the market.

- Upward wave. Ascending correction.

- Downward wave. Volume and progress decrease. Has selling pressure exhausted?

- Upward wave. Confirmation of a shift in sentiment as buying pressure increases, noticeable both in volume (compared to wave 02) and progress.

- Downward wave. Volume and progress decrease relative to previous waves. This decline appears as a descending correction after the upward impulse 03→04. And resumption of the impulse after the end of the correction is a signal to enter the beginning of the trend. In this case, the beginning of the upward wave 06.

- Upward wave. Large volume, significant progress (both in ticks and in the duration of the wave). Now the initiative is in the hands of buyers.

- Downward wave. Large volume. Sellers seem to have become active, although the progress is insignificant, and the wave looks like a correction after the upward impulse.

- Upward wave. It includes an intermediate correction of 2 red candles. The decrease in volume and progress should be alarming. Especially after evidence of seller activity on wave 06→07.

- Downward wave. It largely (30 ticks) negates the achievements of buyers in the previous wave (42 ticks).

- Upward wave. Volume and progress indicate weakening demand.

- Downward wave, indicating that sellers have taken the initiative.

- Upward wave. It looks like a 50% bullish correction from the bearish impulse 10→11. Like the breakthrough at point 5, the resumption of the impulse after the end of the correction is a signal to enter the beginning of the trend. In this case, the beginning of the downward wave.

The above wave analysis covers events on March 14, 2024.

Wave Analysis in Trading. Pros and Cons.

Advantages:

- Comprehensive approach: Wave analysis takes into account market cycles, participant psychology, principles of self-similarity, Fibonacci proportions, and other concepts.

- Identification of entry and exit points: Wave patterns help identify potential market reversal points and make timely decisions whether to enter or exit a position.

- Applicability across different timeframes: Wave analysis can be applied across various timeframes, making it useful for both long-term investors and day traders.

- Compatibility: This method can be combined with volume analysis and other trading approaches to enhance overall effectiveness.

Disadvantages:

- Subjectivity: Analysts may interpret wave structures differently, leading to varying forecasts and trading decisions.

- Complexity: Wave analysis requires a lot of time and practice to master. Novice traders often struggle to correctly identify and apply wave patterns, especially in markets experiencing consolidation phases.

- Uncertainty: Even experienced analysts encounter uncertainty when using wave analysis, as markets do not always follow expected patterns. External events, such as news or changes in economic policies, can also unpredictably influence the market and disrupt wave structures.

BT

![]()