WHAT IS A CORRECTION

⇒ Warning. Any strategy does not guarantee profit on every trade. Strategy is an algorithm of actions. Any algorithm is a systematic work. Success in trading is to adhere to systematic work.

This term appeared in the stock markets of the 20th century, it was used to describe a short-term decline in the price of an overheated stock. Over time, the term spread to other markets. It is also used by technical analysts for intermediate upward corrections during an active downtrend.

Correction is a rather eloquent term, if you think about it. The market itself seems to recognize that a news release caused a stir and prices rose to extreme values, and therefore they need to get back to normal. In other words, adjust.

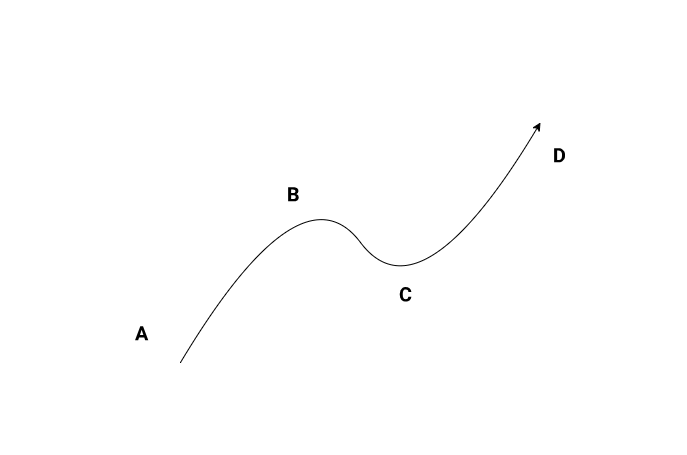

The schematic diagram above shows a correction:

- А→В: an impulse movement that initiates a trend;

- В→С: a correction;

- С→D: a trend resumption.

WHEN TO ENTER A POSITION

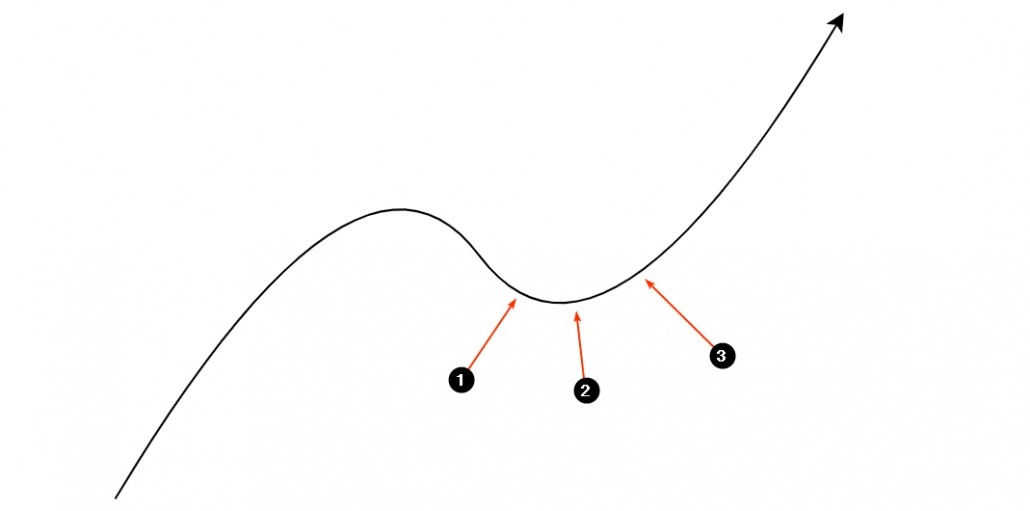

The diagram below shows completely different types of entering a long position considering the end of a correction and the resumption of an uptrend.

- An early entry with the expectation that a correction is getting exhausted. In this case, traders carry a risk that the correction may last.

- The best entry which is rarely obvious. Each correction is unique, and the perfect entry is a matter of luck.

- An entry at the first signs that confirm a trend resumption. In this case, traders increase the size of the stop-loss since the price may already be far away from the correction low, under which a protective order is usually set.

Which entry type to choose – an early one or one that has signals of a trend resumption? Well, it depends on personal preferences, trading style, and risk tolerance. One possible solution is to take an early entry but with the half of the amount and when you get signals of a trend resumption, you can bring the position volume to the working volume.

TRADITIONAL WAYS OF IDENTIFYING THE END OF A CORRECTION

Traders have been using two tools to work with corrections since the first stages of the technical analysis development:

- The Fibonacci levels. It is believed that the size of the correction is about 50% of the impulse.

- The usual volume indicator. It is believed that volumes decrease during a correction.

Let’s have a quick look at both tools on a weekly Apple stock chart.

The A → B movement is a correction within the uptrend of the price of a hot stock.

The volume indicator shows that volumes were slightly above average on the rise to top A. And they were slightly below average during the correction to top B.

The Fibonacci levels show that the correction low occurred almost exactly on the 50% line.

The peculiar thing about Fibonacci is that a correction hardly ever ends precisely at the 50% level. If the initial impulse was strong, then the correction tends to be insignificant – much less than 50%. Therefore, if the impulse was weak, then the correction can be deep.

MODERN WAYS OF IDENTIFYING THE END OF A CORRECTION

To identify/confirm the end of a correction more accurately, use professional volume analysis indicators provided by the ATAS trading and analytical platform (download the platform for free).

In the following part of the article, we will show some examples to give an understanding of how to use these indicators. Settings may be different depending on the market/timeframe.

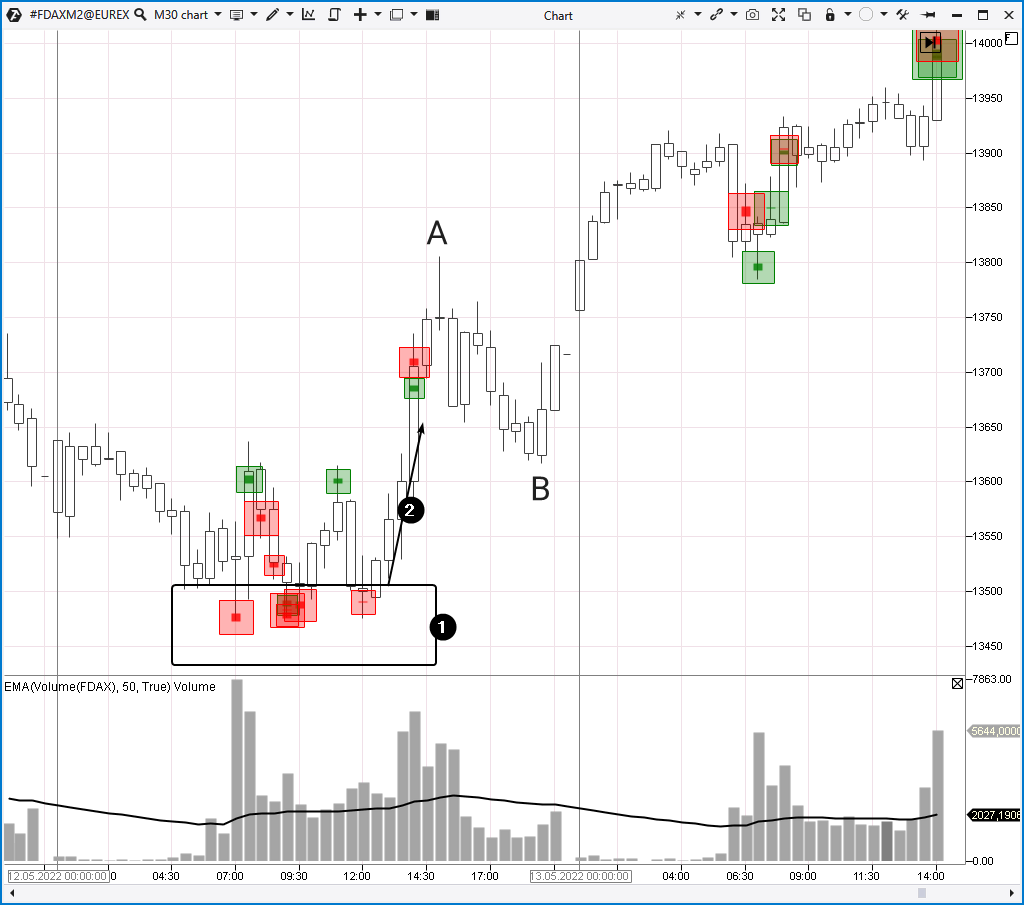

Example 1. DAX Index futures

The Big Trades indicator has been added to the 30-minute chart that displays high volume trades.

Number 1 indicates big sales that took place just below the 13,500 level. However, the price refused to decline any further even though large sell orders had been executed. It was likely to happen because large market sells were actually stop-losses set above the 13,500 level. They are not capable of moving the price lower. We believe that they are used by professionals to accumulate a large long position at the lowest prices.

The zone marked with number 1 served as a basis for the impulse price growth (2). Note that the growth towards point A was accompanied by volume spikes. This is natural since the price was overcoming local resistance levels.

А→В decrease is a correction itself. Small volumes can be explained by the fact that the correction took place during an additional trading session. But even so, the activity was still low.

The Fibonacci levels worked out close to the gold standard in this example, the correction low is just below the 50% level.

Let’s switch to a faster time frame to see the end of the correction better.

Numbers indicate:

- The 50% Fibo level. It seems interesting that it coincided with the high volume level on the profile.

- The Market Profile (arbitrary size) expands at the bottom. This is a sign of balance which usually appears before the price changes its direction.

- Cumulative Delta is going up. It means that market buys are being made, which indicates the presence of demand and reduces the risks that the correction will go further down.

- An increase in price with candles expanding and volume increasing is a sign of a trend resumption.

If you detected all these signs and opened a long position near the maximum volume level (or slightly lower, which is even more profitable), you acted wisely and did not behave recklessly.

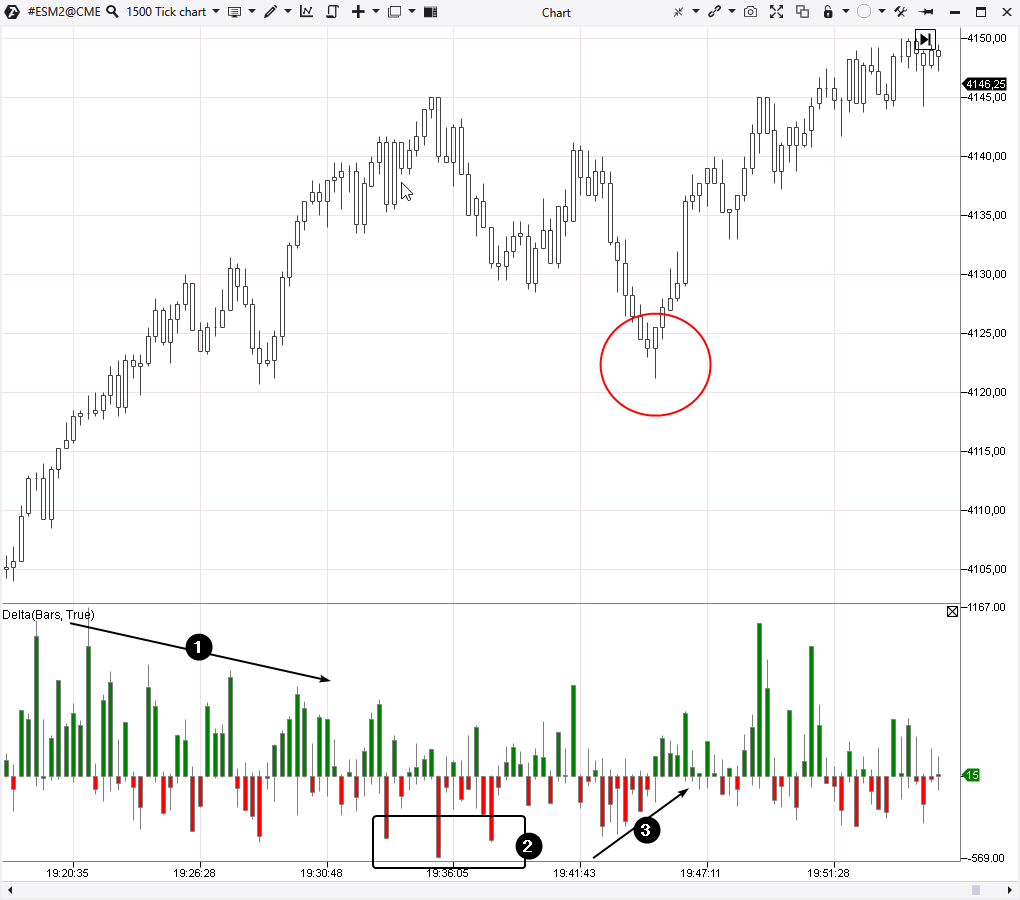

Example 2. S&P-500 index futures

This is a 1,500 tick chart. It does not depend on time and allows you to smooth out charts within a day. Candles appear faster during active periods and more slowly during calm periods. The Delta indicator has been added to the chart.

The delta indicator shows that market buys significantly exceeded market sells during the intraday impulsive upward movement. However, they gradually weakened (1).

Then the market sellers showed up (2) and the price entered the stage of a short-term correction. According to the Delta indicator, it can be seen that the pressure of the sellers gradually decreased (3).

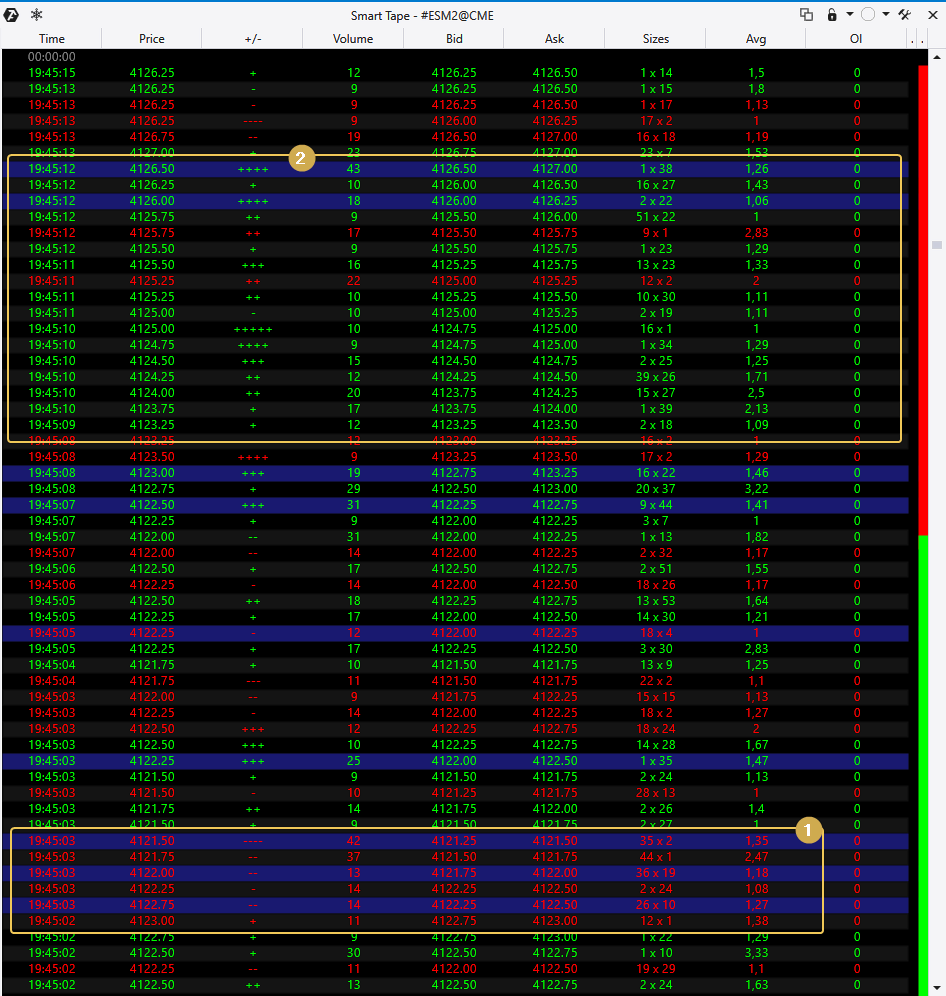

Let’s consider in detail how the upward reversal occurred at the correction low. The Smart Tape module in the Historical mode will be used for that.

Here is what was happening on the Tape ↓ at the moment circled in red in the chart above. We have filtered out all trades with less than 9 contracts from the feed.

We can assume that during the first seconds after 19:45 there was a local selling climax (1). Buyers appeared 5-10 seconds later (2) and the price reacted with an increase, which can be seen by looking at the pluses.

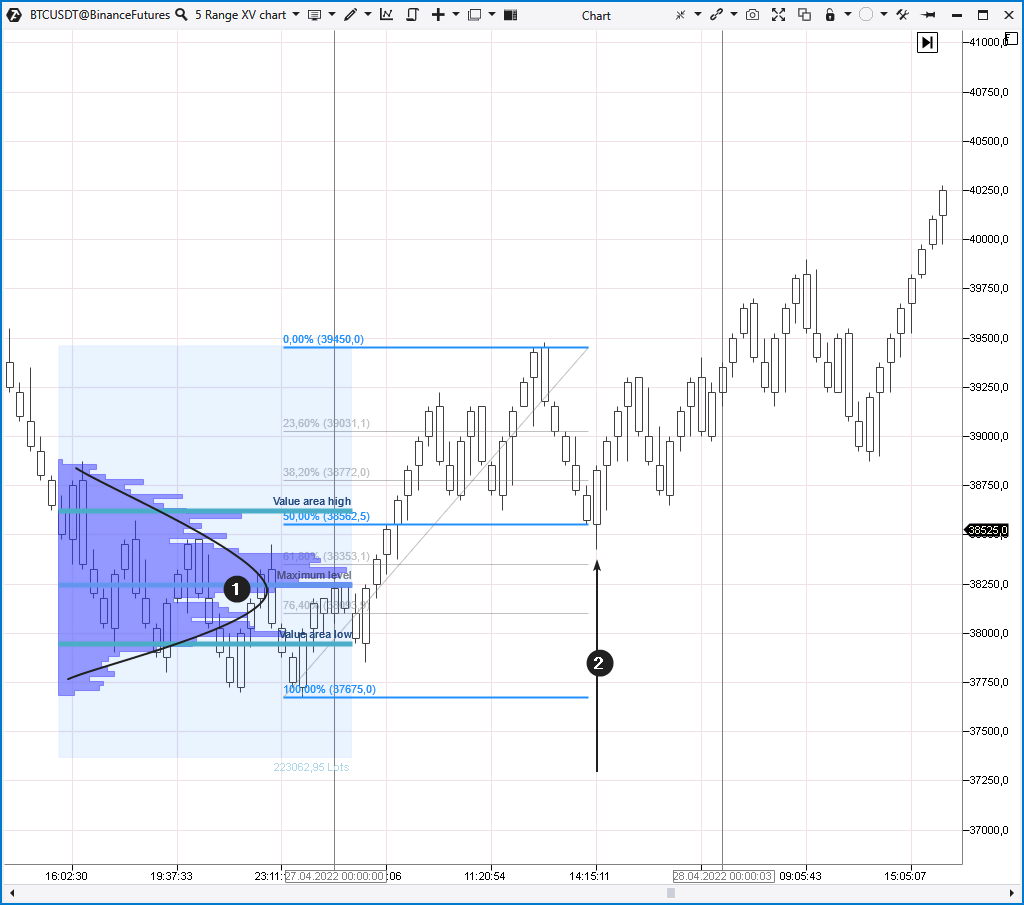

Example 3. Bitcoin futures on a cryptocurrency exchange

The last example is on the Range XV chart. This is a non-standard type of chart that can be used as a signal to enter a position considering that the correction is over.

The chart above shows that after a period of consolidation, noticeable by the bulge on the market profile (1), the price of bitcoin rose to 39,450. It can be interpreted as an impulsive movement that caused the market to fall out of balance.

Now you can build the 50% Fibo level to wait for an entry signal which comes from a reversal candle on the Range XV (2) chart. It is possible to open a long position both with a market order after the signal candle closes and with a limit order placed in the middle of the signal candle’s body.

You can also customize the Range XV to show more detail whose analysis will allow you to get additional confirmations and find a more accurate entry point.

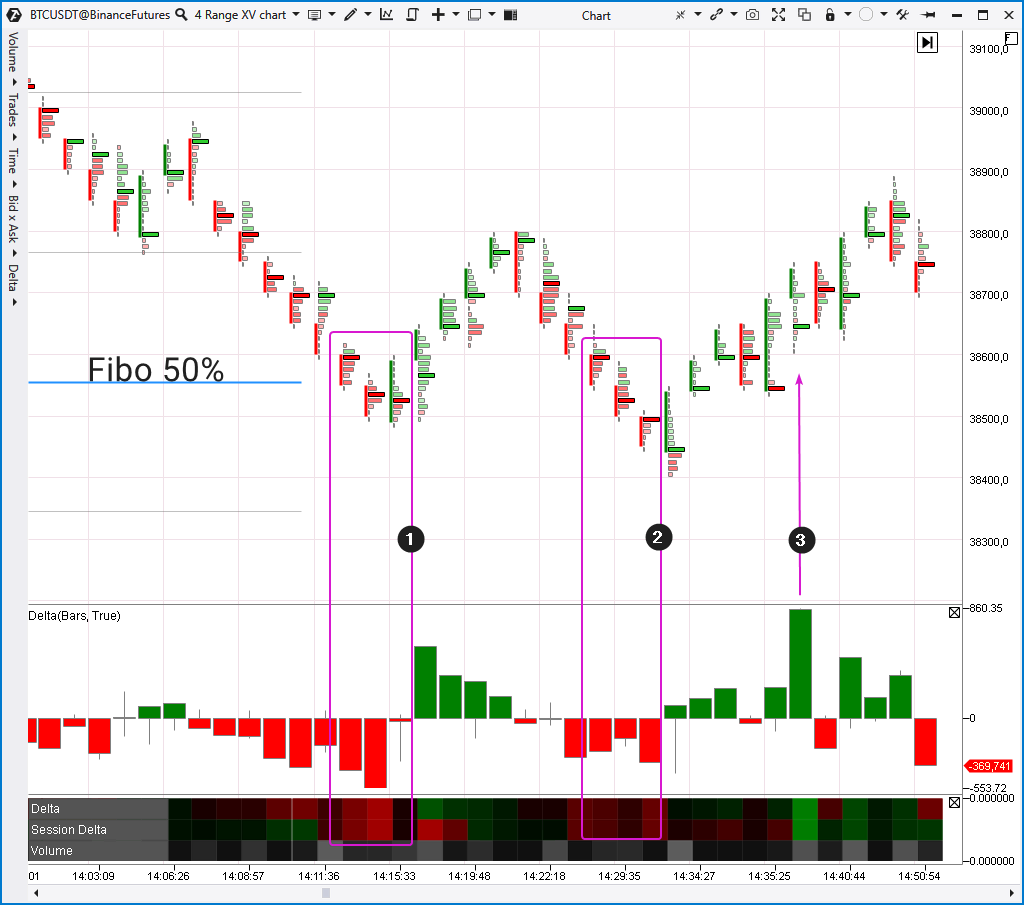

Numbers indicate:

- A selling climax of a local scale. The Delta indicator shows large spikes in market selling volumes followed by a price rise (a sign of a reversal).

- The selling pressure is decreasing, it is easy to notice because the red bars on the Delta indicator have become smaller.

You can enter a long position when a bullish candle appears after a descending wave (2) or when a large buying volume appears (3). In this way, your actions will be coordinated with the buys of large traders.

WHEN TO EXIT A POSITION

Although the article is devoted to finding the end of a correction, which is directly related to opening a position, it is impossible not to mention when to close the position. In fact, this is a question that does not have the only correct answer.

There are some recommendations:

- use a trailing stop technique. It can be easily implemented with the help of protective strategies in the ATAS platform;

- close the position completely or partially when important support and resistance levels are reached;

- use a mathematical take profit. For example, if your stop = 100, then your take = 250.

HOW TO START TRADING

We hope that the information presented in the article was useful for you.

As we have already mentioned in the article about Trend Trading Strategy, it is important for traders to trade in the direction of a trend. But since the price does not change in a straight line (otherwise it would be too easy to make money), entering a position with the trend often comes down to identifying the signals that indicate the end of a correction.

The methods, which were briefly described above, are designed to help you identify the end of a correction more accurately and enter the position with greater confidence.

Try out volume analysis tools to see how useful they are for identifying the end of a correction on your charts. Find out what setup is the best for you.

Download the free version of ATAS right now! Try a powerful cluster chart analysis tool for stock, futures and crypto markets.

BT

![]()