WHAT ARE FALSE BREAKOUTS

⇒ Warning. Any strategy does not guarantee profit on every trade. Strategy is an algorithm of actions. Any algorithm is a systematic work. Success in trading is to adhere to systematic work.

In simple terms, false breakouts are a pattern when:

- The price moves within the range (at this time , a bulge forms on the market profile );

- Then the price breaks the range, but the movement is exhausted, the trend does not find followers;

- The price returns to the range (and often breaks the range in the opposite direction).

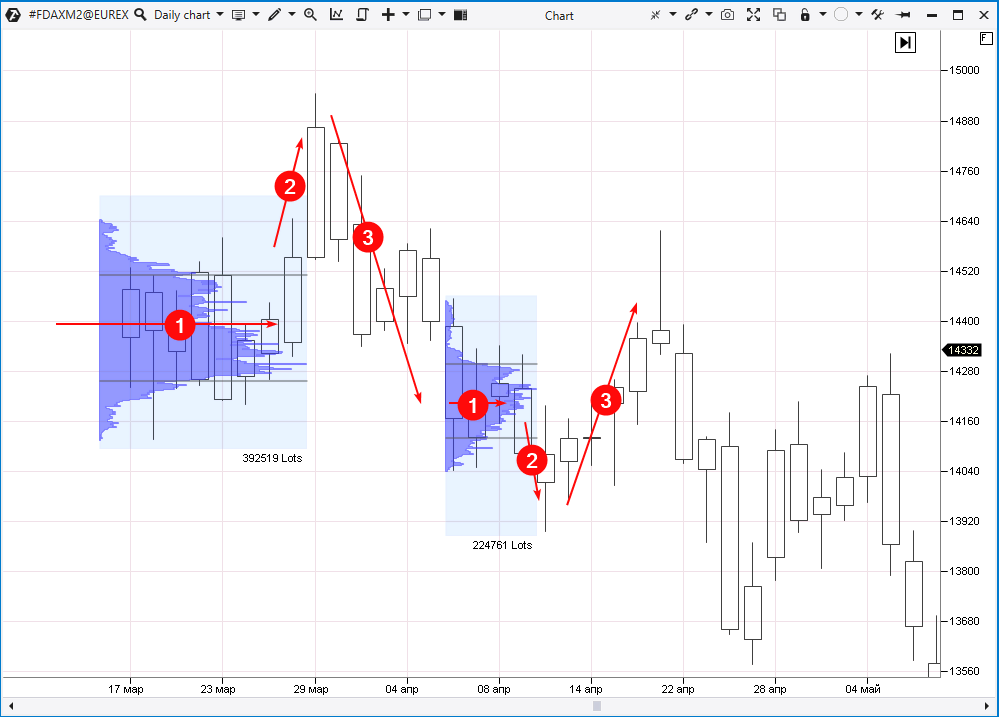

Below are examples of two false breakouts on the DAX futures chart (these are not ideal examples of false breakouts, and a benchmark can hardly be set).

False breakouts are dangerous because:

- some lose money by opening positions in the direction of the breakdown in the expectation that the trend will continue;

- others lose money because their out-of-range stops get knocked out.

Read more about the causes of false breakouts and their features in the above article . And we will move on to the specifics – consideration of the strategy.

STRATEGY IDEA

If the price breaks out of the range down, but then returns to the range, this is a sign of sellers’ uncertainty, not enough selling pressure to establish a downtrend. And if the seller is weak, then there is a reason to look for entry into longs.

Likewise the opposite. A false bullish breakout is evidence of buyer weakness. Consequently, there are arguments for opening a short position.

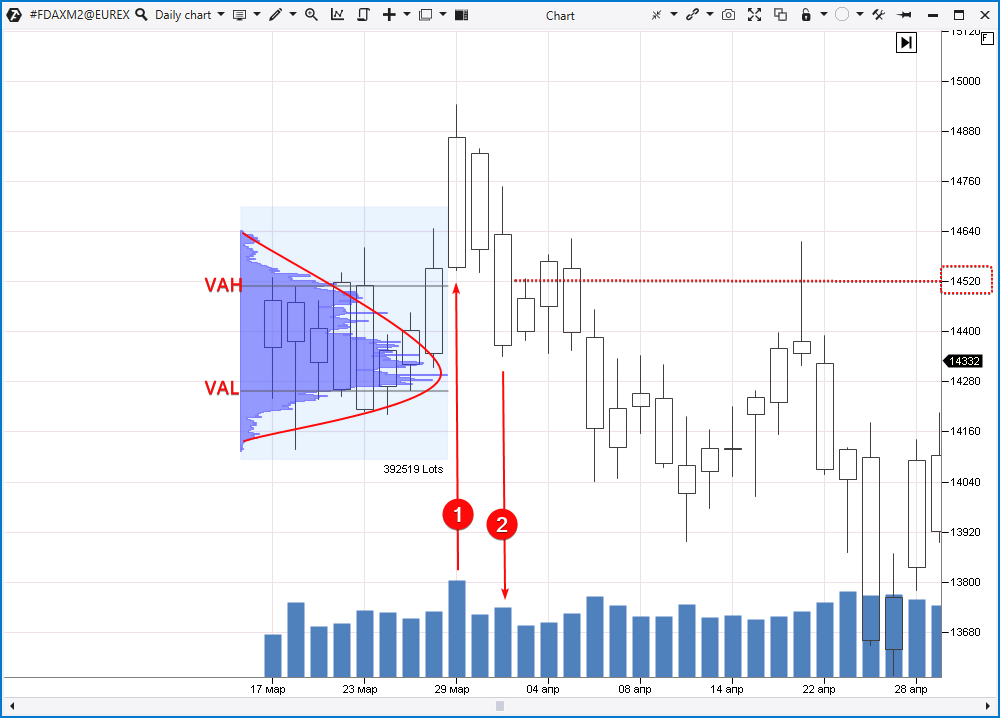

Let’s take a closer look at the same chart (the first candle is March 17, 2022).

On the left side of the chart is a trading range that formed while the market was in a relative balance of supply and demand. A bulge has formed on the profile, the Value Area High and Value Area Low levels show the boundaries of the value zone (read about the basics of the market profile indicator in the articles at the links: “What is a value zone” , “How to use the market profile” , “Volume profile: 3 tools” , “How to Improve Market Profile Trading” ).

As long as there is a balance of supply and demand on the market, it is recommended to sell in the area of the upper limit of the balance (for example, from the VAH level) and buy in the area of the lower limit (for example, from the VAL level). The intention is clear – buy low, sell high. The strategy will lead to profit until the balance is broken.

In our case, the balance was broken when the bullish breakout occurred on the 29th (1). In the market, under the influence of some bullish factors, the supremacy of buyers formed, and the price went up on growing volumes. It seemed that the picture is bullish.

However, the next day, almost all growth progress was leveled, and moreover, a day later the price dropped inside the range that was in effect initially. There was a formation of a false bullish breakdown.

Conclusions that can be drawn:

- there were not enough buyers in the market to support the bullish momentum;

- perhaps the impact of the news was overestimated, and purchases were made on emotions with thoughts “faster, until it flew even higher”;

- the large volume on the 29th (1) depicts buyers who tried to “jump on the outgoing train”. And also this volume reflects the closing of short positions by stop-losses set above the limits of the range.

- a professional player who knows and sees more than anyone else could use this burst of trading activity on a bullish breakout attempt to accumulate a short position. It is believed that a professional sells to buyers “for breakdown”, and buys short positions from those who are forced to close them.

If volume on the 29th is genuine bullish activity from the big players, why did the price drop? This means that a major player is likely to have a bearish view of the market.

So, when the price dropped to the original range after attempting a bullish breakout on high volume, the idea is to open a short from the VAH level – approximately from the 14520 level.

The idea has increased profit potential because a failed bullish breakout can be followed by a genuine bearish breakout. Or maybe even a bearish trend.

Let’s look at a few examples to flesh out the strategy.

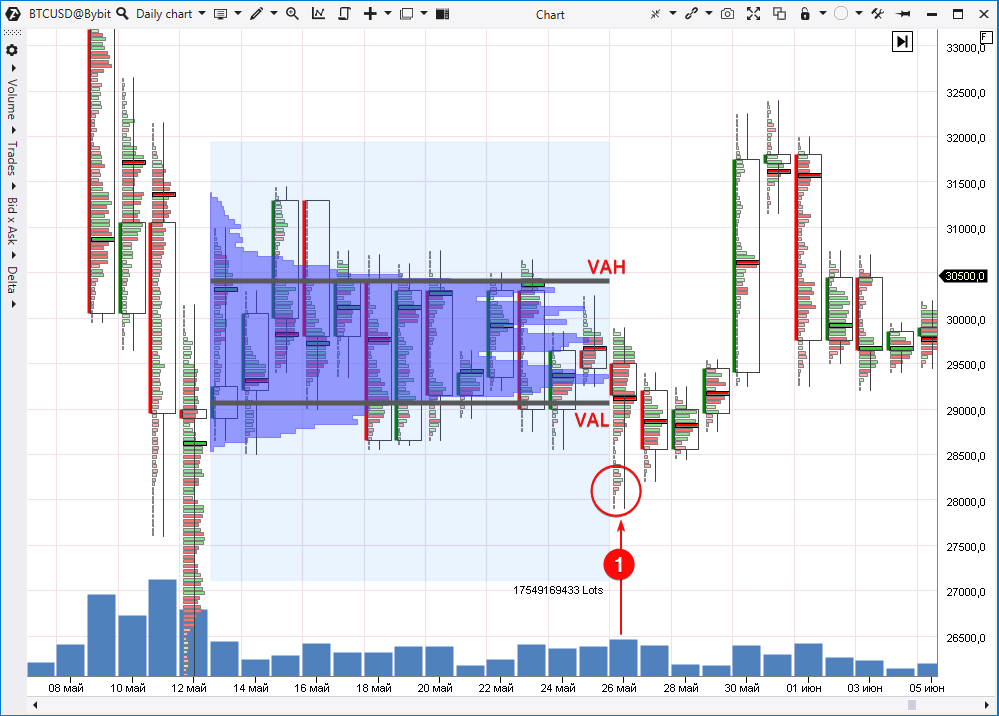

Example 1

This is a daily bitcoin chart.

During May, the market formed a range with VAL around 29000 and VAH around 30500.

Then there was a false bearish breakdown (1). The circle marks the activity, which can be interpreted as panic selling and closing longs by stop losses. On the same day, the price returned to the range, thus showing that the bearish sentiment is exaggerated. So there is reason to believe that the bulls can show their strength.

The next day, the price fell below VAL, providing a buying opportunity, for example, at 28500. A stop loss can be set below the activity indicated by the circle, for example, at 28000. And the final target is at least the level of 31000.

It is important to ensure that the goal-to-risk ratio is at least 2:1.

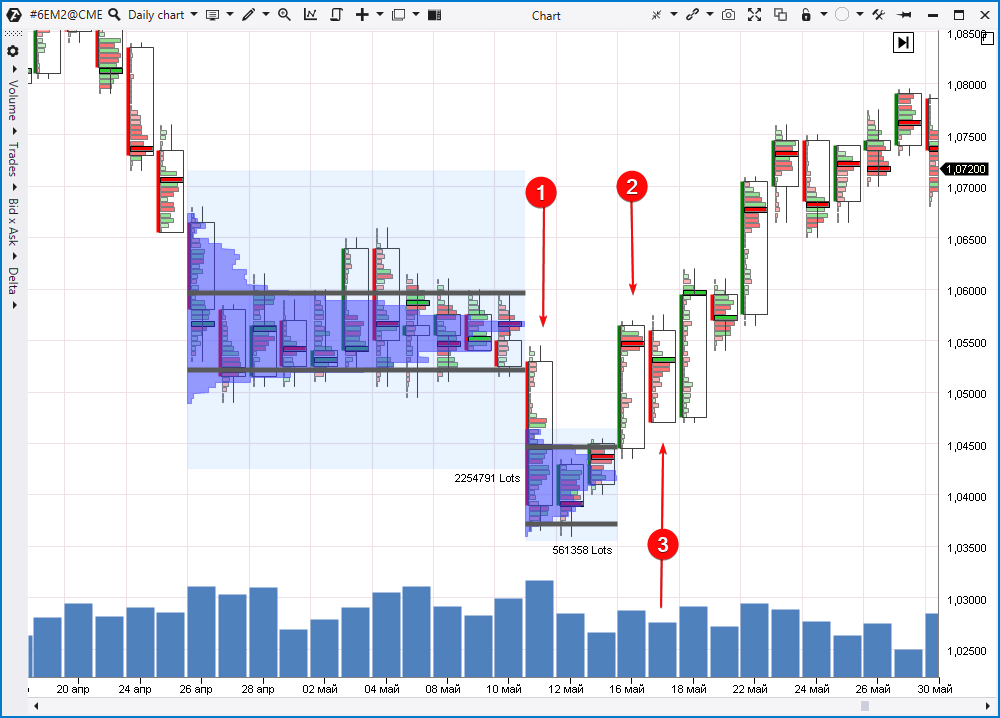

Example 2

Euro futures daily chart.

In late April — early May 2022, a range formed on the market. Contracts traded predominantly between 1.052 and 1.06 (the move up on May 3, by the way, can be seen as a false bullish breakout).

The numbers show:

- Bear test. In the next 2 days, the price traded mostly below 1.045, thereby luring traders into opening short positions on the euro against the backdrop of news about the war in Ukraine, inflation, fuel shortages and others.

- The price returns to the original range. Those shorting below 1.045 were trapped.

- Selling day, but look at the “inside the candle” clusters. Red clusters are depleted at the bottom of the candle. This is the seller’s weakness. The day when it makes sense to open a long position on the strategy in question.

The next day (on the 18th) there are buyers (noticeable by the green clusters). The position, if you opened it, is a plus.

Note that in this example, the false bearish breakdown was very large relative to the initial range, which is why the ratio of risk to potential profit may be unsatisfactory.

In any case, the position volume should be calculated so that in the event of a stop loss triggering, the capital decreases by no more than 2-3%.

Example 3

30 minute gold futures chart.

In mid-April 2022, a range formed on the market, trading went mainly between the levels of 1965 and 1985.

The numbers show:

- An attempt at a bullish range breakout.

- Activity that can be described as follows: some traders on FOMO emotions (fear of missing out on profits) enter long positions, while others are forced to exit short positions. The notional professional uses this activity to build a large short position.

- The price returns to the range. The bullish breakout turns out to be a false one, and accordingly there are ideas that the bearish breakout will be successful.

- Zone for opening shorts according to the described strategy.

BT

![]()