Catching a falling knife means trying to open a long position during a rapid drop in the price.

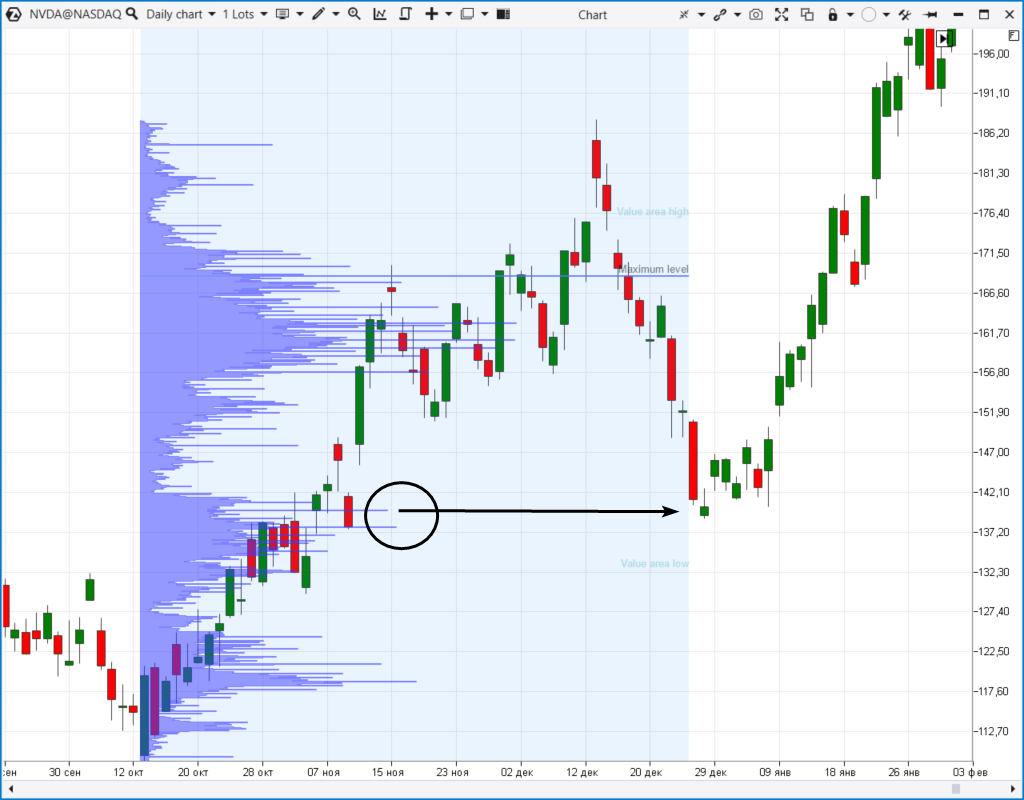

For example, NVDA has an intrinsic value of $180 and you believe that it could go up to $100 in the long term. When the price drops sharply amid bad news with a gap down (shown by the arrow in the chart above), you may decide to buy the stocks, in other words, “catch a falling knife”.

In this example, after a several-month pause, the price rises to the value that you consider fair.

Usually, the phrase “catching falling knives” refers to the stock market when a trader buys stocks after they have fallen sharply and hopes that the price will rebound. The trader believes in the company and that the subsequent price reversal will provide capital growth.

But catching falling knives is not only for long-term investors. The term is also used for short-term trading in futures and cryptocurrencies.

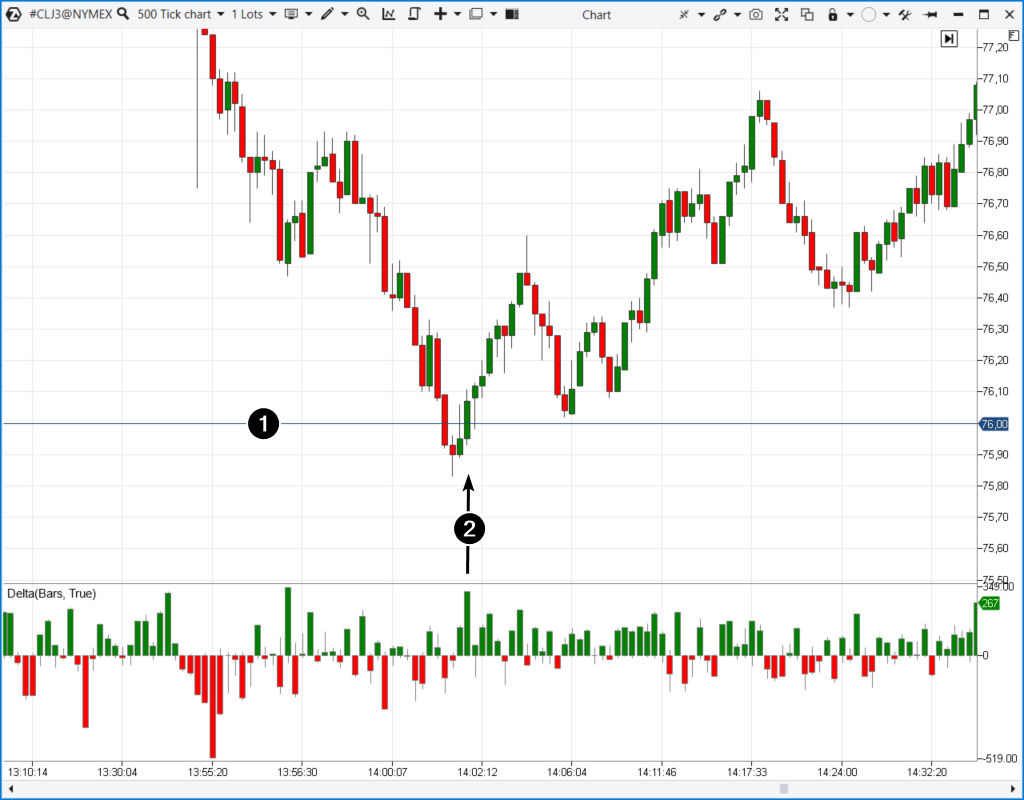

Let’s say the price of the euro is declining rapidly, as shown by the arrow on the intraday futures chart below.

When point (1) is reached, a trader decides to enter a long position.

The position shows an encouraging result for some time, but then falls to a new intraday low (2). Sounds familiar, right?

The trader decides to average their positions by increasing the long ones.

When, fortunately for the trader, the price reaches point (3), the position can be closed completely with a profit. Choosing not to close the position at this point and continuing to hold it may result in significant losses, including irreparable ones.

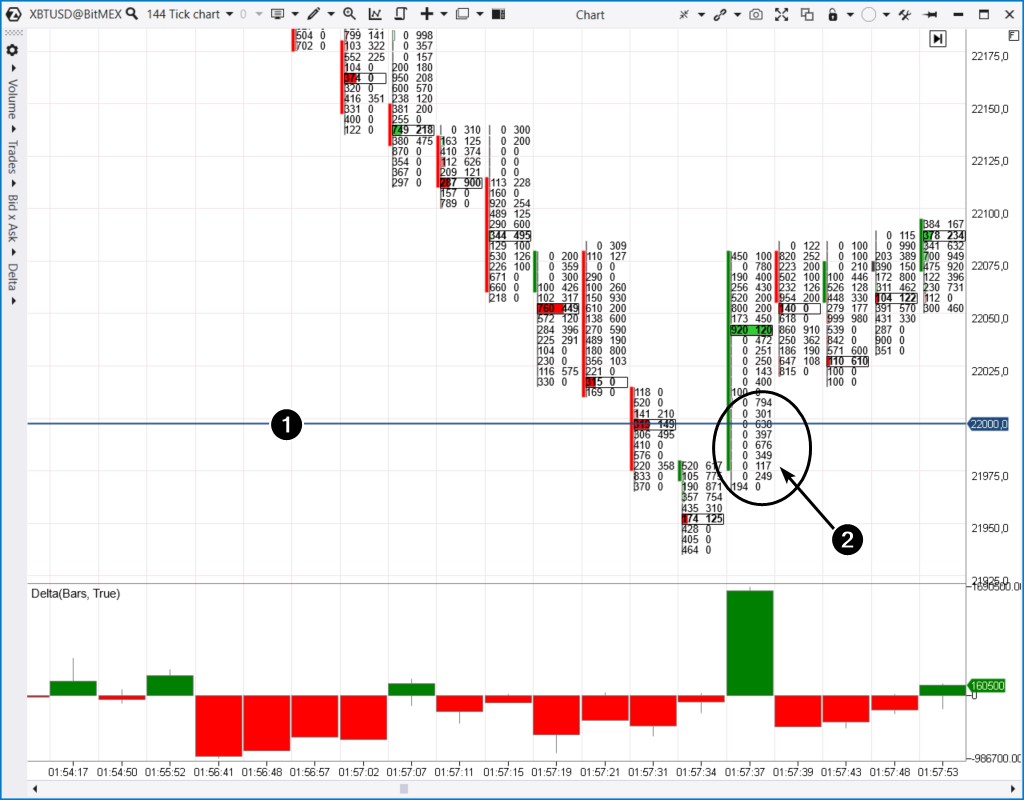

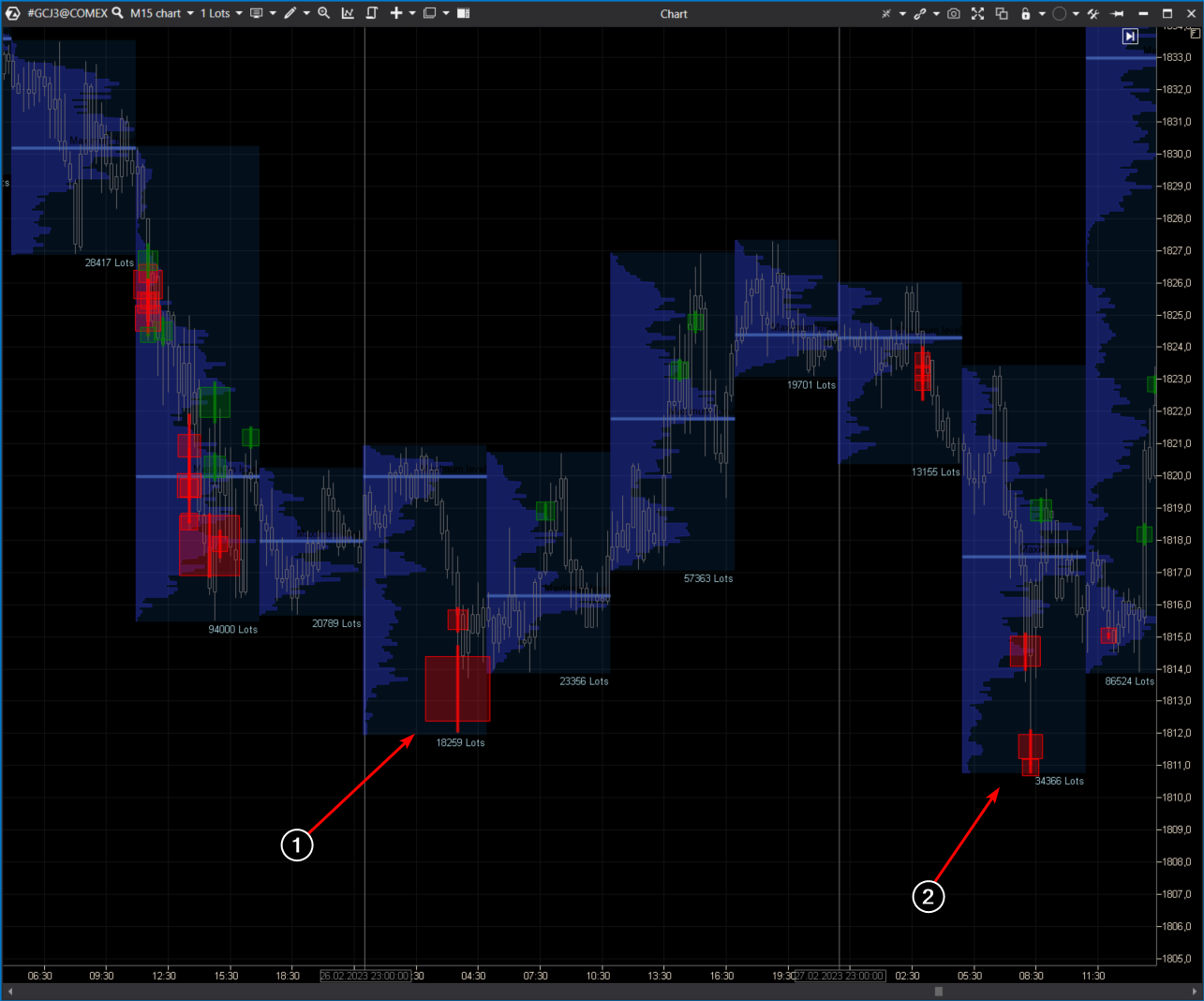

Does it even make sense to use the “catching falling knives” strategy? Is it possible to reduce the risks? In the following part of the article, we will give you three useful ideas.

We will consider catching falling knives as an attempt to go long on a wide bearish candle. The presented information can also be used in a mirror image — when trying to go short in a rapidly growing market.