WHAT DOES A BOUNCE MEAN IN TRADING?

⇒ Warning. Any strategy does not guarantee profit on every trade. Strategy is an algorithm of actions. Any algorithm is a systematic work. Success in trading is to adhere to systematic work.

To put it simply, it is a pattern that includes in sequence:

- falling of the asset price to the support line;

- touching the support line;

- a reversal and price growth from the support line.

The daily chart of the DAX index futures below shows several price bounces off the 1500 psychological level which served as support in the market in the fall of 2021.

Originally, bounces meant buying from the support line. But today, the term is also commonly used for selling from a resistance line (a mirror pattern). In this article, we will consider bounces as a buy setup, but keep in mind that all of it is true for selling as well, only in a mirror image.

TYPES OF BOUNCES

Based on the type of the support line:

- bounces off the support line built from the previous low;

- bounces off the trend line;

- bounces off the round level (what are round psychological levels);

- bounces off the 50% Fibonacci level (what are Fibonacci levels);

- bounces off other types of support lines.

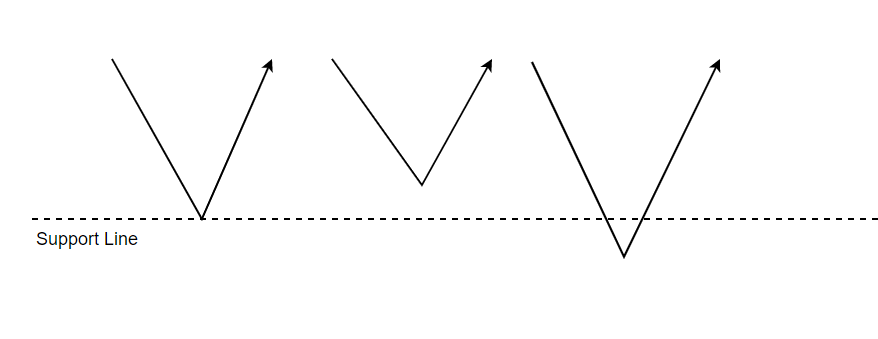

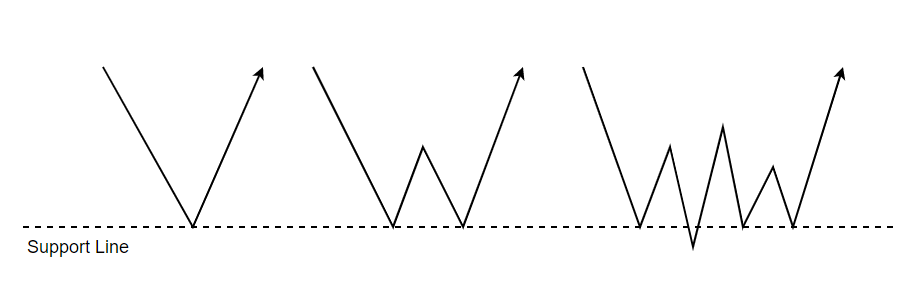

Based on the forms of their interaction with the support line (see the diagram in the figure below):

- a precise touch;

- “undershooting”;

- a false breakout.

Based on speed:

- a simple V-shaped bounce;

- a W-shaped bounce (also known as a double bottom pattern);

- a bounce with the formation of a consolidation zone (more complex formations where you can see a reverse head and shoulders pattern and others).

Based on success:

- a successful bounce (when the price rises significantly after the bounce);

- a failed bounce (when the price rises slightly after the bounce, and it is followed by a bearish breakout of the support).

ADVANTAGES AND DISADVANTAGES OF BOUNCES IN TRADING

Advantages:

- Minimize risks. Since bounce trading is directly related to support levels, it allows you to plan risks when choosing levels for setting a stop-loss.

- Versatility. They are applicable to all financial markets: forex, stocks, cryptocurrencies and others. Bounces occur on different time frames.

- They allow you to find a local entry point in the global market context, for example, to join a trend on a long-term time frame.

Disadvantages:

- The drawing of support lines is subjective.

- There is no guarantee that the support level will hold and the price will make a significant bounce off it.

HOW TO TRADE BOUNCES

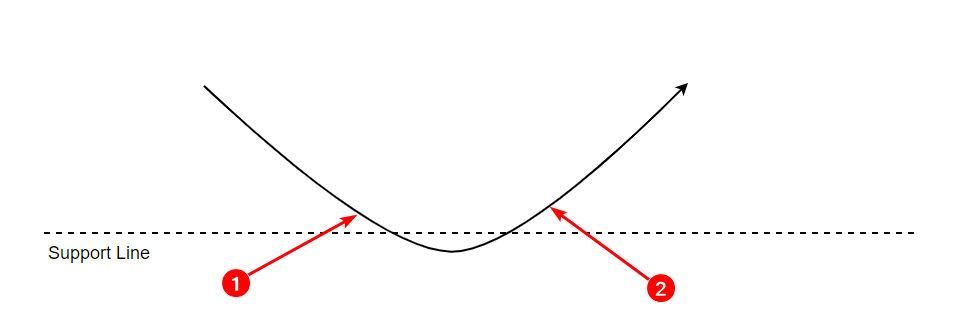

There are two main approaches to buy a bounce:

- expecting a reversal from the support line;

- after receiving confirmation.

Since the bottom point of the bounce is rarely obvious, it is too irrational to consider perfect entries between 1 and 2, let’s be realistic. Let us briefly analyze two main approaches.

The first approach

This approach is associated with forestalling when the price has approached the support level, and the trader assumes that a bounce is about to happen.

Relatively speaking, it is the following situation: “Sales have exhausted, but there are no buyers yet.”

In this case, the trader takes the risks of buying against the downward momentum. The risks are associated with the fact that the price will continue to decline immediately or after a short-term consolidation near the support level.

The second approach

The trader’s actions are considered more conservative here. A long position is opened when confirmations are received. They must be enough to make sure that buyers have become more active and a bounce has occurred.

In this case, the price has already risen significantly from the support level and the trader takes the risk that if the stop-loss is set below the bounce low, it will be a “wide stop”.

Which approach is better?

There is no ultimate solution. It all depends on the trader’s personal qualities, their vision of the market and risk tolerance. Try both strategies on an ATAS demo account to see which bounce trading strategy is best for you.

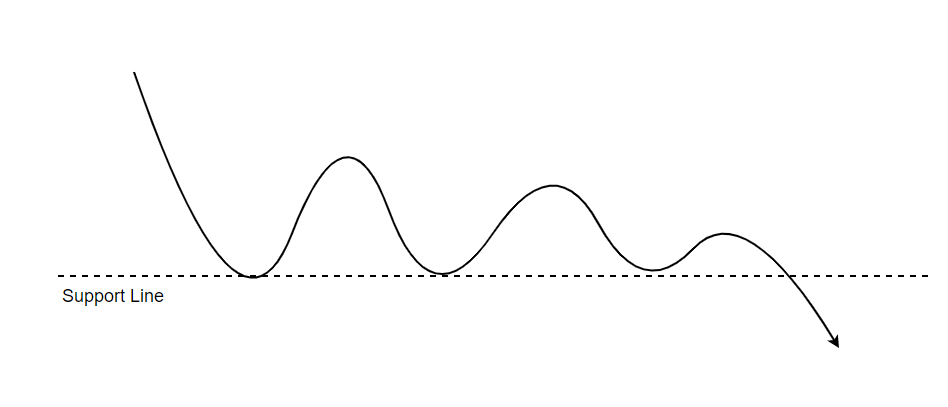

WHAT IS A DEAD CAT BOUNCE

To put it simply, a dead cat bounce is a pattern where a bounce off the support line does occur, but it is weak. The upward reversal does not attract new buyers who are able to provide stable demand and thus support the price growth. As a result, the price may make several bounces, one weaker than the other, but then it goes down and makes a bearish breakout of the support.

It is similar to a ball bouncing off the floor with less force.

This kind of pattern is called a “dead cat bounce” – it means that even a dead cat will bounce off the asphalt if it falls from a great height. Traders say that about weak markets where a falling price can bounce a little off important support.

На картинке ниже (график фьючерса на британский фунт) показано 3 отскока от психологического уровня 1.30. Каждый последующий отскок по масштабу меньше предыдущего.

The picture below (British pound futures chart) shows three bounces off the 1.30 psychological level. Each subsequent bounce is smaller than the previous one.

Dead cat bounces assume that the support will not hold and will be broken from top to bottom.

Example. You know that the cryptocurrency market is in a bearish trend. As a trader, you want to take advantage of this situation by finding a low-risk and high-reward entry point.

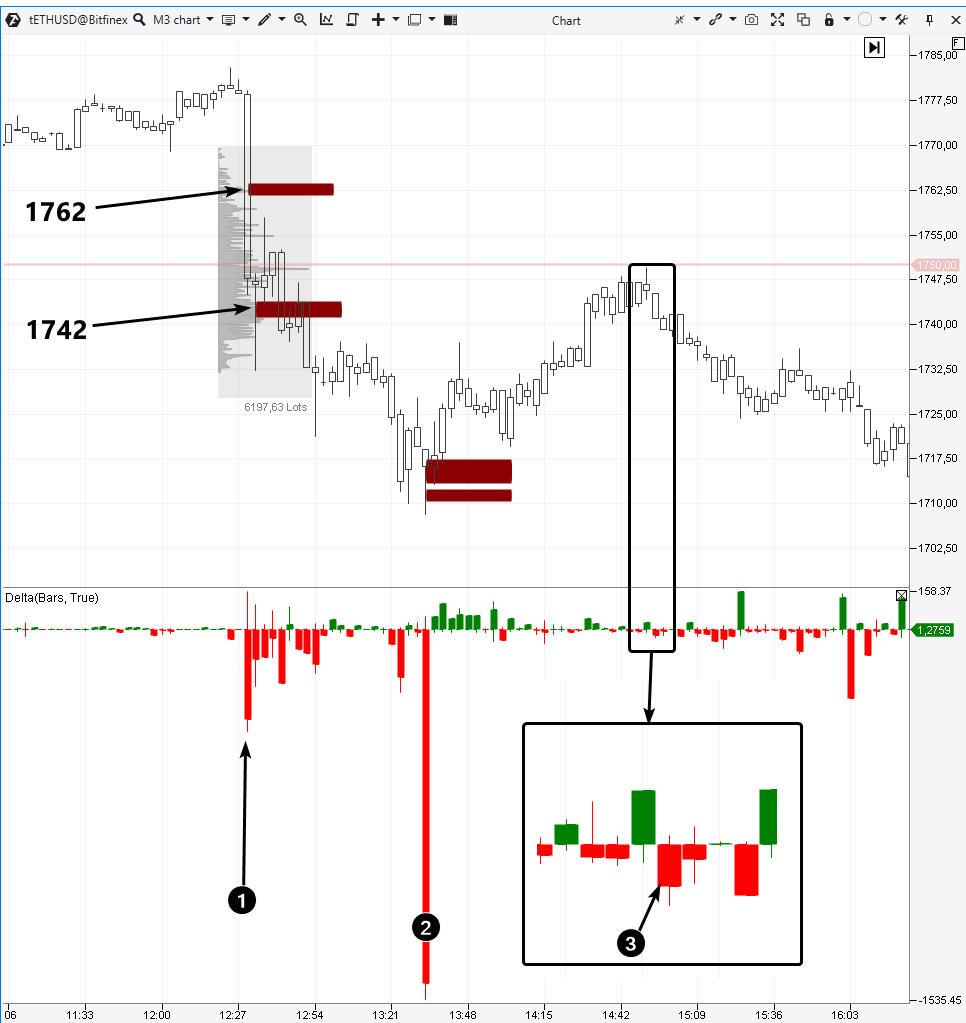

A dead cat bounce pattern will be useful in this situation. Let’s say that you have found a series of increasingly weak bounces from the 1750 level on the daily Ethereum chart (see below).

Your goal is to open a short position either in the middle of the day during a bearish breakout or when the daily candle closes. In practice, such downward movements occur rapidly, it is not necessary to carry the stop-loss above the last (weakest) bounce. It will help minimize the risks.

HOW TO MAKE BOUNCE TRADING MORE EFFICIENT

Use the advanced instruments of the ATAS platform (download the platform for free) to improve your trading performance. By the way, this applies not only to buy bounces.

Let’s have a closer look at the chart above. How was it possible to enter a short position on June 10, 2022 on a bearish breakout of the 1750 level after a series of dead cat bounces?

Let’s select a 3-minute chart and add the Delta and Stacked Imbalance indicators.

A sharp spike in the negative delta shows that sellers are highly active. A wide bearish candle is forming on the price chart with a close below the 1750 level. The imbalance indicator shows a significant predominance of the sellers at the 1762 level. The signal of the imbalance indicator at the 1742 level most likely indicates that the price has fallen into the accumulation of buyers’ stop losses which were set under reliable support of 1750.

Seeing this situation and keeping in mind the dead cat pattern on the daily chart, you can open short market positions. By doing so, you will act in harmony with the market sentiment which is clearly bearish (you do not even need to know the news that caused the selling wave, although such movements are not always caused by the news). There are compelling reasons to set a protective stop-loss above 1762.

Later, there is an intraday panic indicated by a huge negative delta (2). Note that it is followed by several consecutive positive delta candles, which shows a change in the market sentiment to bullish. This change was the start of a short-term corrective rally.

Let’s say you did not enter a short market position directly during the breakout. You get a chance when the price rises above the 1742 level. Notice that the price rise is quite unstable when it approaches the psychological 1750 mark. Now this level, which worked as support, should create resistance to rising prices (more details in the article about Mirror Levels).

In the context of the article about bounces, it should be mentioned that we are talking about entering a short position on a bearish bounce off a resistance line.

- If you act according to the first approach (forestalling), you open a position seeing how the price rises in an unstable way to the resistance level, but you still do not have facts indicating that a bounce has occurred.

- If you act according to the second approach, you need confirmation. The very first appears on the delta indicator (we zoomed it so that you can see this moment better). The indicator shows a sharp change from positive to negative delta (3). The price acts accordingly and declines from the open to the close. This small increase of sellers’ activity was the beginning of a new wave that lowered the price of ETH to 1660 on the same day.

An example from the futures market for stock indices

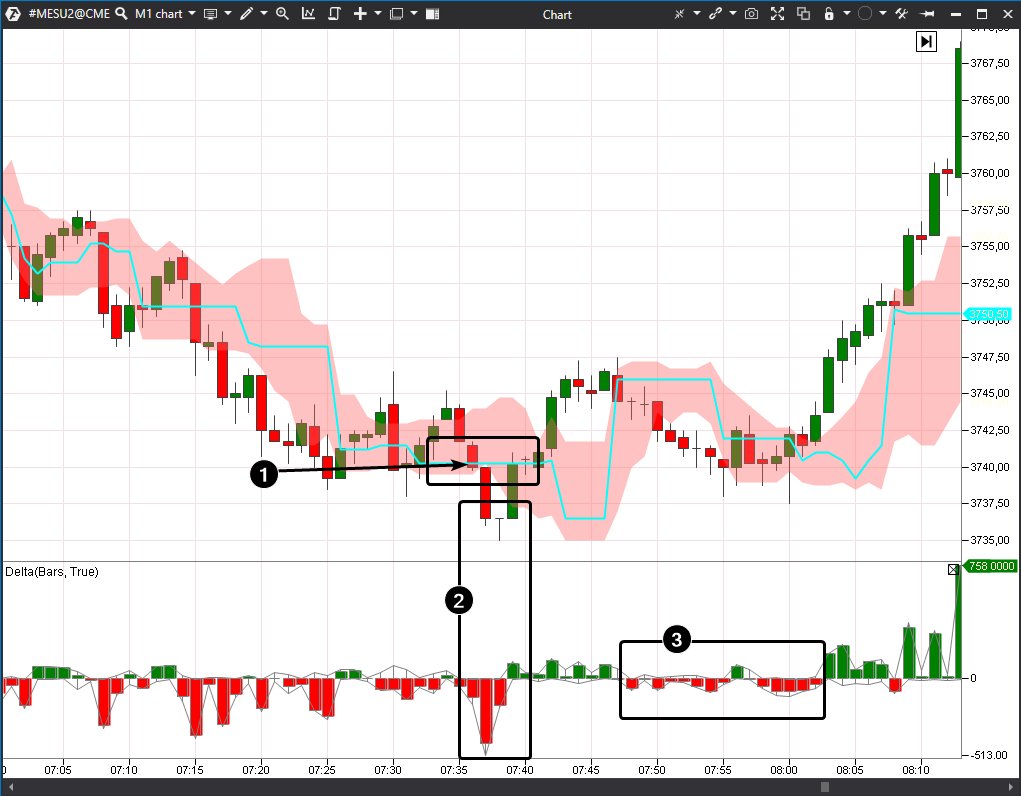

Trading of the S&P-500 stock index futures on a 15-minute chart is illustrated below. Analyzing the situation within the day, we see that the market has found support indicated by local lows 1 and 2.

When the price drops back to this support, we switch to the fast 1-minute time frame to find confirmation to go long on the bounce. Let’s add the Delta and the Dynamic Levels indicator.

Number 1 indicates that the maximum volume level becomes horizontal (7:25-7:40), it suggests that the market finds a balance of supply and demand after falling to the support level. It is a positive sign.

Number 2 indicates an attempt to resume the bearish trend, but it failed. The sellers took the initiative (demonstrated by a spike in the negative delta) by pushing the price down, but very quickly the buyers offset the results of this effort. It is another positive sign.

Another decline follows after that. But the pressure of sellers has noticeably decreased, since the columns of the negative delta are not large (3) compared to what they were before. This is another positive sign.

Having these three facts, you as a trader have a rationale for opening a long position. The trigger for opening a position can be an increase in price and the closing of a candle above the channel’s border of the Dynamic Levels indicator (08:02).

A stop-loss can be set below the lower border of the dynamic channel and then gradually raised to protect the increasing profit.

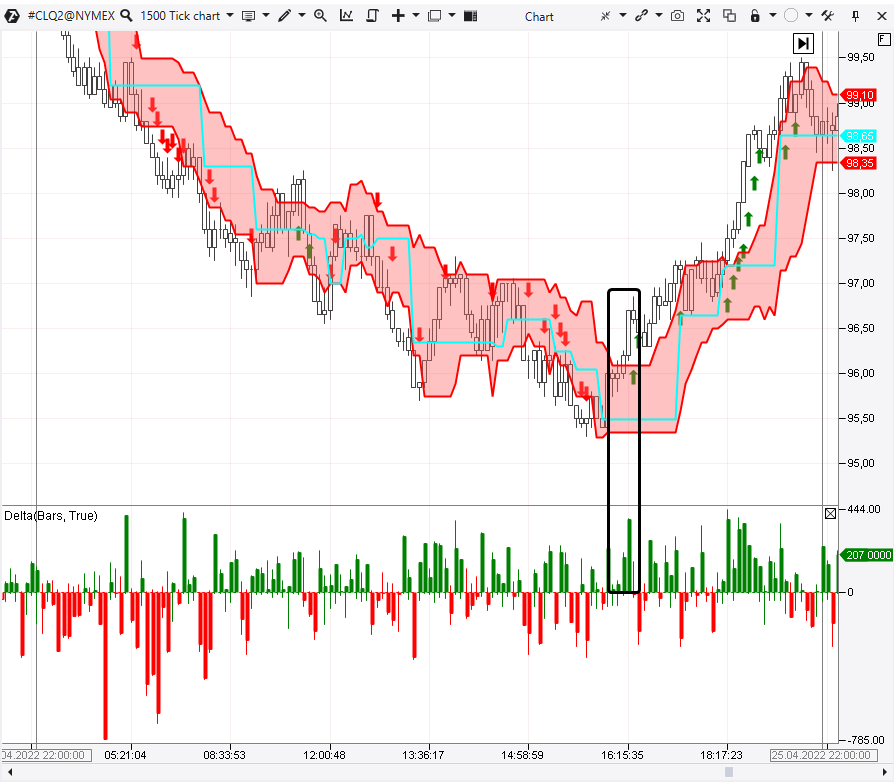

An example of bounce trading in the oil market

The chart below shows the dynamics of oil futures trading on the daily time frame. This is the scale at which stronger supports can be found to trade bounces and hold positions longer than a few hours.

The trend line (1), which supports the growth of oil, can be built on the lows of February-April. When the price declines again towards this line, the conditions are set to switch to the intraday time frame and explore the possibility of entering a bounce off the trend line around the level of $97 per contract.

A tick chart is given below. It shows more details when trading is active during the US session. We use the same set of indicators: the Delta and Dynamic Levels.

A signal to enter a long position appears when the price rises above the upper line of the dynamic channel, while a high green bar forms on the delta confirming that buyers are taking the initiative. This was a turning point in the formation of a bounce which was visible on the daily chart.

There are compelling reasons to set a stop-loss below the lower border of the dynamic channel and then use the trailing tactic, i.e. gradually raise the stop to protect the increasing profit. The ATAS platform allows you to set up automatic trailing, thanks to the function of exit strategies.

How to start trading bounces on the exchange

Combine time frames to find support and potential bounces on long-term time frames and to get confirmation signals on short-term time frames.

Keep in mind that bounces occur very quickly in strong markets, which provides a small opportunity to enter a position at a good price.

If the price has fallen into the zone of a potential bounce but does not show any signs of an upside reversal, it reduces the likelihood of a significant bounce.

To gain an advantage in confirming a bounce, use volume analysis tools. They will help confirm the entry into the short position.

Download the ATAS program for free right now – try a powerful cluster chart analysis tool for stock, futures and crypto markets.

BT

![]()