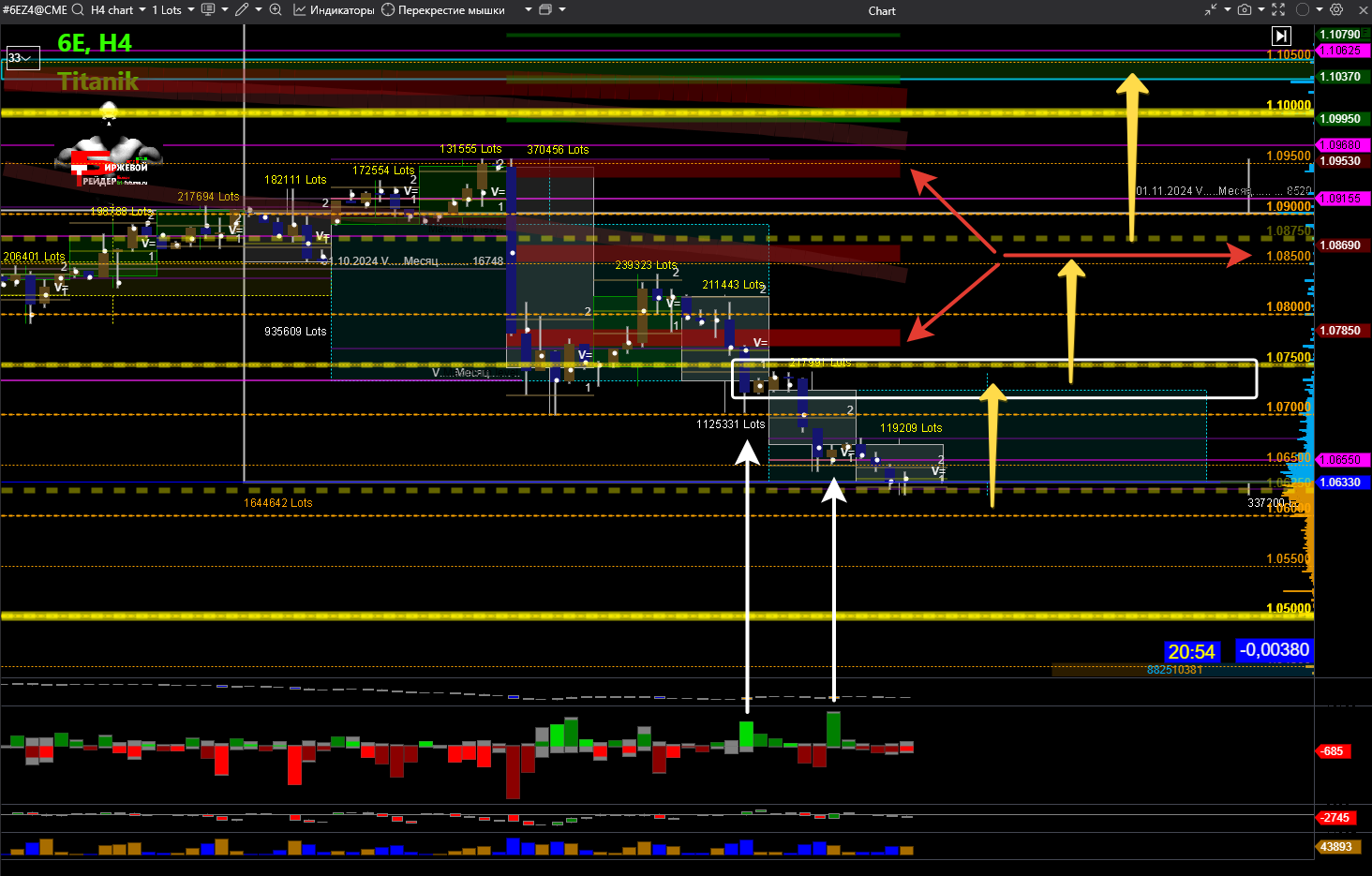

Euro\Dollar Scenario Addition

Addition to: Euro/Dollar. Desired Scenario.

The October 17 scenario remains the baseline. But it is necessary to take into account new introductions, which we must admit have greatly changed the current situation.

The EUR/USD currency pair currently faces pressure due to the dollar’s strength and recent political factors in Germany. The dollar has gained momentum from favorable economic indicators in the U.S. and expectations regarding the Federal Reserve’s next moves, while the euro is struggling under political uncertainty in Europe and inflation risks.

🔍 Key Influences on EUR/USD at Present

Right now, several main factors are contributing to the currency pair’s fluctuations:

- U.S. Dollar Strength: Positive economic data in the U.S., including an increase in business optimism and rising 10-year bond yields, continues to fuel demand for the dollar. Investors are also watching the Fed’s potential interest rate cuts, which have positioned the dollar as a more stable option in the market.

- Political Instability in Germany: Europe’s largest economy is facing political turbulence with the collapse of its coalition government and upcoming elections, placing downward pressure on the euro as investors remain cautious about the uncertainty surrounding Europe.

- Expectations Around Fed and ECB: The Fed is likely to continue rate cuts, though the December meeting may hold off on further action. The European Central Bank (ECB), however, is less predictable, which further reduces the appeal of the euro.

📉 Potential for Euro Correction

Given the current trends, there are a few scenarios for the EUR/USD:

- Dollar Weakening Scenario: Should the Republican candidate win the upcoming U.S. election, the dollar may see stability in the short term, but long-term impacts could weaken it due to potential fiscal instability and economic adjustments. Historically, Republican victories have sometimes led to stringent trade policies, creating dollar volatility and a potential opportunity for the euro to recover.

- Positive Changes in Europe: If Germany’s political situation stabilizes post-election and the ECB provides clearer guidance on rates, the euro may find support and begin to correct, particularly amid stable demand for European assets.

💡 Recommendations for Traders

This period calls for careful monitoring and patience. Current levels near 1.06 might mark a pivot point. It’s crucial to avoid false breakouts and manage risk carefully:

- Focus on News from the U.S. and Germany: Events in the Fed and Germany could cause sudden shifts in the EUR/USD exchange rate. Traders should closely follow election outcomes and central bank announcements.

- Historical Analysis of EUR/USD: Analyzing the pair’s behavior during past political crises can reveal that the euro tends to stay under pressure until the European political climate stabilizes.

- Strategies for a Dollar Downturn: With the possibility of a dollar reversal after the U.S. elections, traders might consider long positions on the euro if there are signals of dollar weakening.

Keywords with Hashtags

#EURUSD, #ForexMarket, #USDollar, #Euro, #FederalReserve, #ECB, #USElections, #GermanEconomy, #Investments, #CurrencyPairs, #TechnicalAnalysis, #FundamentalAnalysis, #MarketNews, #Trading

Meta Description

The EUR/USD currency pair is currently pressured by the dollar’s strength and political factors in Germany, with traders adjusting expectations based on U.S. and EU updates.

![]()