The Iron Scenario: Euro/Dollar for Long!

Analysis of the “Iron Scenario” for EUR/USD: Impact and Perspectives

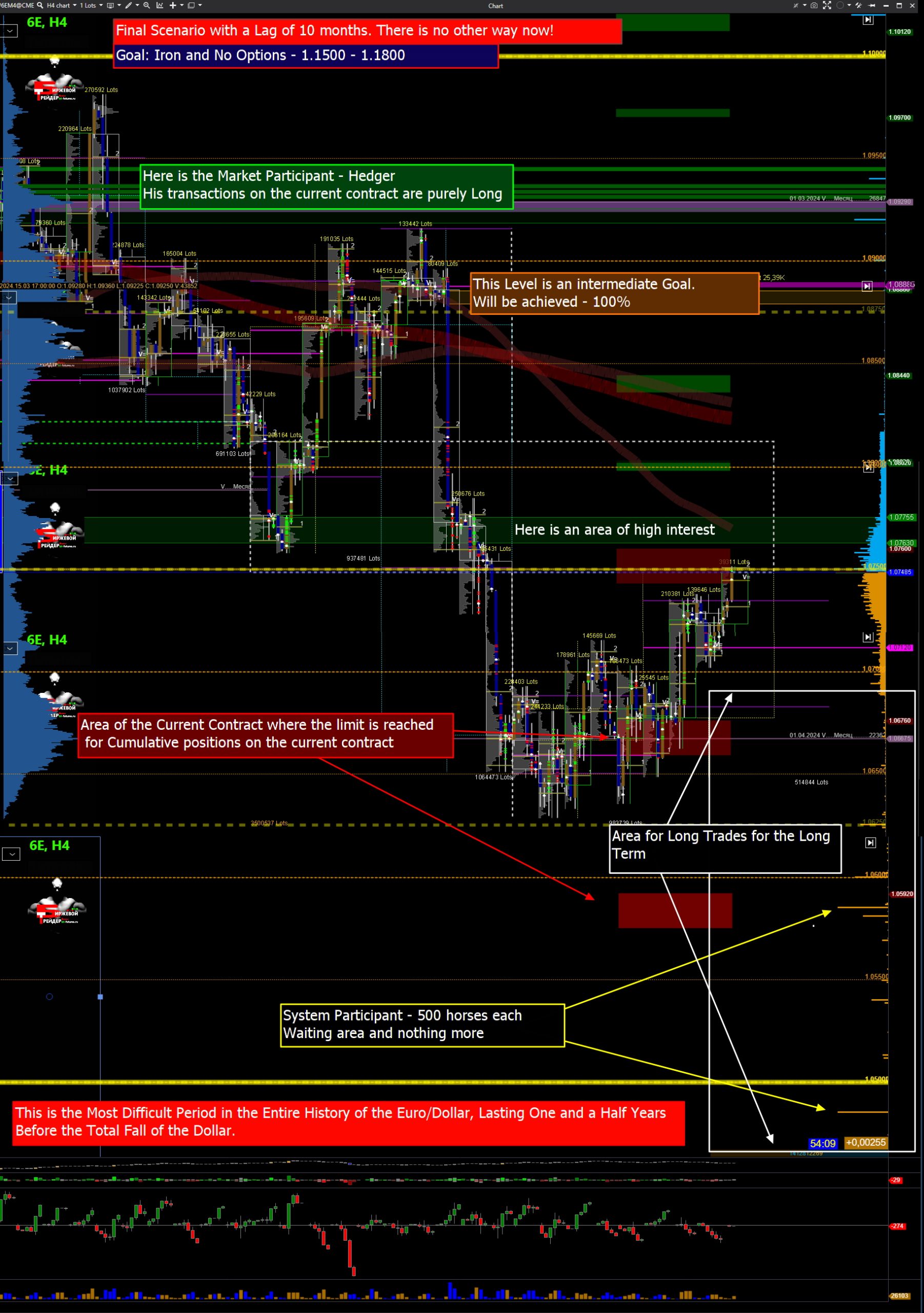

The EUR/USD pair has demonstrated resilience by rebounding from a five-month low near 1.0600. This event highlights key factors shaping the current dynamics and forecasts for this currency pair. Let’s delve deeper into each aspect of this “iron scenario” and its impact on the market.

1. Divergence in Monetary Policy between the Fed and ECB

Divergence in the policies of the Federal Reserve (Fed) and the European Central Bank (ECB) continues to remain a significant factor for EUR/USD. The ECB is expected to lower interest rates in June, which could influence the euro’s exchange rate. Meanwhile, the Fed maintains a more cautious approach to monetary policy, also impacting the dynamics of the dollar.

2. International Monetary Financing (IMF)

The IMF’s spring meetings have attracted attention from investors and analysts. Kristalina Georgieva emphasized the need to “fasten seat belts” due to potential risks of a soft landing in various parts of the world. Discussions also revolved around debt sustainability and the need to support countries facing dire situations.

3. Debt Crises in Developing Countries

Debt crises in developing countries remain a pressing issue. High interest rates serve as obstacles to their economic recovery. It is expected that low-income countries will pay over $185 billion in interest on their total external and internal debt by 2024.

4. Inflation and Challenges for the Fed

The Fed faces challenges in managing inflation. Consumer price inflation has increased, making it difficult to achieve the target level of 2%. This has sparked discussions about the need to change the Fed’s strategy and its potential consequences.

Conclusions and Forecasts

The “iron scenario” for EUR/USD underscores the complexity of the current market situation. Divergence in monetary policy, debt issues in developing countries, and inflation challenges significantly impact the dynamics of this currency pair.

EUR/USD

The conclusions drawn from the analysis represent a mature assessment of the financial landscape, indicating that the world is in a state of instability. Bubbles in financial markets are becoming increasingly menacing, surpassing all expectations and possibilities. Gradually but steadily, servicing debt is exceeding incomes, creating a situation where new borrowings are used to repay previous debts. This is already becoming a phenomenon on the global stage. The question arises: what will this behavior of governments lead to? Previously, individuals engaging in such financial pyramids could be prosecuted, but now the United States itself seems to be embarking on the construction of such a structure. As the attention of many is focused on the actions of the Federal Reserve System (FRS), it is likely that many will follow its example.

Subjectively, there is no reason to consider the dollar still the world’s primary currency. Although the process of change may be unclear and the trigger may be elusive, the past eighteen months have shown that the dollar is undergoing deep systemic changes. These changes are likely to impact the global financial system. It is forecasted that the EUR/USD exchange rate will exceed 1.5000 in the next 15 years, with an intermediate target range of 1.1500-1.1800.

BT

![]()