Exhaustion, drying up – traders can use different descriptions, but the essence does not change. We are talking about a consistent decrease in the activity of buyers or sellers as the price becomes less favorable for them.

When current prices become unfavorable for market participants, they naturally reduce their initiatives. Thus, the classical law of supply and demand manifests itself.

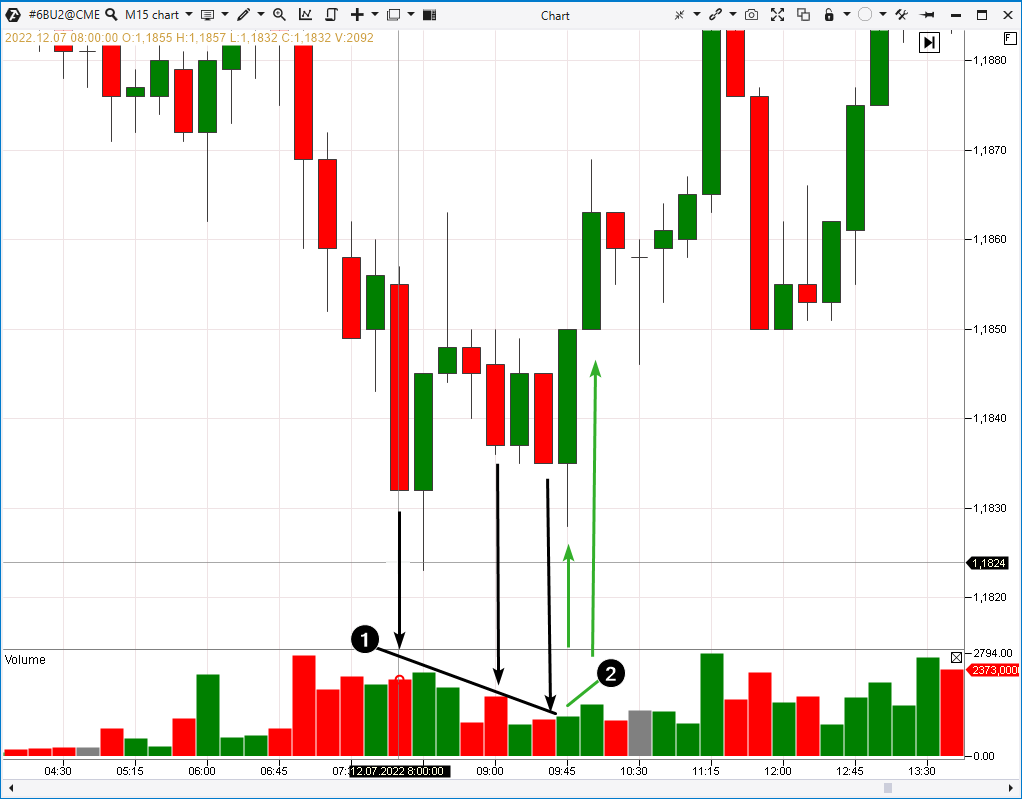

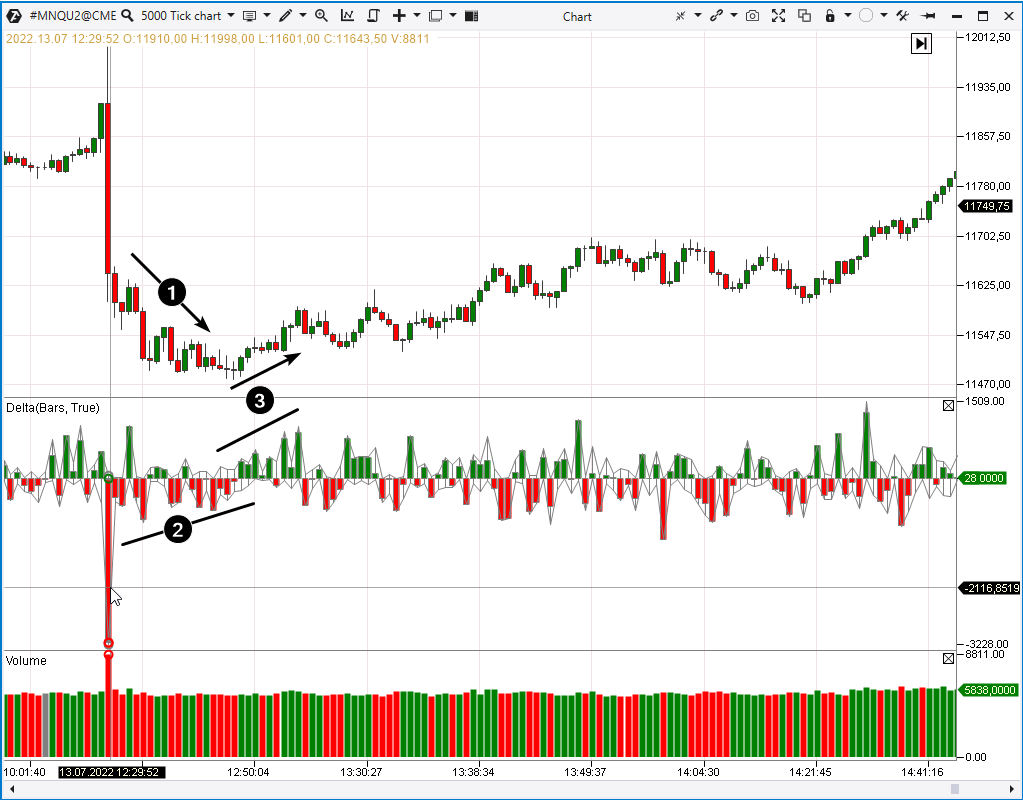

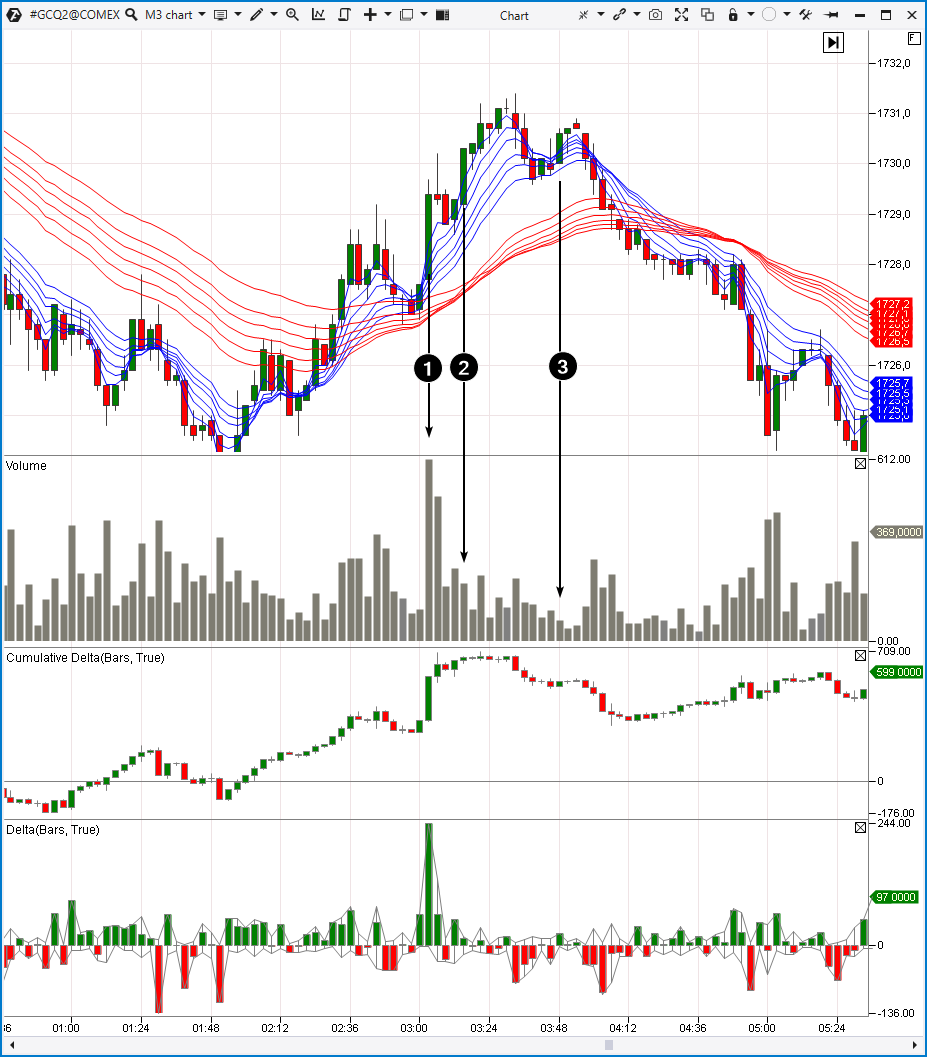

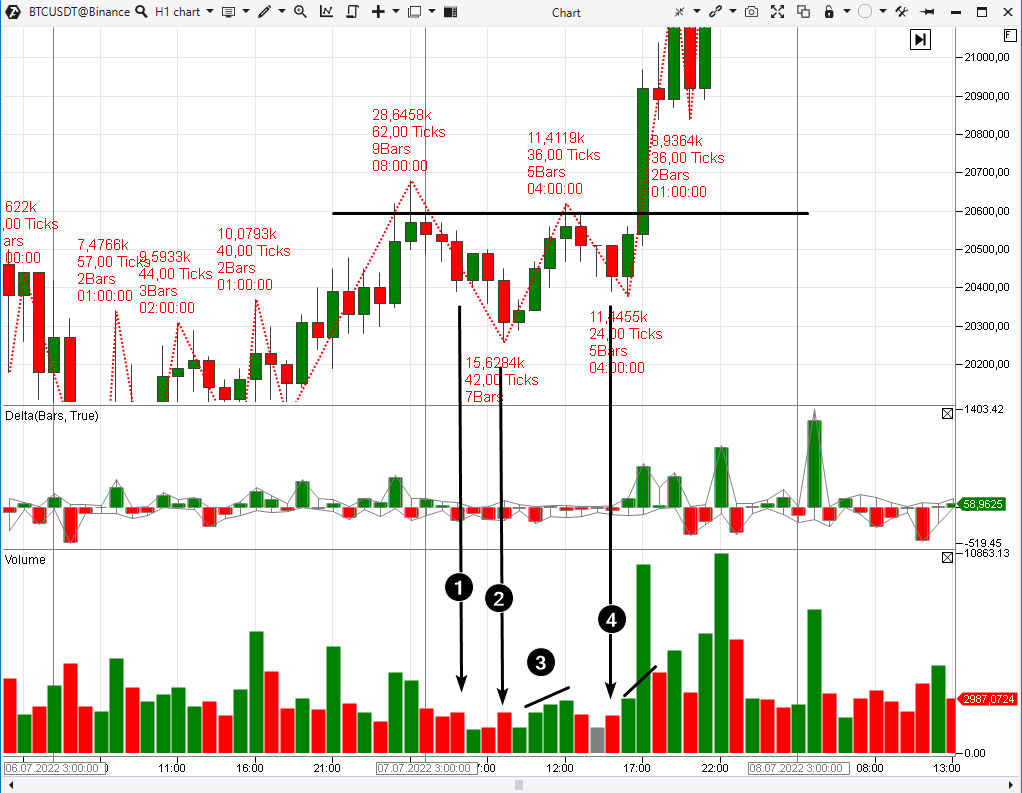

In the following, we will show a few examples, but we must warn that they will not be ideal references. In live trading, there will always be noise and other factors that distort the signal that a professional trader needs to recognize on a chart in order to achieve his goal.