Futures hedging. How to hedge risks using futures contracts

WHAT IS HEDGING?

The goal of hedging in the financial markets is protection of investments. Hedging is an investment method, which is directed at reduction of possible losses. Instruments, which do not correlate with each other, can be used for hedging.

A hedging example from everyday life is purchase of an automobile insurance policy. Insurance can cover a part of possible losses in the event of a car accident or damage.

The same approach is applied in the financial world. Hedge funds, investment funds and private traders actively use hedging for reducing various risks. Hedging cannot protect from losses completely, but can reduce them. It is possible to hedge various markets and events:

- Stocks. The stock market is actively used for investing in individual stock, stock portfolios and stock indices.

- Commodities. Oil, gold, silver, wheat, coffee and so on are important commodities in the world economy, and it is important for many companies to hedge their price fluctuations.

- Interest rate market. This field includes lending and credit rates, and respective risks.

- Currency market. This field is connected with investing in currencies of various countries (we have an individual article about hedging currency risks).

- Weather. It is possible to hedge even weather risks, which can be interesting for agricultural producers.

Risk hedging is an important part of the modern business and economy, that is why it is important both for companies and private traders and investors to master basic hedging principles.

ADVANTAGES OF HEDGING

Hedging is getting more and more popular, that is why new derivative instruments, which help to control risks, emerge all the time. Various financial derivatives are used for hedging:

- Forward contracts.

- Futures contracts.

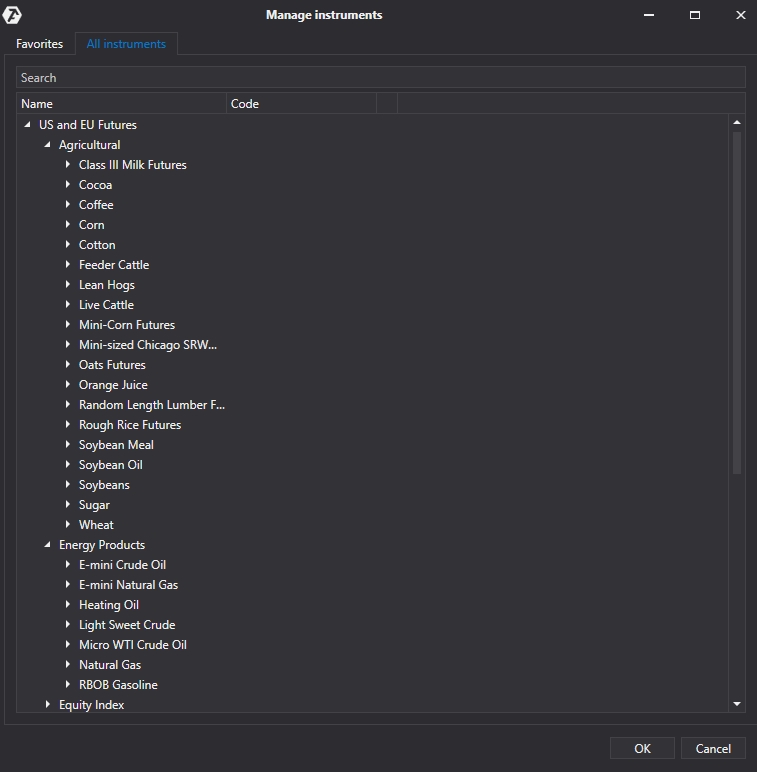

Here’s the list of some agricultural and energy futures available for hedging in the trading and analytical ATAS platform:

- Options.

- ETF.

Other more complex financial instruments.

Hedging risks with futures is a very popular method. Many professional investors and traders use futures hedging against potential falls in the market.

For example, they can try to protect or secure their portfolios against so-called black swans. These can be unforeseen events in the market, such as a financial crisis, an unexpected election result, natural or man-made disasters. Such events can result in a significant fall of stock prices, a protection against which futures hedging can be.

Individual investors can also use hedging through various stock index futures. Such an approach can protect individual investor portfolios against excessive volatility and falls in the market.

DIFFERENCE BETWEEN DIVERSIFICATION AND HEDGING WITH FUTURES

In order to understand the difference between diversification and hedging, first of all, it is important to discuss what risks an investor can face. In fact, you expose yourself to a risk when you buy a company stock. Actually, there are two types of risk:

- Systematic risk.

- Non-systematic risk.

When you buy stock or stock futures, you automatically expose yourself to both of these risks.

Stock can fall for many reasons, such as:

- Yield reduction.

- Rate-of-return reduction.

- Higher cost of financing.

- High leverage.

- Managerial misconduct.

In fact, there can be many such reasons and this list can be expanded. However, you may have noticed that all these risks have one thing in common – they are company risks.

For example, let’s assume that you have investment capital in the amount of USD 10,000. You decide to invest this money in Company 1. Several months later, Company 1 announces that its income has decreased. It is obvious that the Company 1 stock price will go down. It means that you will lose money having such an investment.

However, this news will not influence the stock price of its competitor – Company 2. It is evident that company risks exert influence only on one specific company and not on others. Such risks are often called non-systematic.

Non-systematic risk can be diversified, which means that instead of investing in one company you can select diversification and invest in 2-3 different companies preferably from different industries. Besides, a non-systematic risk reduces sharply.

Let’s come back to the above example. Just imagine that you decide to invest USD 5,000 in Company 1 and USD 5,000 in Company 2 rather than investing the whole capital for buying the Company 1 stock. In such circumstances, even if one company stock goes down (due to a non-systematic risk), damage will be inflicted only on one half of investments since the other half has been invested in another company. In fact, you can have a portfolio with 5 or 10 or even 20 stocks instead of two stocks. The bigger number of stocks in your portfolio, the higher the diversification is and, consequently, the less a non-systematic risk is.

This brings us to a very important question – how many stocks should be in a good portfolio to diversify a non-systematic risk completely. Studies show that up to 21 stocks in a portfolio will have the required diversification effect.

Systematic risk is common for all stocks. Usually, these are macroeconomic risks, which have a tendency to influence the whole market. Systematic risk examples include:

- GDP growth reduction.

- Interest rate tightening.

- Inflation.

- Budget deficit.

- Geopolitical risk and so on.

Systematic risk influences all stocks. So, if you have a properly diversified portfolio with 20 stocks, GDP growth reduction will influence all 20 stocks, and all of them, most probably, will go down. A stock portfolio is subject to a systematic risk, which cannot be diversified. However, a systematic risk can be hedged with stock index futures. That is why, when we speak about futures hedging, remember that it is not the same as diversification.

Remember that we diversify to minimize a non-systematic risk and we hedge with futures to minimize a systematic risk.

HEDGING WITH THE HELP OF FUTURES

There are different strategies of futures hedging. A simple strategy can include buying a stock portfolio and selling a stock index futures. More complex strategies can include additional futures hedging with options and other derivatives.

Let’s consider a simple example of hedging currency risks with futures. Every person wants to protect his funds against the currency devaluation risk.

How to do it in practice? You can compose your portfolio of the developed countries currency futures. To do it, you need, for example, to open an account with a licenced American broker who has access to the Chicago Mercantile Exchange (CME). The futures broker accounts are guaranteed both by the CME and US Government up to USD 250,000, which will help to protect funds by itself.

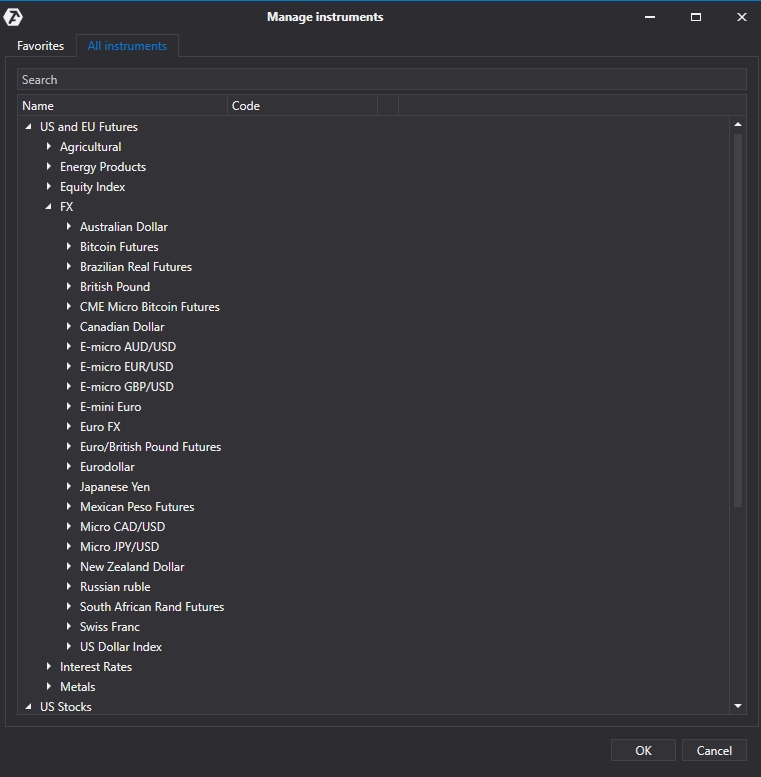

Then it is necessary to distribute your account amount evenly between the main developed country currency futures. Currency futures allow hedging USD risks in the trading and analytical ATAS platform.

You can select the following futures from this list:

- Australian Dollar,

- British Pound,

- Canadian Dollar,

- Euro Fx,

- Japanese Yen,

- Swiss Franc.

You can leave the seventh part of your portfolio in USD on your account. It is preferable to buy futures at their full face value without using leverage, since the goal of such a portfolio is to protect your funds. If you have a small account, you can use micro futures or only a part of currency futures.

You can buy other currency futures while your deposit grows. You will need to track contract expiration dates. When a contract expires, you will need to buy another contract, however, it doesn’t happen often.

Such a portfolio, which consists of currency futures of various countries, can hedge any currency devaluation risks properly. In fact, you can keep your savings in a basket of seven basic world currencies.

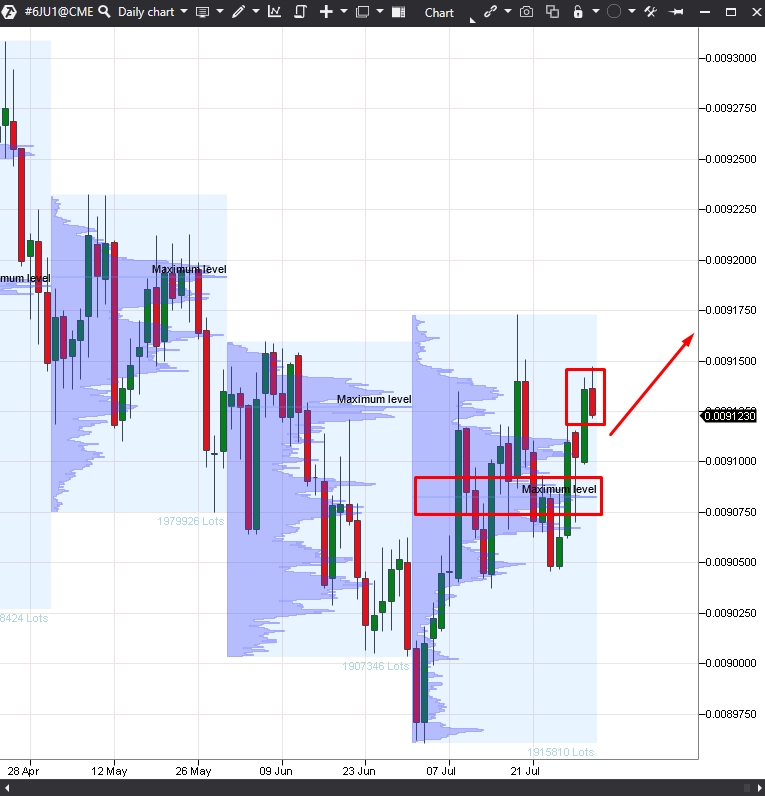

And how to select the most successful entry point? The trading and analytical ATAS platform can also help you in it. Use the daily futures chart for it.

Let’s consider an example of the Japanese Yen futures (6J) chart with the TPO and Profile indicator with the monthly period. This indicator is good at showing volume accumulation for the past month.

The picture shows the month’s closing price above the month’s maximum volume level. Most probably, the major player’s buys pushed the price up, so there was a probability of the up movement continuation. This situation represents a good opportunity for buying Japanese Yen futures for your currency portfolio.

![]()