SMART MONEY IN TRADING. WHAT IS IT?

⇒ Warning. Any strategy does not guarantee profit on every trade. Strategy is an algorithm of actions. Any algorithm is a systematic work. Success in trading is to adhere to systematic work.

The term smart money comes from gambling – casinos, horse racing, and sports. This name was given to people who won money so consistently that it could not be explained simply by luck.

Later on, the concept of smart money started being used in the startup community, venture capital investing, and trading.

In the trading community, smart money refers to large institutional investors and funds that possess significant resources and professional analytical capabilities. These players can access valuable information, analytical reports, and instruments that provide an advantage in making investment decisions.

Smart money includes significant pension funds, investment companies, central and commercial banks, hedge funds, and other stock market professionals.

In trading, the term smart money usually refers not to a specific professional market participant but rather to the collective strength they possess. It is assumed that each professional acts independently of others – sometimes, their actions synchronize, and occasionally prominent players compete, trying to outsmart each other.

In trading, smart money often uses advanced technologies and algorithms for data analysis, market modeling, and automation, including high-frequency trading and/or arbitrage.

Due to large volumes of trades, smart money can influence the market. Their actions have a significant impact on asset prices and market trends.

HOW TO SPOT TRACES OF SMART MONEY ON THE STOCK CHART?

The ideas below are based on years of market observation. They are applicable for trading stocks, futures, and cryptocurrencies.

Warning! No method can guarantee a 100% profit. You should make investment decisions based on your ability to interpret charts; only you are responsible for your assets.

TIP 1. STAY INFORMED ABOUT THE NEWS

The smart money has an emotional edge over retail traders, who are subject to fear and greed. Warren Buffett expressed this idea concisely:

“Buy when everyone around is fearful. Sell when everyone is greedy!”

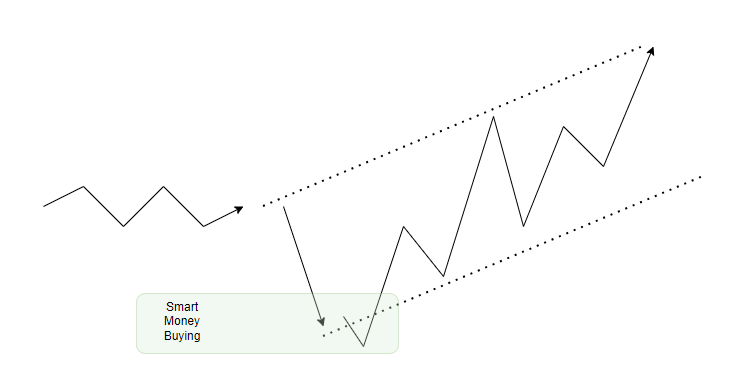

If smart money wants to buy on the eve of an uptrend, it will be interested in buying at a lower price. Therefore, before that, you usually see a downward movement on the chart (often accompanied by negative news), indicating the width of the subsequent upward channel. Perhaps smart money deliberately fuels panic to accumulate a more significant amount of exchange assets before a period of rising prices. Below is a schematic representation of this concept.

The same applies in reverse. Rapid growth amid positive news may be the opening of a downward channel. Indeed, smart money uses the market to sell their long positions (and open short positions) when everyone else is driven by greed, as noted by Buffett.

Example. Chart from the bitcoin market, 2021

In the autumn of 2021, the price of Bitcoin surpassed the psychological level of $60,000 per coin amid news of Coinbase’s stock listing on the Nasdaq exchange. Analysts were discussing the potential timing of Bitcoin reaching the $100,000 mark, while smart money seemed to be strategically selling off their positions (closing longs and opening shorts), taking advantage of the hype surrounding Bitcoin’s price breaking the significant milestone.

Pay attention to the market profile indicator: the ROS level formed above the psychological mark. After its breakout, the influx of greedy buyers was substantial, and smart money had enough demand to sell their bitcoins.

Also, take note of the sharp increase in the negative delta at the beginning of the trend. Smart money likely finished establishing their short positions, the intense buying pressure waned, and market sell-offs swiftly pushed down the price of Bitcoin, trapping buyers in the process.

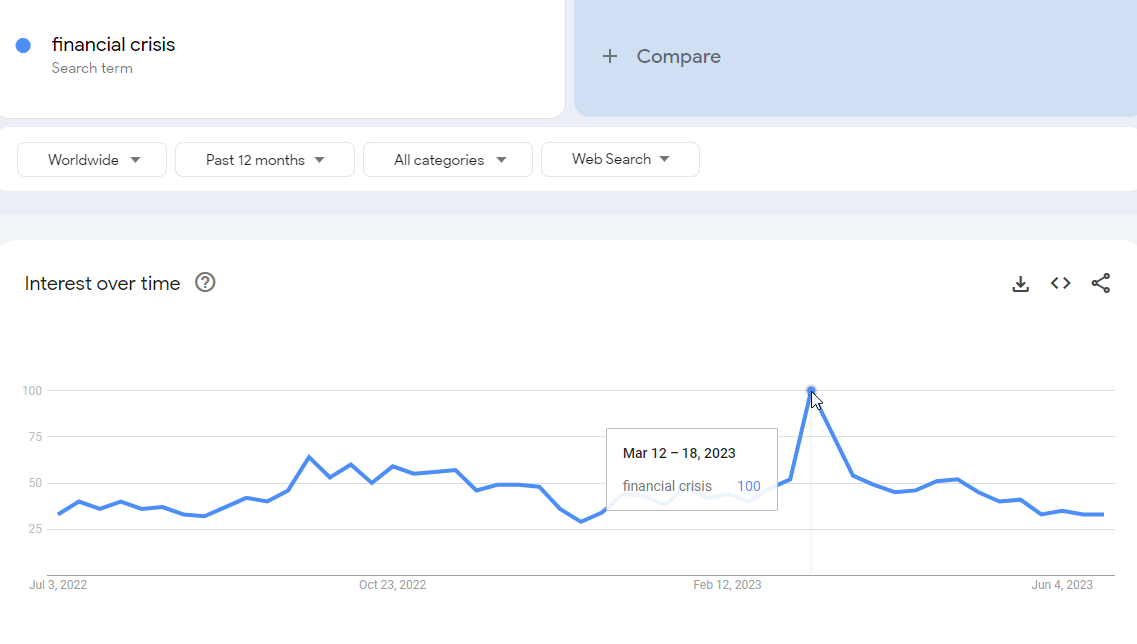

Example. The E-mini S&P-500 market and the banking crisis

In March 2023, financial market participants were greatly concerned about the bankruptcy of Silicon Valley Bank, SilverGate, and others. This is displayed on the Google Trends chart.

Let’s turn to the E-mini S&P-500 chart. It can be assumed that this period coincided with a significant market low.

Market profile analysis suggests that amid the news about the crisis, the smart money was accumulating long positions around the 3900 level, where a maximum volume level was formed.

Based on the delta shift from negative to positive, it appears that the campaign occurred in two stages (as is usually the case):

- Initially, the smart money was using limit buys to buy up sell orders from traders who were fearful of a widespread crisis due to a series of bankruptcies.

- Once the panic subsided and the bankruptcy issues were resolved (as larger banks acquired them), the E-mini S&P 500 started to rise due to market purchases by smart money. It is presumed that they had information suggesting that the bankruptcies would be resolved and a market crash would be avoided.

TIP 2. TRACK VOLATILITY

Increased market volatility indicates smart money activity since retail traders and their small order sizes cannot move the market.

The easiest way is to use the ATR indicator.

Example. A spike in market volatility in the oil market

From late November to early December 2021, the world became deeply concerned about the emergence of a new African variant of the coronavirus. The price of oil experienced a 10% drop in a single day, triggering memories of the paradoxical negative oil futures prices witnessed during the panic in the spring of 2020.

Example. The situation on the British pound market

Liz Truss was the shortest-serving Prime Minister in the history of the United Kingdom. Her tax reform created a lot of controversy, and as a result, Truss resigned, which helped stabilize the markets. The chart clearly shows a two-day panic when the price dropped to the lower border of the parallel channel and then bounced off it.

The panic sentiment was a favorable opportunity for smart money to establish long positions. Undoubtedly, they had access to more information regarding the change in the prime minister than what was publicly disclosed in newspapers. And at the same time, they had a better understanding of the intrinsic value of the British currency, which had fallen to the 1.05 level.

Once again, the change in delta readings suggests that smart money initially encountered panic market selling through limit buy orders. When the panic subsided, they started buying at market price.

TIP 3. TRACK COT REPORTS

COT reports are publications that disclose the positions of prominent market participants.

These reports help reduce the risks of market crashes and provide valuable insights into the long-term perspectives of prominent players (smart money).

The data is displayed in a user-friendly format in the ATAS platform through the COT report indicator.

The peak values of the red line (refer to the wheat futures chart above) correlate with market lows.

You can read more about COT reports in the corresponding article on our blog.

TIP 4. TRACK THE VOLUME INDICATORS

Volume indicators are the most obvious instruments for tracking the activity of large players. COT reports and other mentioned sources of information can be delayed, while indicators such as Big Trades and Heat Map in the ATAS platform allow tracking smart players intraday in real-time (requires connection to the exchange data feed).

Example. LTCUSD market

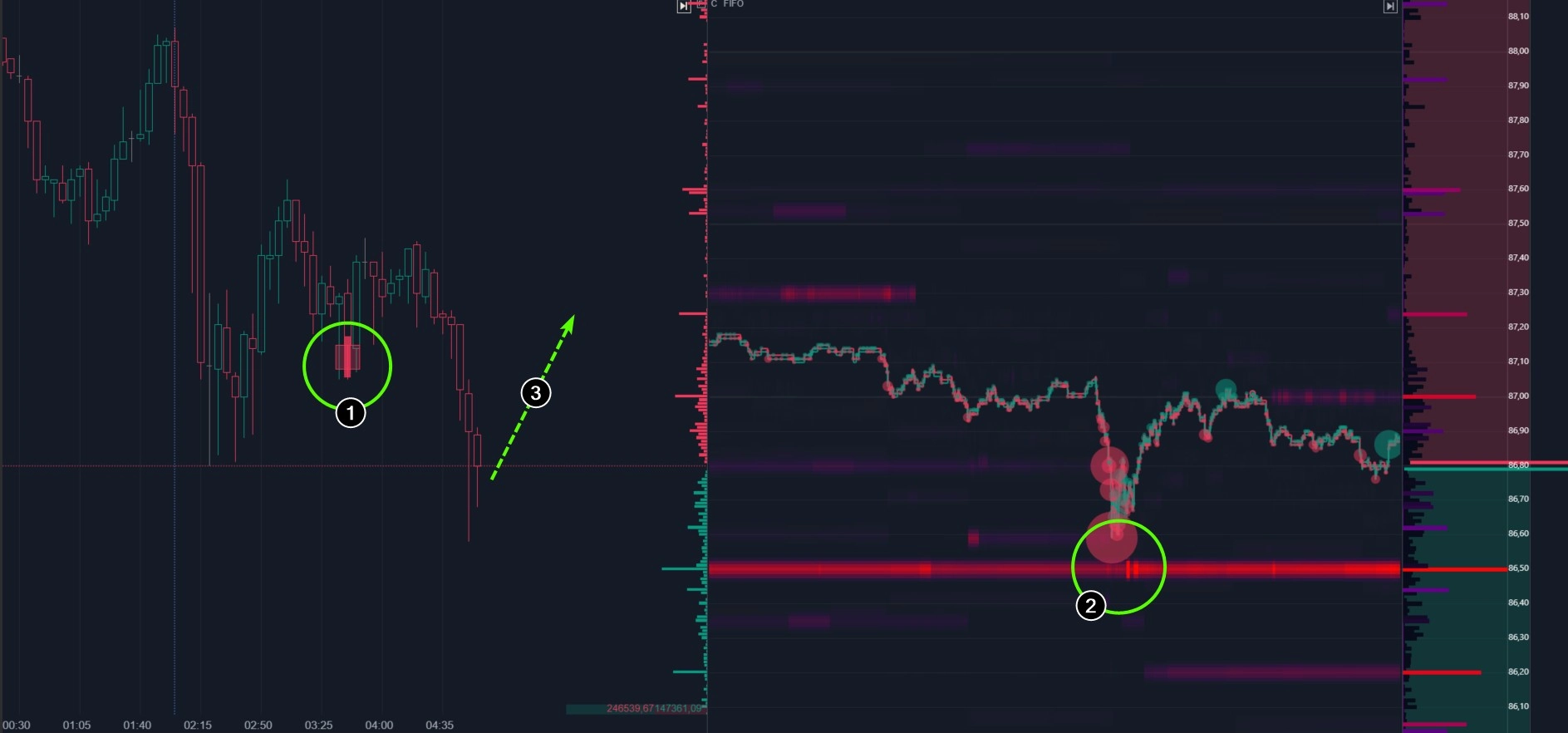

The 5-minute chart below shows the intraday situation. The Big Trades indicator has been added to the chart and the DOM Trader module, which includes a heat map.

The Big Trades indicator shows a spike in market sales (1). Can one say for sure that smart money was active here? Perhaps this was a single activity of a large seller who rushed a little.

The further development of events is better observed on the heat map. At the price minimum, it closely approached a significant volume level in the order book (2) – only a large player could have placed that limit buy order. At the same time, there was a series of panic selling, noticeable through the red dots on the Smart Tape. The selling pressure was insufficient to break through the support of the large volume, ultimately leading to a bullish reversal (3) in price.

Example. The gold market prior to the speeches of central bank governors

The chart below is similar to the previous one, but from the gold market.

We can assume that smart money is interested in buying in the range of 1908-1912. This is where the large limit buy orders are located. This interest is likely expressed through the downward movement (as seen on the 5-minute chart on the left) losing its momentum, and there are signals of Big Trades appearing at local lows, followed by bullish candles.

However, an opposing interest (2) is present in the market, which is evident from significant limit sell orders being placed near the current price to counteract the bearish wave. Overall, market sentiments were particularly volatile, given that the speeches of central bank heads were scheduled for that day (June 28, 2023).

BT

![]()