WHAT PARALLEL CHANNELS ARE

⇒ Warning. Any strategy does not guarantee profit on every trade. Strategy is an algorithm of actions. Any algorithm is a systematic work. Success in trading is to adhere to systematic work.

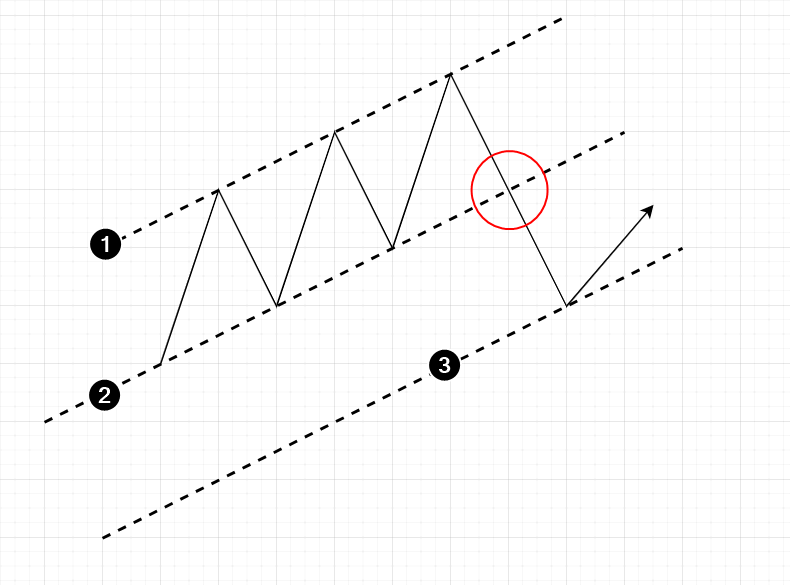

A parallel channel is a technical analysis pattern in which the price forms a trend channel (1-2) and then breaks through one of the boundaries to find the next boundary (marked with a red circle in the diagram below).

This provides a condition for creating a parallel channel.

To draw a parallel channel line for a bullish trend, you need to:

- Create the initial channel (1-2).

- Measure the width of the initial channel.

- Draw a parallel line (3) below the initial channel (2) at a distance of the channel width (1-2).

Technical analysts may expect this line (3) to serve as new support from which the bulls will try to resume the uptrend.

The parallel channel pattern for a bearish trend works similarly but in a mirror image.

WHY THE PATTERN WORK

The parallel channel pattern is similar in its nature to the 50% retracement . In both cases, there is a proportional correction of the price dynamics within the global trend.

Hypotheses about the efficiency of both patterns also coincide:

- They are affected by Fibonacci proportions.

- The market equally reduces the opportunity to earn for both trend traders and counter trend traders.

- Trading psychology and price perception have an impact.

In addition to assumptions about the reasons for the parallel channels’ effectiveness, we are going to give examples on historical charts. They will definitely convince you to pay attention to this technical analysis pattern.

Example 1

The first example is the dynamics of the S&P-500 in 2018. Throughout the year, it was between by the initial channel lines 1 и 2. However, a bearish breakout occurred at the end of the year. On December 24, the SPX made a low, which probably killed the Christmas mood for traders.

At the same time, the parallel channel line (3) quite clearly indicated the level of a quick reversal on the daily chart. One could use lower intraday time frames to get confirmation and enter a risky position with a small volume — it had a chance to become the “best trade of the year”.

Example 2

The same SPX index, but on a larger scale. Another candidate for “trade of the year” or even more.

If you draw the main channel (1-2) through the extremes of 2014-2020, the parallel channel line (3) will indicate the bottom of the panic caused by the spread of the coronavirus. While the rest of the world was terrified, the parallel channel helped cold-blooded investors choose the accurate entry point.

Example 3

During 2018-2022, the NFLX stock price formed a trend channel (1-2). But then the price plunged down amid the news of a decline in the number of subscribers.

The parallel channel line (3) indicated the level at which the panic subsided. The price formed a several-week range and then rallied noticeably (although the overall market was not bullish in the second half of 2022).

Example 4

At the end of 2021, the investors’ agenda was formed considering strict restrictions due to the coronavirus in China. They led to a decrease in demand. The statistics also made it clear that some of the world’s largest economies were heading towards a recession. Oil futures fell sharply in price.

A false breakout in August makes it more difficult to draw the main channel. Other than that, the main channel (1-2) shows up quite clearly. The parallel channel line (3) provides a major reference point for finding a long entry point.

Example 5

A similar situation occurred in the market of another energy asset during the same period.

However, the rebound from the parallel channel line did not form as actively on the natural gas futures chart as it did on the oil futures chart.

Example 6

Now let’s have a look at a bearish pattern from the cryptocurrency market. After declining from a historical peak in November 2021, the early spring of 2022 gave bulls hope.

However, this was only a correction to the parallel channel line (3). The main channel can be drawn based on the price actions marked with arrows. In April, the bearish trend resumed and the price of bitcoin reached multi-month lows amid bankruptcies of major participants in the crypto industry.

ADVANTAGES AND DISADVANTAGES

Like many other technical analysis patterns, the parallel channel has its advantages and disadvantages.

Advantages

- it is easily formed;

- you can enter a position at the beginning of a trend impulse;

- examples are found in all markets, time frames;

- reference points for calculating target and a stop-loss.

Disadvantages

- the price does not always break through the trend channel in order to test the parallel channel line;

- there is no guarantee that the trend will resume;

- a setup for a rebound from the parallel channel line may mean countertrend trading, which carries additional risks;

- subjectivity in the drawing of initial channel lines.

It is impossible to completely eliminate risks when trading parallel channels. Or any other patterns. But they can be significantly reduced by using professional instruments for analyzing exchange trading.

HOW TO IMPROVE PARALLEL CHANNEL TRADING WITH ATAS

Try to use the following trading plan as a basis:

- Find a trending market.

- Draw a trend channel.

- Wait for its breakout. Correct the channel contours if necessary.

- Draw a parallel channel line.

- Wait for the price to reach the parallel channel line.

- Get confirmation that the price is reversing from the parallel channel line.

- Enter a position with pre-set target and stop-loss levels.

ATAS platform has professional instruments for trading volume analysis. They will help you at the 5th stage of the above plan.

S&P 500 Index futures example

Below is a price chart for the S&P-500 futures. It includes three days: bullish news was released on the first day, the price formed an ascending channel on the second day, and there was a rebound from the parallel channel line on the third day.

You can see two charts on the screenshot:

- the top one shows the price dynamics on a 15-minute period. We use it to draw the main channel (1-2) where the price entered after the important news. The parallel channel line (3).

- lower is also drawn on this chart (3).

Let’s suppose that you have drawn the main channel on the second day, and during the third day you keep watching the market in order to enter a long position during a bounce from the parallel channel line (3).

The chart gives confirmation with the delta indicator. Note the three downward arrows. They indicate spikes of negative delta — evidence of market sellers’ activity. Analyze how the price changes in response to this activity:

- arrow 1 —significant bearish progress, even though the price has closed in the middle.

- arrow 2 — bearish progress has decreased. The pressure of the sellers is strong, but the price has slightly decreased in response.

- arrow 3 — progress is insignificant, moreover, the pressure is decreasing significantly.

All this indicates a shift in sentiment and a possibility that some major trader has set up a wall of buy limit orders to meet the full wave of sells (most likely emotional ones).

When sells become exhausted, the appearance of a buyer (marked with the up arrow in the chart above) causes a flexible price increase as the price does not encounter any resistance from sellers.

It is curious that there is a characteristic pattern on the market profile in the shape of the letter “b”. The thickening at the bottom confirms the hypothesis that there is power in the market with the intent to “buy everything that sells below 4140”.

The maximum volume level is formed around 4137. The parallel channel line, which helped prepare in advance for a bullish reversal at this level, passes very close to this area. A coincidence?

Euro futures example

The price action on the left side of the chart (the evening of the previous day and the morning of the next day) provided information for drawing the main channel (1-2).

Having drawn it, you can find the parallel line 3 and wait for its test. Let’s have a look at a lower time frame, more specifically, at the moment of testing, which is marked with a circle on the above chart.

Note that the chart has exactly the same features:

- thickening of the profile in the lower part: the “dam” of limit buys keeps the flow of market sells;

- over time, the flow of market sells becomes exhausted (1);

- a change in delta shows that buyers have become more active (2). The price responds in a cheerful way and skyrockets.

When to open a position? It depends on luck and personal qualities — patience and willingness to take risks. In any case, you must act systematically and avoid excessive risks.

Consider calculating take and stop levels based on the current channel width. To protect the buy, you can set a stop-loss at one third of the channel’s width 2-3. Partial take near the line 2. Sounds like an idea for a trading plan.

Example from the cryptocurrency market

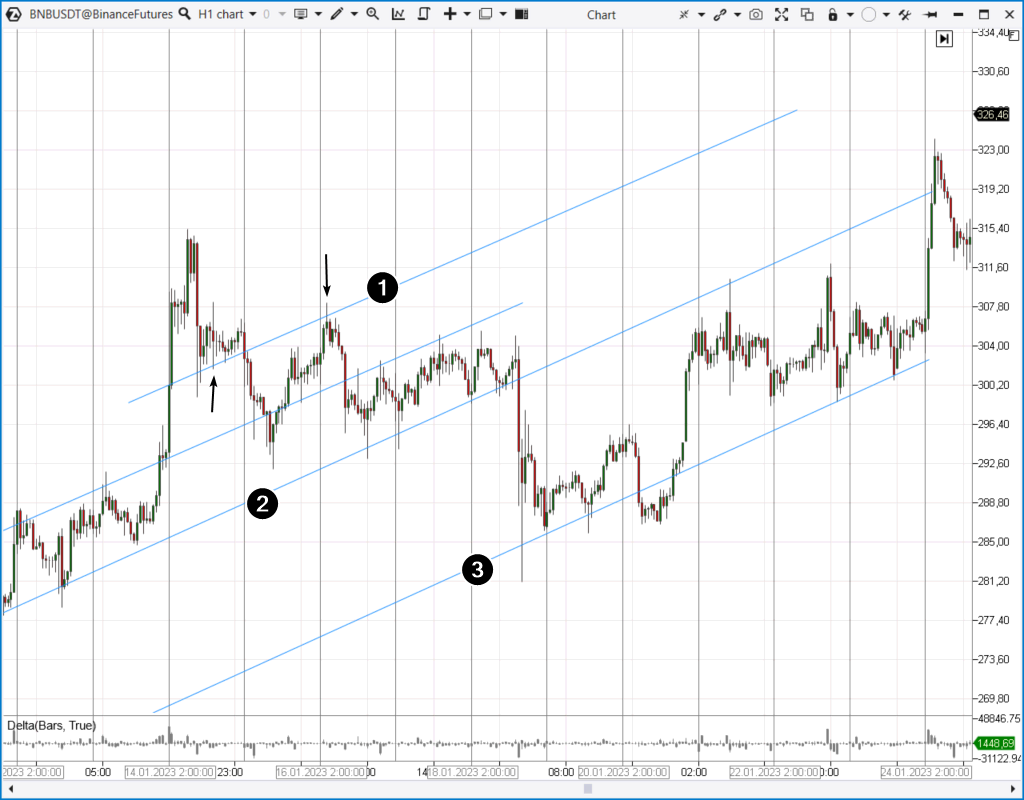

The 1-hour chart shows the price action for the BNB token futures market (the data was taken from the Binance exchange).

It is easy to draw the main channel line (2). Despite the characteristic “pivots” that abound in such crypto futures and bring some chaos due to false breakouts, support from the channel line is clearly visible.

After examining the chart, you can draw a line (1)– a line between1 и 2. The price should react to touching the lines (shown by arrows) as often as possible.

This will give you the initial data for drawing the parallel channel line (3). It can serve as support after a wave of euphoria in the market, which was caused by a sharp price rise above $310 per token (on the left side of the chart). A lot of traders went long, and now the price can head towards the area of stop-losses set by the traders.

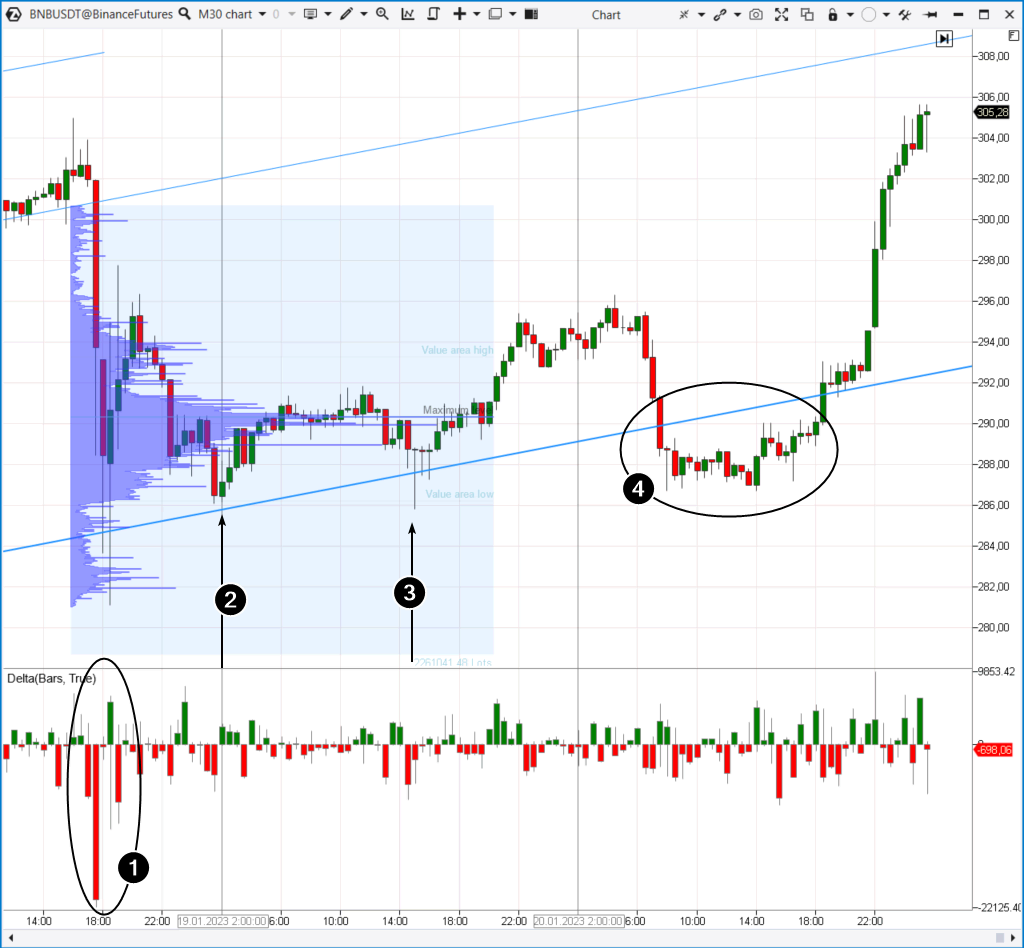

Let’s consider the details of touching the line3on the M30 period.

A sharp change in readings on the delta indicator (1) indicates that buyers became more active after a panic price decline. This is the first sign that demand is present. The presence of demand is then confirmed by tests.

The presence of demand is then confirmed by tests(2) and (3)which give reasons to open a long position.

It is worth noting that the market profile does not form a well-defined “b” shaped profile in this example.

Another interesting feature is a decline (4) that goes under the parallel channel line. But if you give the price some space by placing a stop-loss below the parallel channel line at a distance of one-third or one-half of the initial channel width, you will have a certain amount of freedom to go into an acceptable drawdown and still get profit in the end.

In any case, do not risk money that you cannot afford to lose.

BT

![]()