Euro/Dollar – Scenario 05.07.24 – Executed.

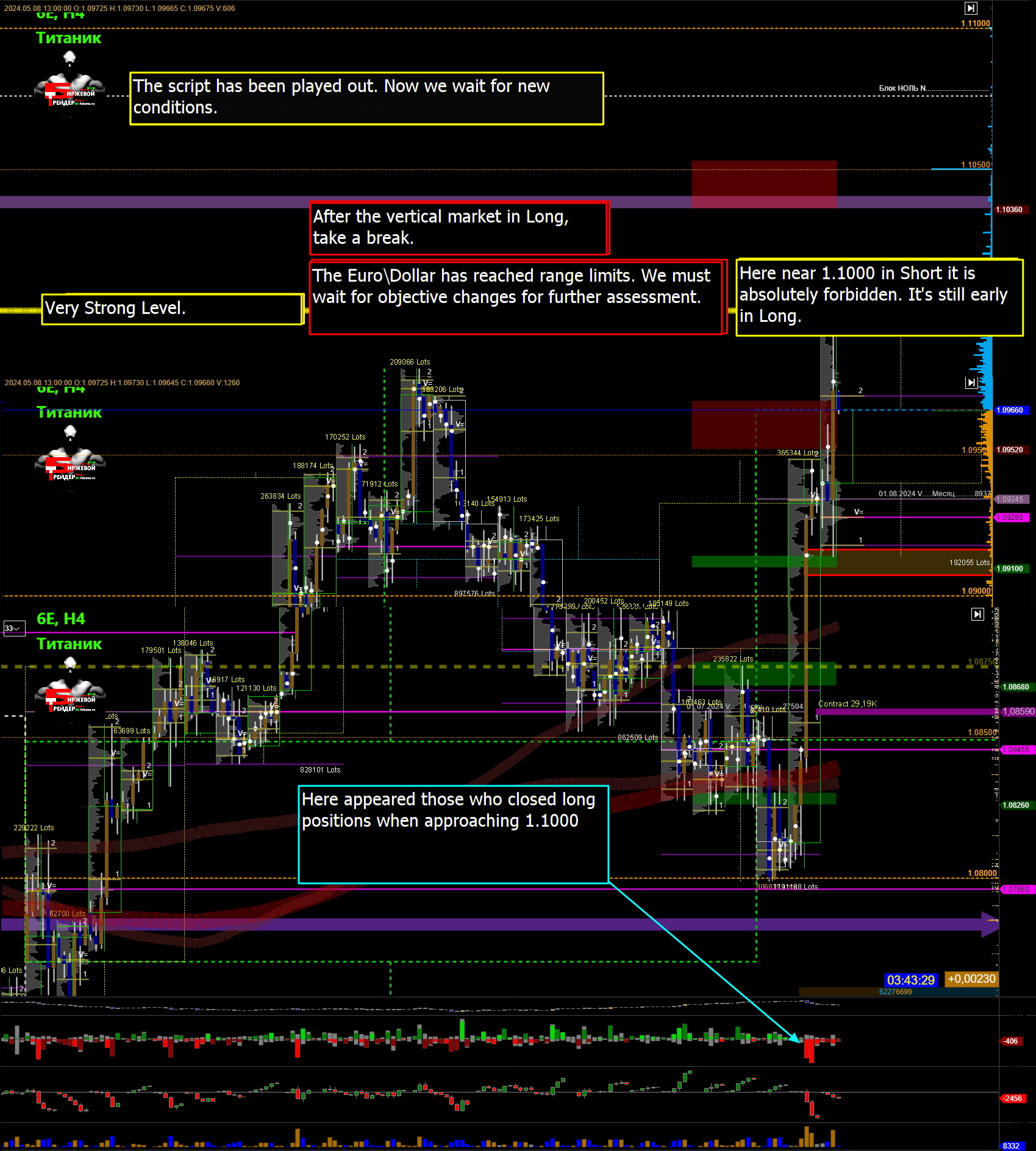

The scenario for the EUR/USD currency pair has been fully played out.

The market is not some kind of predictable living or non-living organism – it’s a business model, a capitalist environment designed to generate profit for those closest to the level of gods among men. I’m writing this because we can make assumptions based on expectations. The most experienced, like me, can determine with a very high probability how the scenario will develop, but that’s all.

The main thing we lack is an understanding of when this will happen and why. Any information, especially at the current stage of civilization, is a tool for solving specific problems. Namely, creating conditions under which the majority of people (the herd) must do as is subtly formed in the media in the form of articles, analytics, or data. Certainly, the scenario has been played out, but how? Suddenly, sharply, and supposedly because some data showed a result much worse than expected.

The question remains, was it expected? To have someone, you need to create conditions and bring the situation to a point where NO ONE expects anything, i.e. so that no one has time to realize what is happening and why. The vertical movement of the Euro/Dollar, playing out a three-week swamp in one trading day, indicates one important detail – this is a tough, prepared manipulation. Insiders knew how it would be and, most importantly, planned when to do it so that others would not have time to recover.

Now that, in essence, they have delivered all the expected movement in the Long for a day or two, of course, the price of the Euro/Dollar was brought to 1.1000, i.e., they flew more than 150 points in a matter of hours, which is unthinkable in this and the previous year. The main thing is based on what, on some ordinary data on unemployment. In fact, they completely sharply leveled the current volatility and created a new form of fluctuations for this instrument.

WAIT. Now it is categorically impossible to take any action. Yes, of course, Long is already on the horizon. The level of 1.1000 is VERY important. In the Long for the Euro/Dollar, you can only look if any subsequent Week Closes Above 1.1000. In other cases, taking Long is Taboo. Taking Short is also not worth it, in the current conditions near 1.1000 it can be a Trap. You need to WAIT! Now, in order to move the Euro/Dollar somewhere, they are starting to play a new game – recession. They are rocking a new message – recession in the US and other points. The Federal Reserve may be forced to cut interest rates before its next meeting in September to prevent the formation of a recession-inducing feedback loop between markets and the real economy. Money markets are raising the odds of an emergency rate cut as global stocks fall amid concerns about economic growth following weak US jobs data last week.

Traders are betting on a 15 bp cut in the Fed rate within a week, compared with about 5 basis points on Friday, according to weekly OIS swaps. Money markets are pricing in a total of 54 basis points of cuts at the September Fed meeting and 131 basis points by the end of the year. Futures traders are pricing in roughly the equivalent of five quarter-point Fed rate cuts by the end of the year, suggesting expectations of unusually large half-point moves over the final three meetings. Such large cuts haven’t been seen since the pandemic or the credit crisis.

BT

money markets, rates, probability, extreme decline, interest rates, global equities, economic growth, weak employment data, US, traders, Fed rate cut, weekly OIS swaps, September Fed meeting, basis points, Goldman Sachs, recession, American economy , financial imbalances, inflation, central bank, interest rate cuts, two-year treasury bonds, yields, banking crisis, global financial crisis, dot-com crash.

![]()