Scenario for the EUR/USD currency pair

⇒ Warning. Any strategy does not guarantee profit on every trade. Strategy is an algorithm of actions. Any algorithm is a systematic work. Success in trading is to adhere to systematic work.

The single European currency (EUR) is holding above the 1.08 level, attempting to defend the modest gains of the past two weeks. The revival of limited possibilities for two rate cuts by the Federal Reserve continues to pressure the US currency (USD), especially after the week’s macroeconomic data.

Current Situation and Key Levels

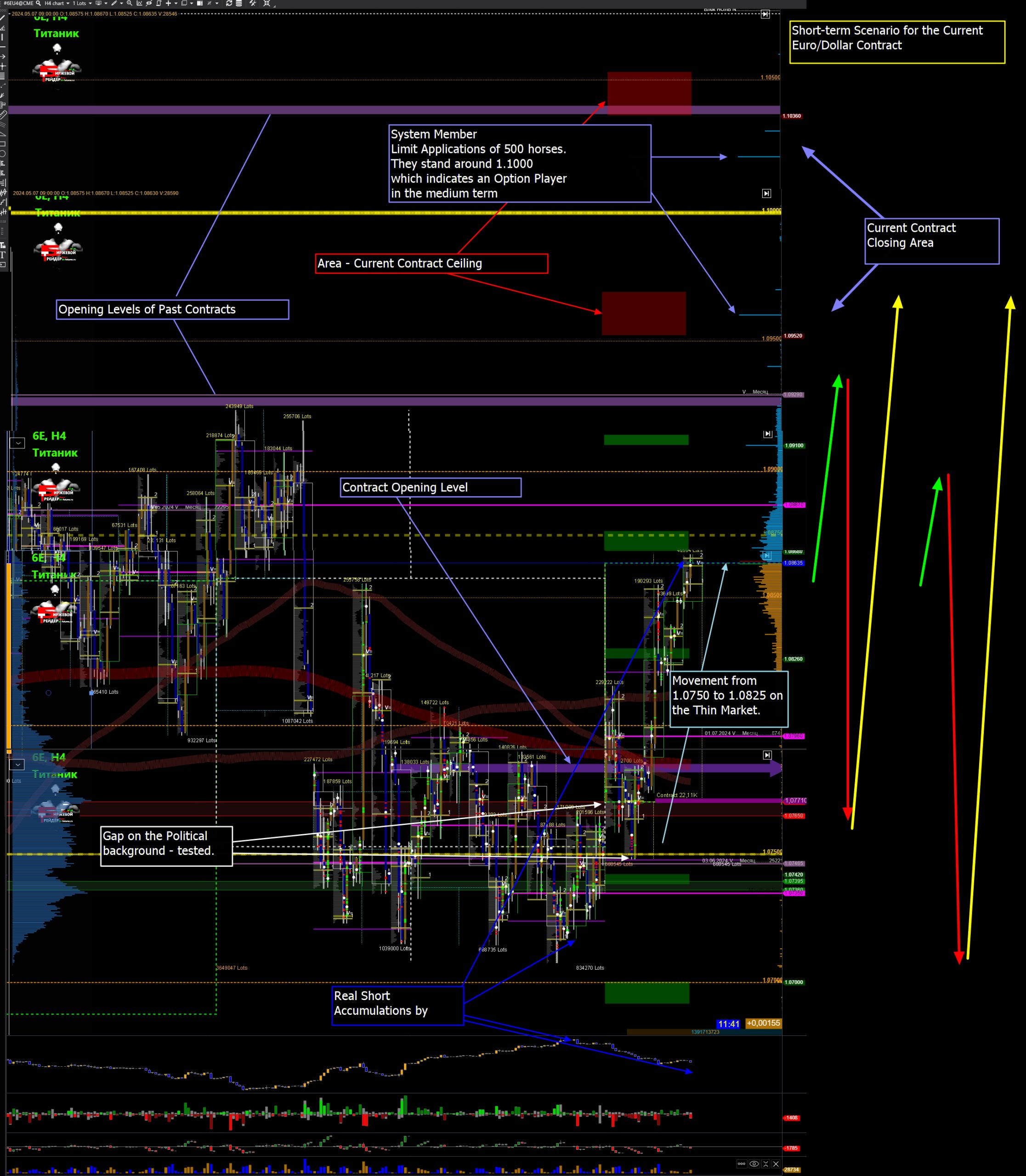

The chart of the current contract for the EUR/USD currency pair highlights several key levels and zones:

- Systemic Participant:

- Limit orders of 500 lots are located around the 1.1000 level. This indicates an options player in the medium-term perspective, making this level a significant resistance.

- Opening Levels and Ceiling of the Current Contract:

- The opening level of the contract and the ceiling area of the current contract are marked on the chart, indicating important trading zones.

- The opening levels of previous contracts are also highlighted, which may serve as historical supports or resistances.

- Notes and Events on the Chart:

- The gap on the political background was tested, emphasizing the importance of this level.

- Real short accumulations in the market indicate bearish sentiments at certain times.

- Movement from 1.0750 to 1.0825 in a thin market may indicate low liquidity and high volatility in this zone.

Impact of Macroeconomic Data

Despite yesterday being a holiday in the US due to Independence Day, the US dollar remains in question. Disappointing macroeconomic data from the US services sector, released on Wednesday, still have an impact, continuing to pressure the dollar.

Expectations and Prospects

The ongoing reaction of the European currency has taken the exchange rate out of the narrow fluctuation range near the 1.07 marks. However, there are no clear signs yet that could confirm a trend change and an easy return of the euro above the 1.10 level. Important events that could affect the further movement of the currency pair include the Non-Farm Payrolls (NFP) data in the US and retail sales data in the Eurozone. These data often cause increased volatility and can significantly change the current trend.

Short-Term Scenarios

The chart presents short-term scenarios:

- Bullish Scenario (green arrows) indicates a possible price rise.

- Neutral Scenario (yellow arrows) indicates possible consolidation.

- Bearish Scenario (red arrows) indicates a possible price decline.

Recommendations

- Monitoring Key Levels: It is important to monitor the price reaction at the 1.1000 level, as this can be a significant resistance or support.

- Scenario Analysis: Use the presented short-term scenarios for planning trading strategies.

- Considering Historical Levels: The opening levels of previous contracts can help determine long-term trends and potential reversal points.

- Reaction to Political and Economic Events: Closely follow political news and macroeconomic data, as they can cause significant market movements.

In conclusion, the current situation in the EUR/USD currency pair market requires careful observation of macroeconomic data and market reaction to key levels. Making the right trading decisions in such conditions can significantly improve the effectiveness of trading strategies.

BT

![]()