“The trend is your friend.” Perhaps it is the most popular saying among traders and there is a reason for it.

Trend trading strategies assume that the price of a financial asset will continue to move in the same direction as it is currently trending.

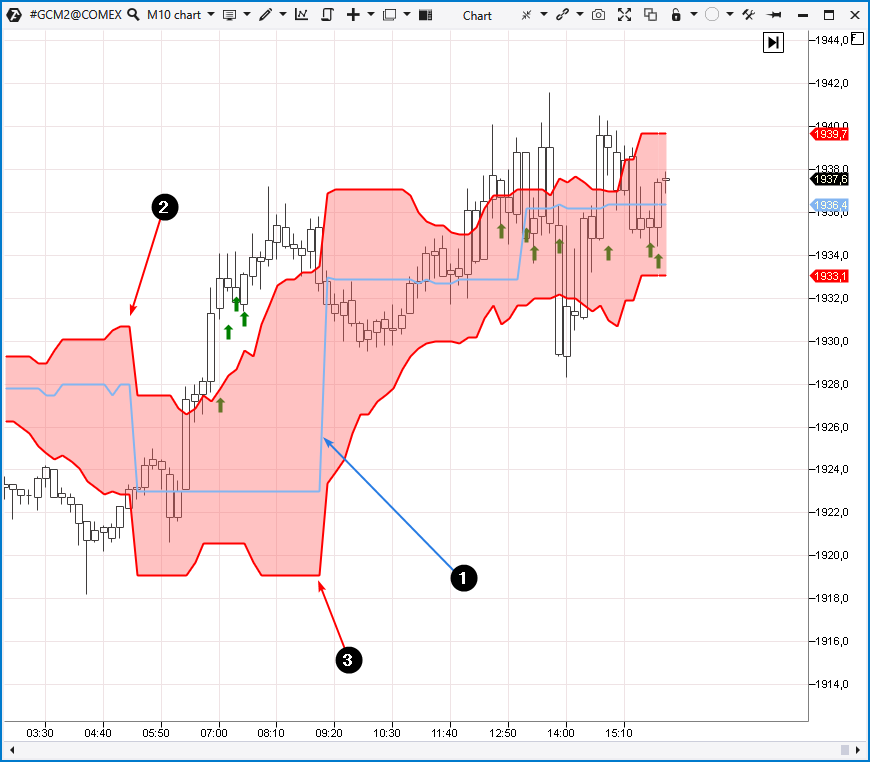

The top chart shows a downtrend in the S&P-500 futures market. Opening a short position will have more priority according to trend trading .

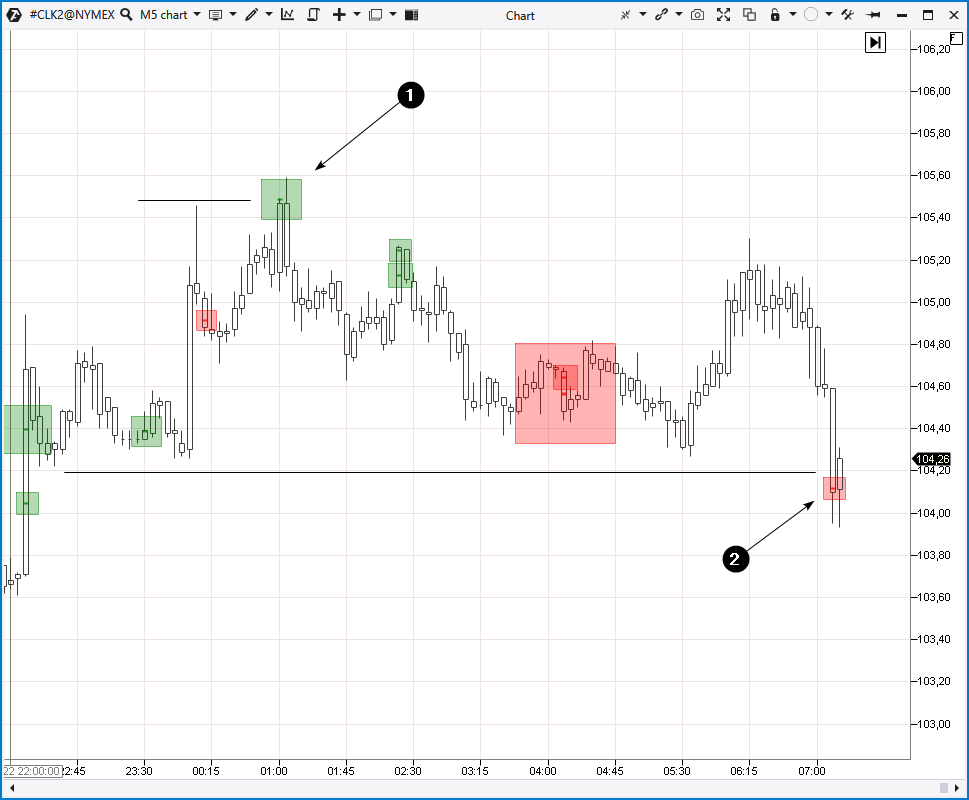

However, if the trend is upward, opening a long position will have more priority (the bottom chart, ETHUSD market).

If you trade with the trend, you:

- probably act in harmony with market sentiments and its fundamental background;

- increase your overall chances of making a profit;

- reduce the amount of time that is required for a position to show profit;

- increase the potential of the trade.

However, there is some bad news:

- sooner or later trends come to an end. Some trends last for a very short period of time;

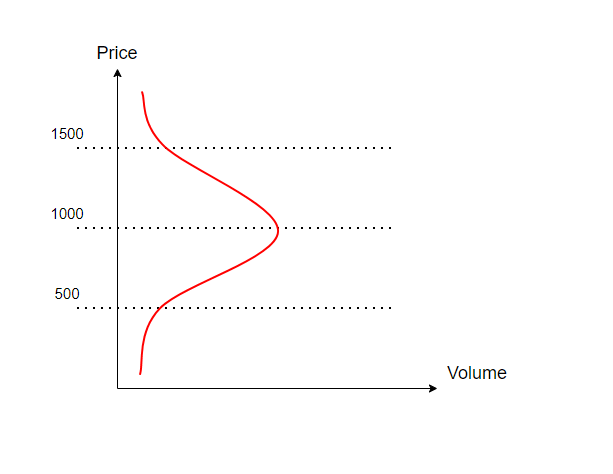

- it is quite difficult to determine the strength and direction of a trend.

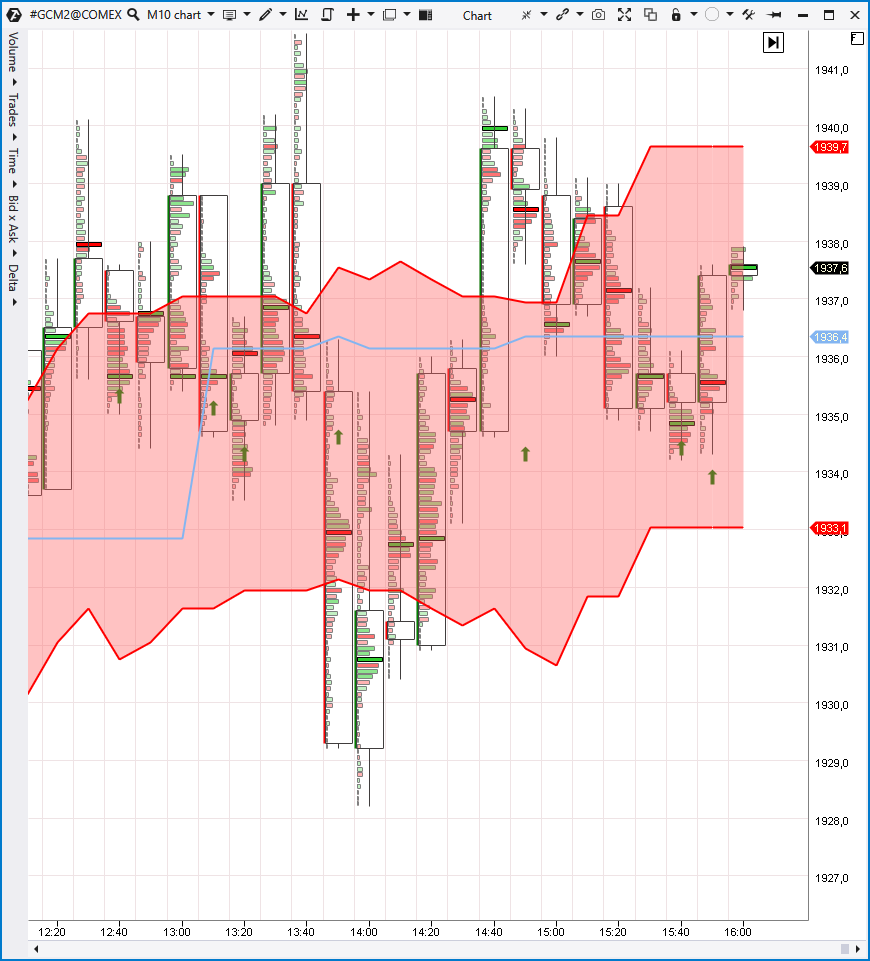

In the following part we will show you how to identify a trend using the Dynamic Levels Channel indicator. After that we will use the Cluster Search to find a good entry point.