7 things that answer the question: ‘What is volatility?’

Volatility in the non-financial world describes a tendency to fast and unpredictable changes. This definition is approximately the same in application to financial markets – it is just a bit more technical.

Market volatility is a statistical measure of the asset price deviation from the established standard or own average indicators.

It means a measure of how big a sudden fluctuation or strong change of a stock or another asset price is.

In simple words, market volatility is a frequency and range of the price up or down movement. The stronger and more frequent prices fluctuate, the more volatile the market is.

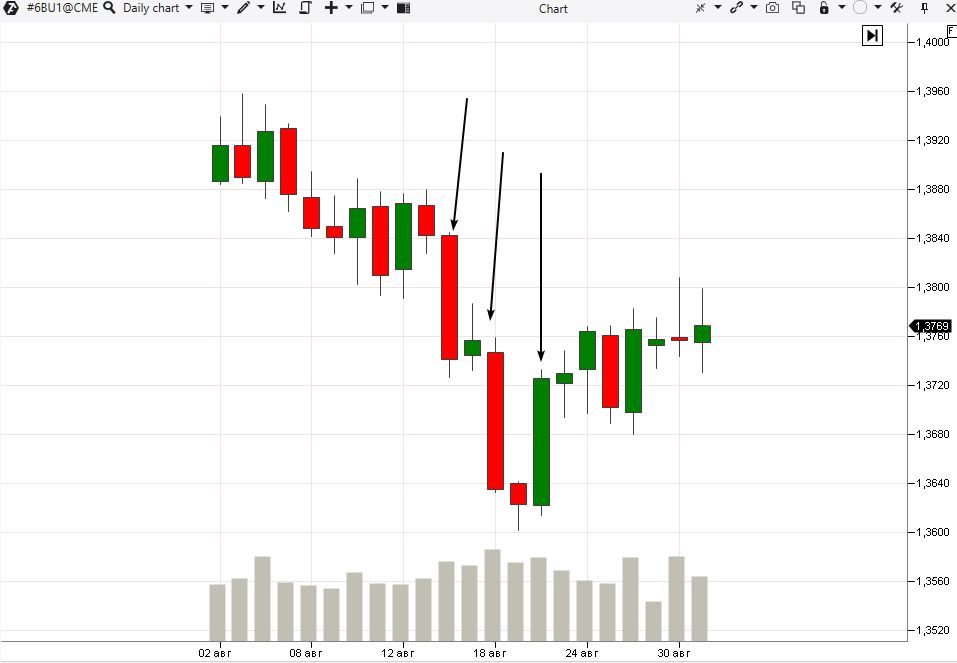

Example. The picture below shows a daily chart of the British pound futures contract prices as of August 2021. If we speak about the currency rate volatility, the most volatile were August 16, 18 and 22 (these days are marked with arrows).

It is not surprising that volatility of currencies, stocks and other assets is often considered as an investment risk indicator. Besides, according to a widely held opinion:

- low volatility is connected with security and predictability of results;

- high volatility points to a danger and negative consequences.

Although high volatility can be a sign of problems, it is nearly inevitable in long-term investing and, in fact, can be one of the keys of investment success.

Compare it to riding a bicycle.

If you ride a bicycle, a safe journey is never guaranteed.

Sudden minor fluctuations are an integral part of a bicycle ride and, usually, they pass unnoticed. However, if you suddenly turn around to bypass an obstacle, it will become more difficult to adjust your route, which will increase the probability of losing your balance, falling and hurting yourself.

Some routes have less turns than others. Any specific route risk assessment and preparation of the scheme of its most dangerous turns is how investors assess and measure volatility.

And, which is even more important, understanding volatility can help you in making decisions on when, where and how to invest.

TYPES OF VOLATILITY

There are two types of market volatility:

- Historical volatility, which allows making observations by looking back.

- Implied volatility, which allows making forecasts by looking forward.

Historical Volatility (HV), as the term suggests, deals with the past. It is identified by observations of the past time period asset price values and it shows how strongly its price has deviated from its average value.

If historical volatility grows, it is a reason for concern, since it can point to a fact that something has happened to an asset or will happen in the nearest time. In case it moves down, it means that the situation comes back to a regular state and is stabilized.

Implied Volatility (IV) deals with the future and is more complex. It is a forecast of the future asset activity based on the prices of its options (what options are).

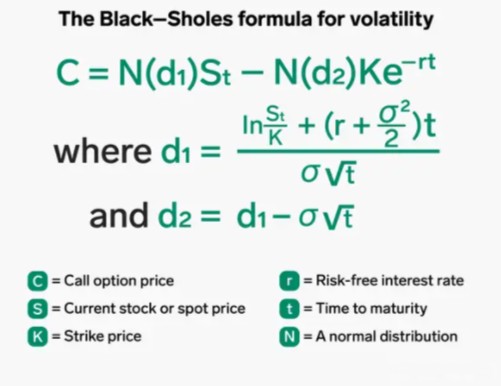

5 indicators are taken for calculating implied volatility: the option market price, underlying asset price (spot price), strike price, time to maturity and risk-free interest rate.

The Black-Sholes formula is used for calculating implied volatility:

Both types of volatility (HV and IV) are expressed both in percentage and standard deviations (plus or minus). If you say that standard deviation of XYZ stock is 10%, it means that the stock can either gain or lose 10% of its total value. The higher this number, the more volatile the stock is.

HOW IS THE MARKET VOLATILITY MEASURED?

Market volatility is measured by means of identifying the price change standard deviation for a certain period of time. The statistical concept of standard deviation allows seeing how something differs from an average value.

We will show you how to identify volatility through an example.

Task. To calculate volatility of XYZ stock for the past four days. The stock prices are shown below:

Day 1 – USD 10.

Day 2 – USD 12.

Day 3 – USD 9.

Day 4 – USD 14.

The volatility calculation formula will become clear from the following solution.

In order to calculate the price volatility, we need to take 6 simple steps.

Step 1. Calculate an average price:

USD 10 + USD 12 + USD 9 + USD 14 / 4 = USD 11.25

Step 2. Calculate the difference between each price and average price:

Day 1: 10 – 11.25 = -1.25

Day 2: 12 – 11.25 = 0.75

Day 3: 9 – 11.25 = -2.25

Day 4: 14 – 11.25 = 2.75

Step 3. Raise each difference from the previous step to the square:

Day 1: (-1.25) squared = 1.56

Day 2: (0.75) squared = 0.56

Day 3: (-2.25) squared = 5.06

Day 4: (2.75) squared = 7.56

Step 4. Sum up squared differences:

1.56 + 0.56 + 5.06 + 7.56 = 14.75

Step 5. Calculate dispersion:

Dispersion = 14.75 / 4 = 3.69

Step 6. Calculate standard deviation:

Standard deviation = the square root of 3.69 = 1.92

Standard deviation shows that the ABC Corp. stock price usually deviates from the average stock price by USD 1.92. This is the solution to the task.

Standard deviations are important because they do not only tell you how much a value can change, but they also provide the ground for a probability of its occurrence. Values will be within one standard deviation from an average one in 68% of cases, within two in 95% of cases and within three in 99.7% of cases.

Traders calculate standard deviations of market values based on trading values at the end of the day and intraday volatility or forecasted future value changes during a trading session.

Outside market observers, perhaps, are better acquainted with the last method, which is used by the Chicago Board Options Exchange volatility index that is usually called VIX.

VIX VOLATILITY INDEX

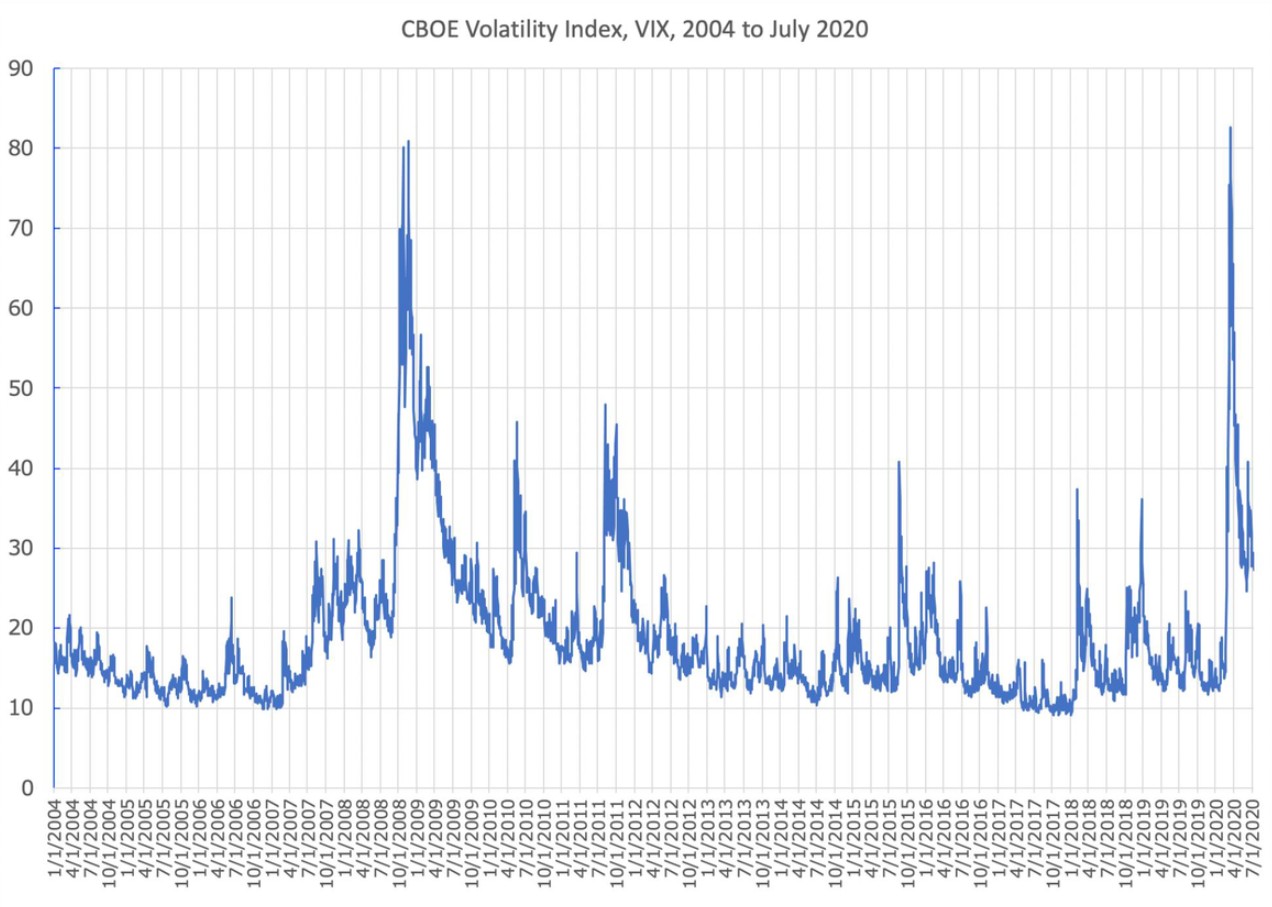

VIX is the most well-known indicator of stock market volatility.

This index, developed by the Chicago Board Options Exchange (CBOE), is usually called the ‘fear gauge’ of the stock market because it represents a snapshot of the market forecasts with respect to volatility for the next 30 days (which are recalculated later on an annual basis to get a set of forecasts for the next 12 months).

For this purpose, VIX ‘collects’ PUT and CALL option prices for the value of the S&P 500 index, which is often used for presentation of the market as a whole. After that, these numbers are weighed, averaged and passed through the formula, which shows how confident investors are.

In simple words, VIX shows how strong traders expect that the S&P 500 price will move up or down the next month. Thus, VIX is a well-reasoned indicator of stock volatility.

As a rule, the higher the VIX, the more expensive options are. Why?

Because the options, which are called PUT, represent agreements for traders on selling an underlying asset, S&P 500 in this case, at a certain price after a certain period of time. These PUT options become more desirable (and more expensive) with an increase of a probability that the S&P 500 price will drop. If the S&P 500 price will drop below the selling prices of their PUT options, they will make profit.

Thus, the growing value of these PUT options becomes an indicator of expected market falls and, as a consequence, volatility.

Historically, standard VIX levels are within the range of up to 20, which means that the S&P 500 index will differ from its average growth rates for not more than 20% most of the time.

However, it can reach 80 in times of panic. It happened twice since 2004:

- during the 2008 financial crisis;

- in 2020 during the panic which was caused by the spread of coronavirus.

If the VIX is too low, the profit-making potential is small. On the other hand, if the VIX index is higher than 30, as a rule, it is also believed to be a challenging time for investments.

Of course, if other investors run away from the market, it can become a good time for those with strong nerves to jump up and make some money – hence comes the phrase: ‘It’s time to buy when VIX is high’.

HOW HIGH IS THE STOCK MARKET VOLATILITY?

Most of the time, the stock market is rather calm and the periods of high stock volatility are short.

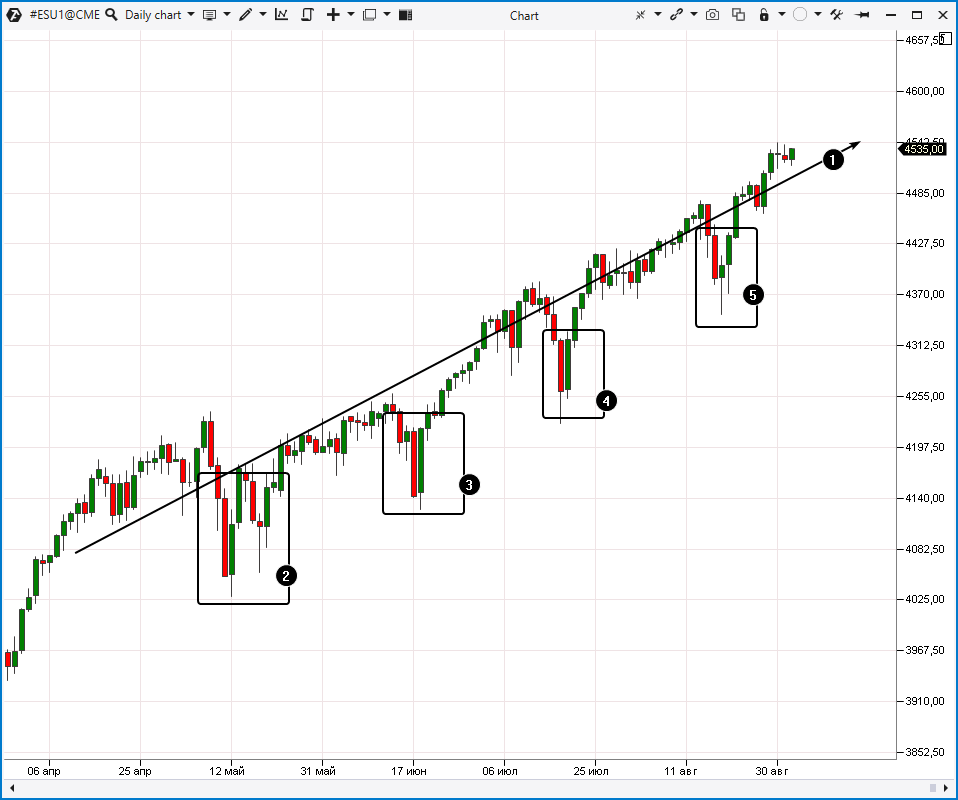

In general, up movements are usually connected with low volatility (1) and down movements are usually accompanied by unpredictable price fluctuations (2, 3, 4 and 5) as it is shown in the ES futures chart below.

It should be expected approximately once in five years that the market will fall by about 30% which is, roughly speaking, an average performance.

Besides, implied volatility for an average stock is about 15%. That is why, be careful if you see an asset with IV more than 20%.

Moreover, there is always a probability of extreme splashes of volatility like the stock market fall in 1987 when the Dow Jones Industrial Index fell by 22.6% during one day.

There are a big number of ways to respond to a sharp change of your portfolio value. However, one thing can be stated for sure: experts do not recommend panic selling after a strong market fall.

According to the Schwab Center for Financial Research analysts, during the periods starting from 1970, when stocks fell by 20% and more, they brought the biggest profit during the first 12 months of recovery.

HOW TO COPE WITH MARKET VOLATILITY

If market volatility makes you nervous, apply one of the following approaches:

- Remember your long-term plan

Investing is a long-term game and a well-balanced diversified portfolio is built with consideration of such periods.

- Consider market volatility an opportunity

For example, you could have bought the S&P 500 index stock (at the time of the bearish market in 2020) at approximately one third of the price, at which it was quoted a month before, after a more than 10-year stable growth. By the end of 2020, your investments would grow by approximately 65% from the year’s low and 14% from the year’s beginning.

- Create an emergency stock

Volatility of cryptocurrencies, stocks and futures is not a problem if you do not need to close your position. That is why it is important for investors to have a reserve fund, equal to three-to-six month living expenses.

- Rebalance your portfolio if required

When rebalancing, sell a part of the asset type, which took a far too big portion of your portfolio. Use the revenue to buy more asset types, the share of which became far too small. It is recommended that you rebalance your portfolio when the breakdown deviates by 5% or more from the initial correlation.

HOW TO COPE WITH MARKET VOLATILITY

You can think that risk and volatility are the same, but it is not so.

Volatility is an assessment of the price movement, which includes both losses and profits, while risk is exceptionally a loss indicator.

It is obvious that risk and volatility are connected. Also, volatility is a useful factor when you consider the issue of how to reduce risks. However, the mixture of these two factors can seriously limit the profit-making capabilities of your portfolio.

VOLATILITY INDICATOR

Many well-known indicators can be used for measuring volatility, since it is connected with the price deviation from average values. It is also true for Bollinger Bands – volatility increases if the bands expand.

However, the most widely-used indicator for these purposes is ATR. The ATR volatility indicator in the ATAS platform is added to the chart similarly to all other indicators:

- open the indicator manager in the chart window (or press Ctrl+I);

- find Technical Indicators / ATR in the list of indicators;

- press Add and OK.

The ATR (Average True Range) volatility indicator measures the difference between high and low and then smooths the result. That is why, ATR is universal and can measure volatility of currency pairs (for example, RUB/USD volatility), stocks, cryptocurrencies and any other asset for any period.

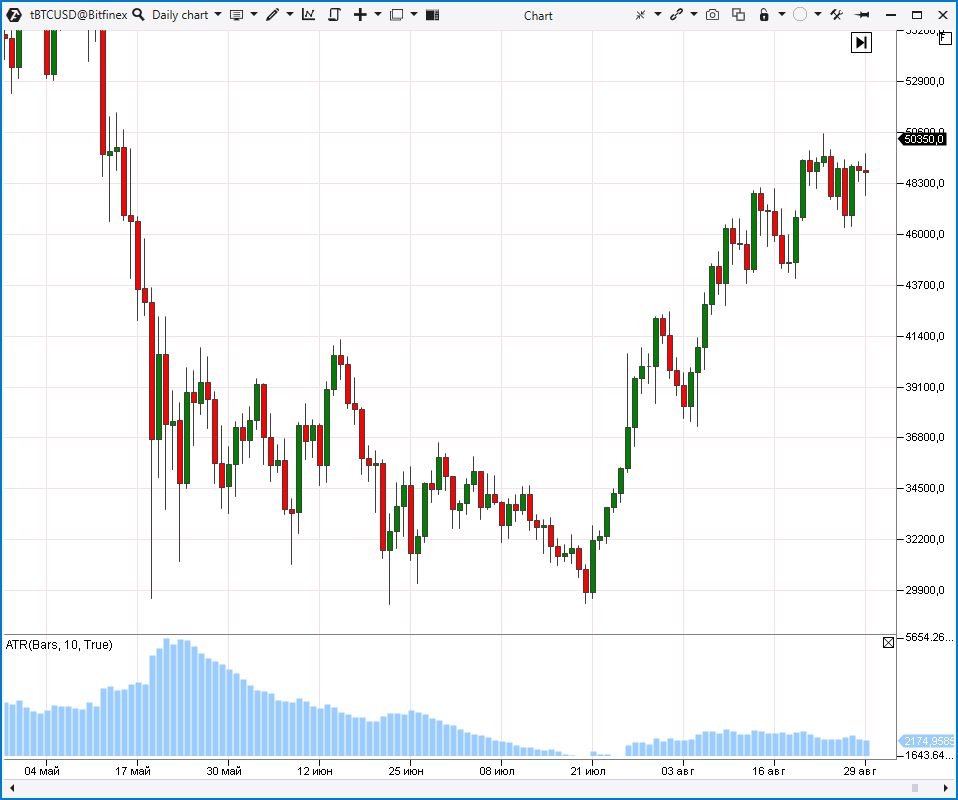

The above picture shows that volatility was extremely high in the middle of May 2019 during the fall of cryptocurrencies.

![]()