WHAT IS THE 50% RETRACEMENT

⇒ Warning. Any strategy does not guarantee profit on every trade. Strategy is an algorithm of actions. Any algorithm is a systematic work. Success in trading is to adhere to systematic work.

Let’s suppose that some factors made the price rise from 100 to 110 dollars, for example, it happened due to a release of positive reporting. This is an impulsive move.

The 50% retracement is a subsequent price decline to $105 from a $110 peak. That is half the impulse. A trend is likely to resume after the 50% retracement.

Usually it works like this:

- volumes decrease during a decline;

- the price decreases more slowly during the retracement compared to the increase.

This phenomenon was discovered more than 100 years ago. No wonder that the 50% level of the impulse is described as a very important thing in numerous books on technical analysis for beginner traders.

HOW TO USE THE 50% LEVEL TO MAKE A PROFIT

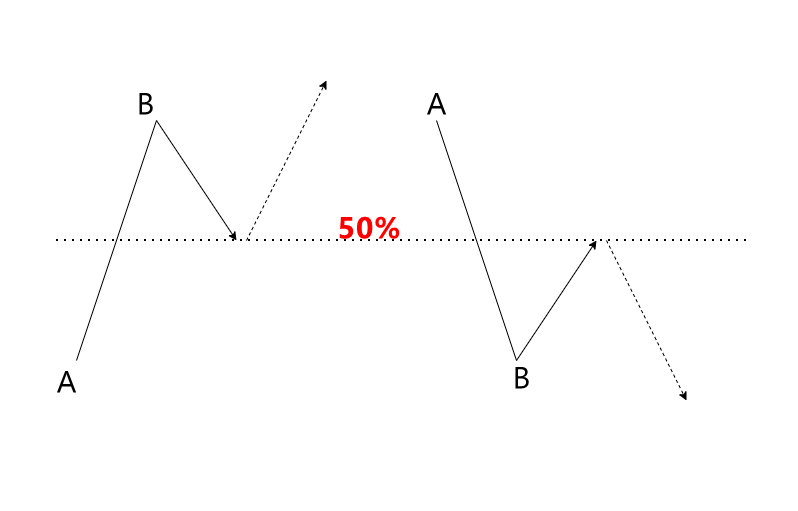

The principle is simple (see figure below):

- identify a bullish (bearish) impulse А→В;

- wait for the 50% retracement in the opposite direction;

- enter long (or short), it is highly desirable to receive confirmation and follow the risk policy.

It is done in anticipation of an impulse (trend) resumption after a break.

There is plenty of evidence on any chart that the 50% retracement is very effective: from minute to weekly, from stock to cryptocurrency.

But why does this level work? What is the internal reason that explains the reversal which sometimes occurs with the pinpoint accuracy?

THOUGHTS ON THE NATURE OF THE PHENOMENON

We do not claim to be the ultimate truth, we will only present three hypotheses. Which one is the most plausible is up to the reader. After all, every trader is responsible for their own actions.

Hypothesis 1

The 50% level works because it is a Fibonacci level. The Fibonacci numbers describe proportions that are found everywhere.

Hypothesis 2

A situation that occurs on the exchange is similar to a typical bargaining between two people:

— I’ll buy your car for 20 thousand.

— I will sell for 30 thousand.

— Well, what about 25? Let’s meet halfway.

— Okay, deal.

If the seller is confident in the quality of the product and the demand for it, he is unlikely to lower the price below 25. Or below 26. Or he will not make any concessions at all. This can explain retracements which are less than 50% and typical for strong trending markets.

Hypothesis 3

Let’s imagine that the market is a universal mechanism which is designed to “take money in a relatively honest way” from a large number of emotional private investors who dream about getting rich quickly and without any effort.

Then the motivation for the price movement is to cause losses to as many similar market participants as possible:

- A retracement begins when too many market participants have entered the direction of the impulse move. The purpose of the retracement is to make them feel pain and anxiety.

- The retracement is over when the evil goal has been reached. Assuming that the trend has reversed, they enter a position in the direction of the retracement and end up suffering losses when it ends.

Therefore, 50% is a kind of balance that prevents those who trade with the trend and those who trade with the retracement from making a profit.

EXAMPLES ON CHARTS

Using professional instruments of the ATAS platform, let’s analyze some examples from different markets to identify:

- impulse moves,

- subsequent retracements to the 50% level;

- confirmations on lower time frames to enter a position.

We are going to use the Fibonacci levels drawing object. Use the hot key F8 to call it.

Example 1. Futures on the S&P-500 stock market

The hourly chart below (August-September 2022) shows:

- On day A, there was an impulsive decline in the market with a breakout of the previous day’s low;

- On the following day B, there was an increase which was 50% (as marked with arrow 1) of the fall of day A. The tops of day B are the time to enter a short position.

- Some time later, there was an impulsive rise in the same market on day C. The bulls showed the ability to raise prices from multi-day lows and break through the previous day’s highs.

- On day D, there was a rather aggressive decline that was 50% (as marked with arrow 2) of the C-day rally. The low of the D-day is the time to go long.

Let’s say you notice a bearish impulse on day A. On day B, you mark off the 50% level of the impulse to wait for a retracement to the 50% level and enter a short position.

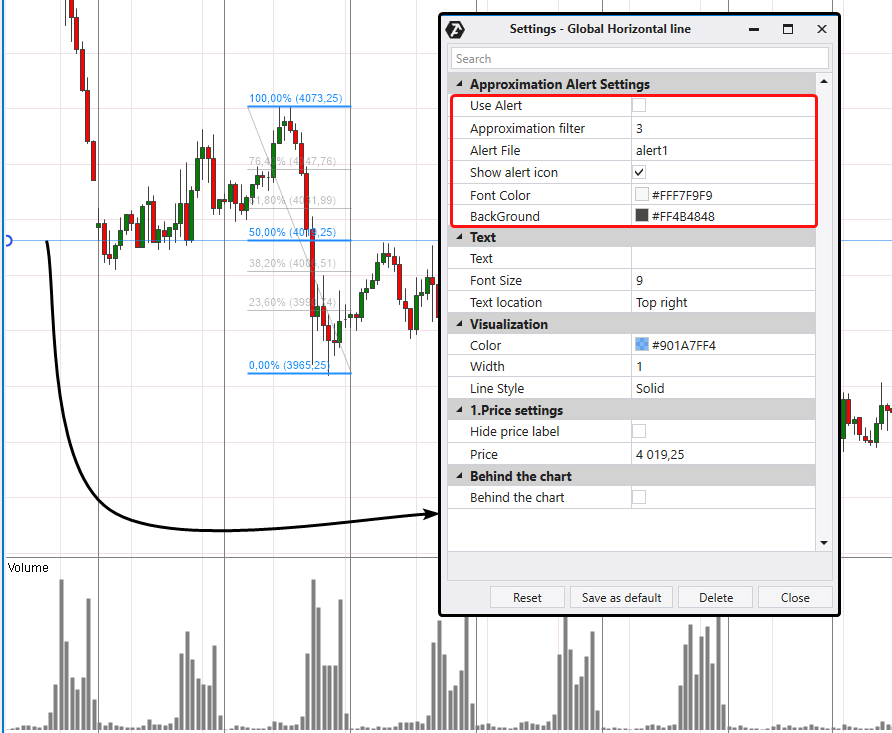

To make it more convenient, you can set an alert for the created level so that you do not miss the moment when the price approaches the level. This feature of the ATAS platform saves traders time and effort by allowing them to track price movements on multiple charts at the same time.

To set an alert:

- build the level (for example, by pressing the F4 key);

- right-click on the level, set up alerts in the level settings (as shown in the picture below).

You can learn more about alert settings in the Knowledge Base or by contacting the support.

Let’s imagine that today is the beginning of day B and we want to sell from around 4020 level.

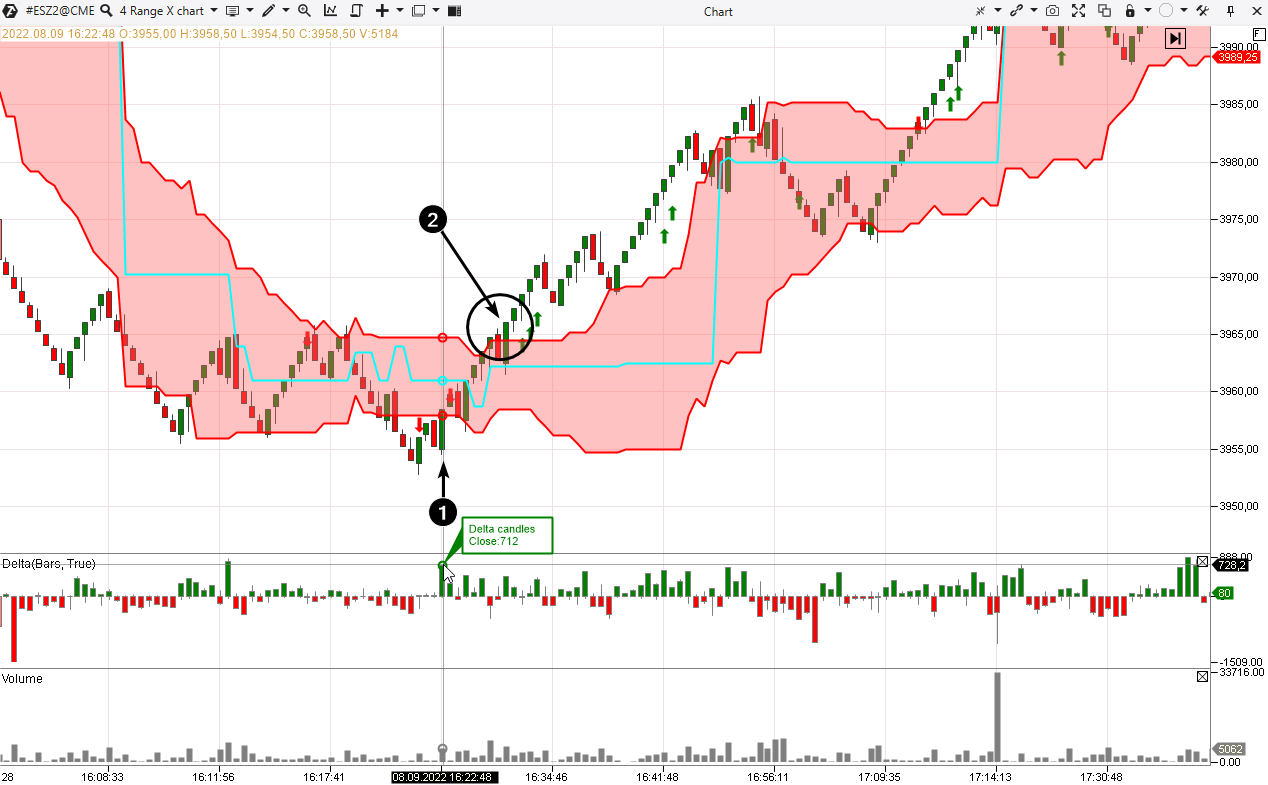

Let’s switch the chart to Range X mode – ES futures have very different volatility during the day, but range charts smooth it out. We will also add the Dynamic Channel and the Delta to the chart.

The chart above shows the first of two bullish retracements to the 4020 level which is the 50% level of the bearish impulse from the previous day.

The price dynamics forms an ABCD pattern of falling highs and lows, which might be a sign of weakening demand as the price approaches the 50% level. The weakening is also indicated by the fact that the candles are formed not above the channel (as it happens on the left side of the chart), but inside it.

There are two setups for entering the short position (marked with black arrows):

- A bearish engulfing candle with a spike in volume.

- A bearish breakout of the lower line of the Dynamic Levels Channel indicator.

The chart below shows a moment when the price approaches the 4020 level for the second time:

There are three setups for entering a short position from the 50% level on a higher time frame:

- A bearish candle with high volume, negative delta, and a long upper tail indicates that the bears have an advantage.

- A bearish breakout of the lower line of the Dynamic Levels Channel indicator.

- A local 50% retracement of the bearish A→B impulse.

For competent risk and capital management, we suggest thinking about an idea of setting stop-losses based on the setup on the lower time frame and take-profits based on the perspective on the higher one.

The Short Position drawing object will help you evaluate the ratio of a relative risk to a potential reward (R:R). If the stop-loss is placed above the dynamic channel on the lower time frame, and the take-profit is placed on the update of the impulse’s low, then the ratio will be more than 4:1.

The R:R ratio can be improved if you find a take-profit level in anticipation of an even more powerful trend resumption.

You can use alternative options or activate protective money management strategies built into the ATAS platform.

The main thing is not to let the losses grow if you do not see a trend resumption after the 50% retracement of the impulse move.

Example 2. Futures on the S&P-500 stock market (entering a long position)

Let’s have a look at a setup for entering a long position on day D and use the same chart settings for the lower time frame.

Knowing about a strong rally on the previous day C, we can expect a 50% retracement to go long when the appropriate signals are received.

The chart provides two such signals (marked with black arrows):

- A bullish engulfing candle with a sharp spike in positive delta close to the 50% retracement level which is around the 3939 area in this case.

- A bullish breakout candle of the dynamic channel.

Example 3. Bitcoin market

There have been several disappointing price drops in the cryptocurrency markets in 2022. In particular, the June decline of A → B when the cost of bitcoin fell sharply below 20 thousand dollars per coin.

We can assume that this fall caused a lot of panic. Traders were actively entering short positions, the news was bad, and even long-term holders were getting rid of bitcoins.

When the panic selling climax was over, the price began to gradually increase towards the 50% level of the A→B impulse (around $25k area).

As the price approached 25k, the long upper shadows on daily candles signaled sellers’ activity.

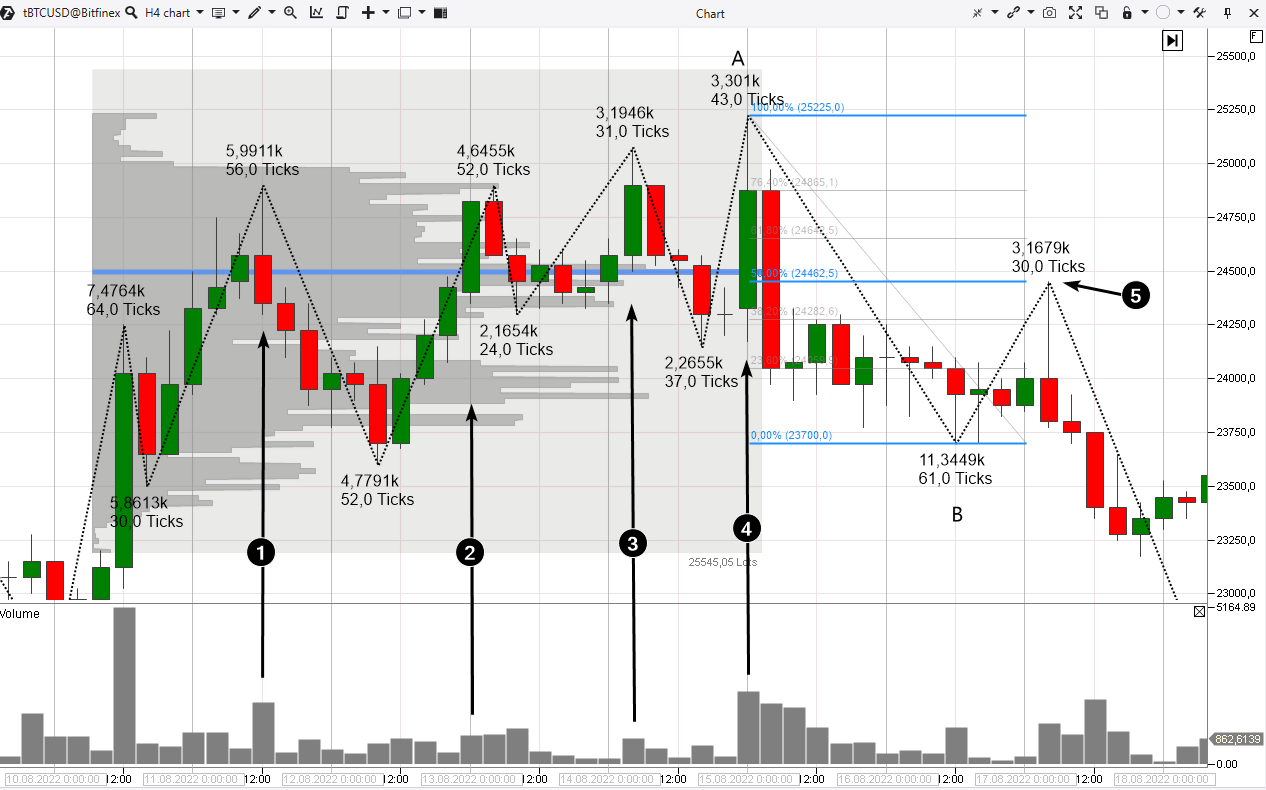

Let’s switch to the 4-hour time frame to find confirmation of a bearish reversal:

In this case, the formation of a reversal from the 50% retracement level took several days. The TPO and Profile drawing object has been added to the chart, it covers events preceding the reversal.

The black arrows show:

- A bearish candle that indicates the appearance of sellers. It is shown by a spike in volumes with closing at the lows and a long upper shadow. Later, the maximum volume level was formed at the level of the candle’s body.

- An attempt of a bullish breakout of the previous top. The growth is uncertain because volumes are relatively small. The following two bearish candles, which completely “engulfed” the bulls’ effort, prove the failure of the attempt.

- Another unsuccessful attempt – volumes are small during the growth. The next candle engulfs the bullish progress that has been made.

- Another bullish candle. It has high volumes – let’s say they reflect the bulls’ effort. But what progress will they make? Closing in the middle of the candle and below previous highs. The next candle is a bearish engulfing one. The chart shows that the bulls fail to succeed over and over again. A wide swing, a spike in volumes on candle number four and the subsequent bearish engulfing candle indicate a shift in sentiment.It is also a sign that the market is turning down from the 50% retracement level which is seen on the daily chart. The price is holding below the high volume level, this is a confirmation of the buyers’ weakness. The bears have made significant progress on wave A→B (which is noticeable by the volume of 11.3k and the height of 61 ticks) – another confirmation.

- A sharp retracement to the 50% level (which, by the way, coincides with the maximum volume level) – an opportunity to enter a short trade. You can switch to an even lower time frame in order to accurately choose the right moment

BT

![]()