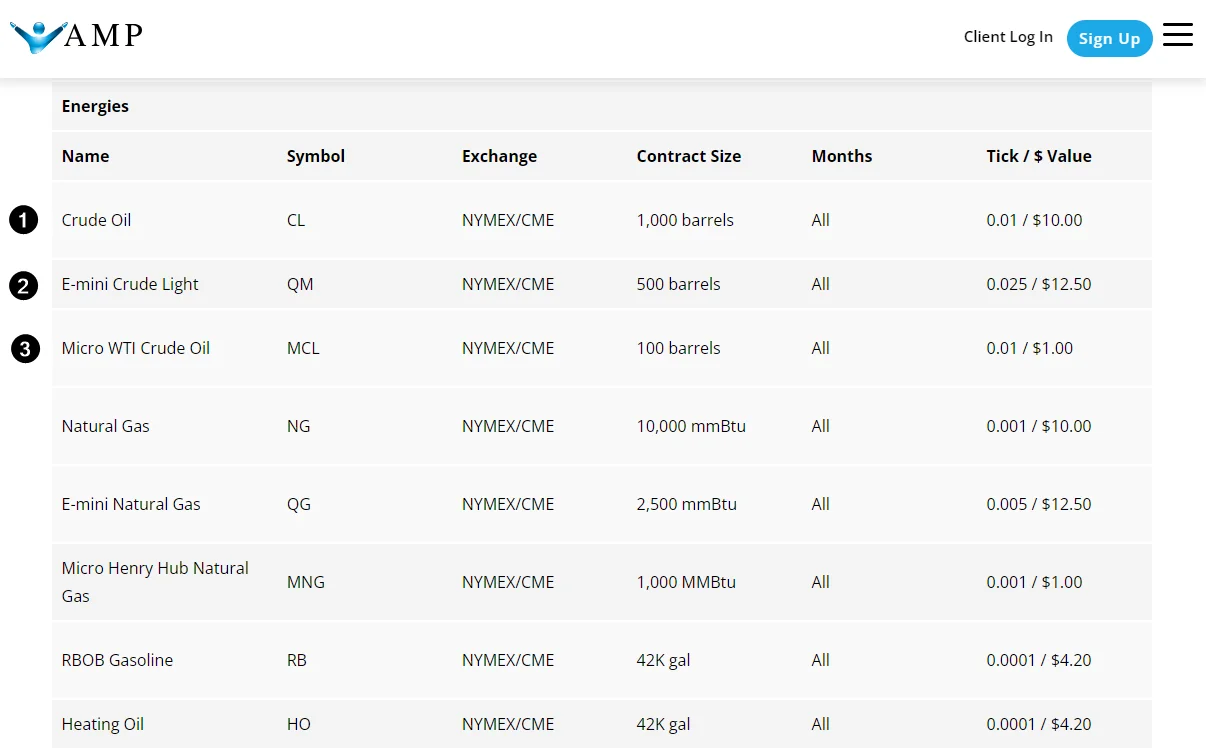

Understanding the standardization of contracts used in crude oil futures markets is fundamental to planning a trading strategy. Let’s explain the basics using an example.

The difference lies in:

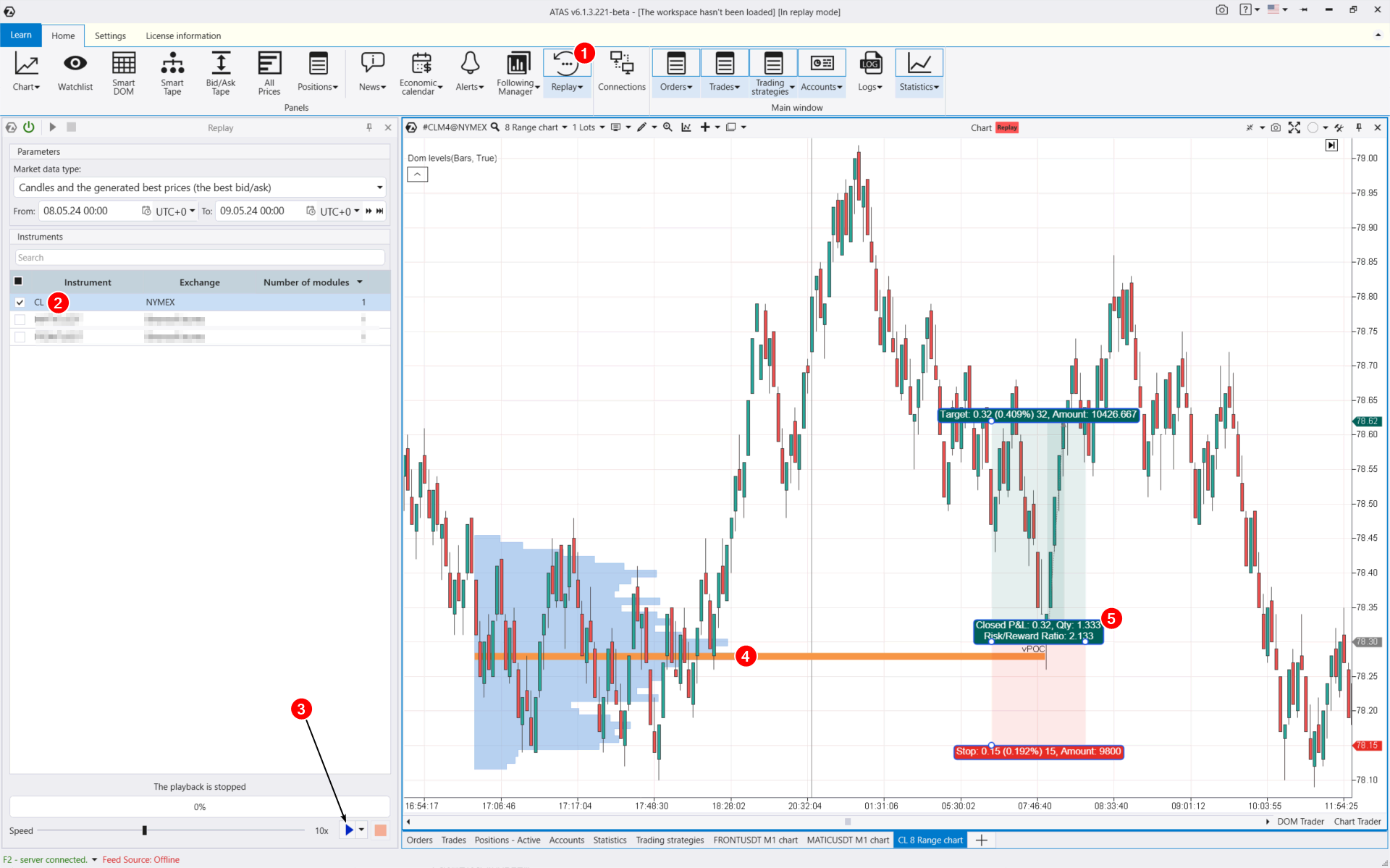

- the contract size: for example, 1 standard CL contract represents 1,000 barrels, while the micro contract is 10 times smaller;

- the tick value: in 1 standard CL contract, a price change of 1 tick results in a contract price change of $10, while in the micro contract it is 10 times smaller.

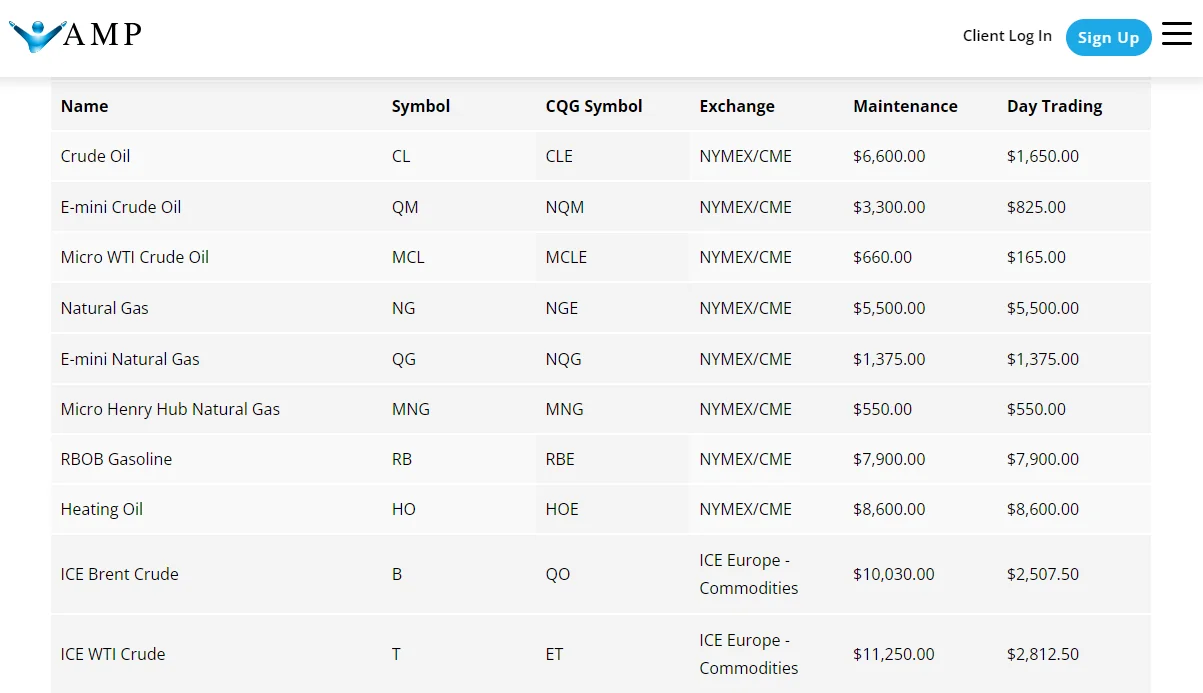

More important information for planning your crude oil futures trading can be found on the page with margin requirements (Futures Margin Calculator List).

As seen from the table above, to trade crude oil futures:

- with overnight positions: for a standard CL contract, you need to have at least $6,600 in your account; for a micro MCL contract, 100 times less;

intraday: for a standard CL contract, you need to have at least $1,625 in your account; for a micro MCL contract, only $165. - Of course, the broker has the right to change the terms of service, and the current requirements should be verified when necessary. However, the information on the specifications pages allows you to assess how capital-intensive crude oil futures trading is.

In fact, if a trader has a few hundred dollars available, they can already try trading micro-futures, which have minimal requirements for intraday crude oil trading. Moreover, if the trader has access to futures on stock indices under the brokerage service conditions, they are likely to have access to crude oil futures as well.