BAR-BY-BAR ANALYSIS OF THE S&P-500 INDEX FUTURES MARKET

⇒ Warning. Any strategy does not guarantee profit on every trade. Strategy is an algorithm of actions. Any algorithm is a systematic work. Success in trading is to adhere to systematic work.

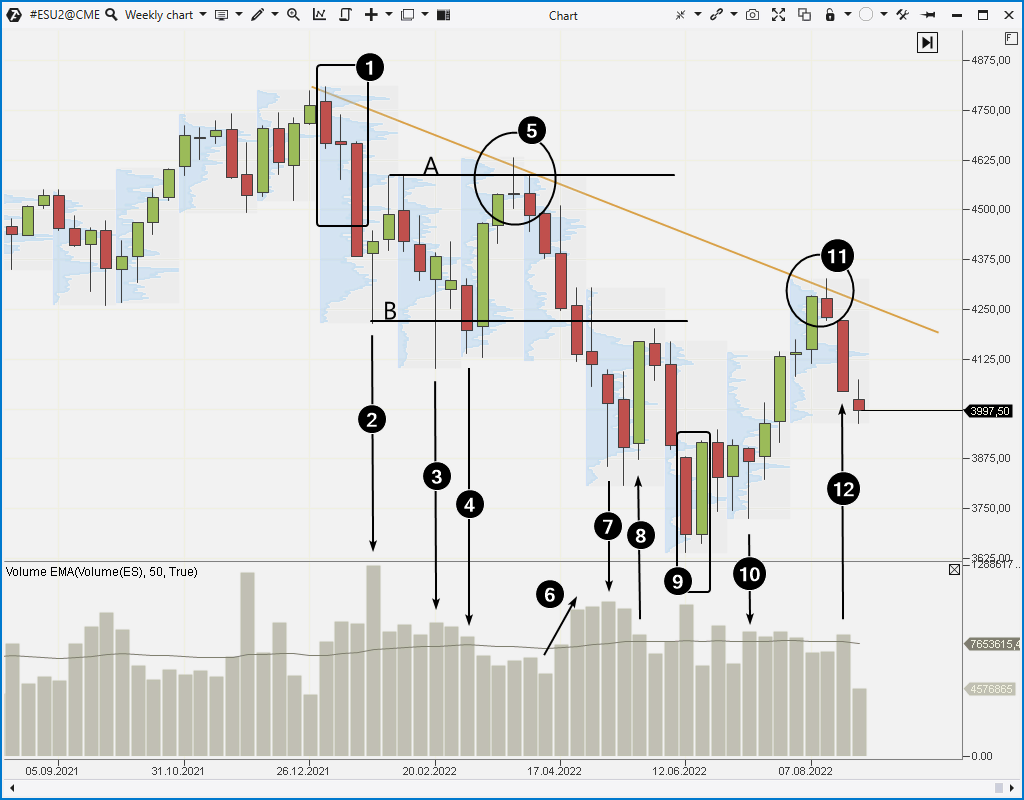

To give you a better idea of how to use bar-by-bar analysis in practice, let’s look at an example of reading a chart (weekly period) of the S&P-500 index futures market for the first eight months of 2022 (at the time of writing the article). Market profiles have been added to the chart.

Number 1 indicates three bearish candles – the year started in a negative way for the stock market. According to the statistics, it was one of the worst Januarys in the history of the stock market. Growth of volumes (but not extreme) amid price decrease in bar-by-bar analysis means selling pressure.

Number 2 indicates an extreme spike in volumes on a candle with a long lower shadow. This can be interpreted as the appearance of buyers. They decided to take advantage of panic that broke out as futures declined under the lows of the fall of 2021. According to buyers, the market could provide an opportunity to sell contracts at a higher price later.

Having the selling pressure (number 1) and the appeared buyers (number 2), we can assume that the market will achieve some balance (AB range). Such consolidations with false breakouts usually form after a sharp spike in activity (in this example, a sharp decline in January 2021).

Number 3 indicates another activity of buyers who pushed the price up, it means that demand is present only near level B.

Number 4 indicates a bearish candle with exhausting volume. Selling pressure is insignificant, which increases the likelihood of an upward impulse (it happens on the next candle).

Low trading volumes (5) near the upper limit of the AB range can be interpreted as market indecision. The rise to level A is approximately equal to 50% of the decline from the high to level B. Rising prices cooled buyers’ willingness to pay for contracts. The subsequent decline on growing volumes (6) confirmed the dominance of sellers.

When the price declines to the support level on growing volumes, it is a sign that the support level will be broken. After pushing the market through the support at level B, sellers met the activity of buyers around 3675, it is indicated by a candle with a long lower shadow and high volume marked with number 7. It is followed by a bearish candle which probably reflects the weakening of the selling pressure – we can see a false bearish breakout about the low of candle 7.

Buyers decided to take advantage of the fact that sellers’ activity was exhausted – a bullish candle (8) appeared on the chart. But the next narrow candle with low volume shows another period of indecision (a similar one was marked with number 5). A bearish exit on rising volumes from a period of indecision suggests that the market will reach a new low.

Very large volume is recorded on a bearish candle 9. At first glance it may indicate sellers’ pressure but if sellers controlled the market, why did the next candle close higher? A bullish engulfing pattern, where the bearish candle has high volume, suggests that major traders used the situation to buy back the panic. Apparently they assumed (using insider information?) that the market could recover during the corporate reporting period.

Number 10 indicates a candle which has a “bear trap” at its low. Similar traps often form at the very beginning of a bullish impulse.

Strong corporate reports raised the value of the S&P-500 index stocks. Optimism returned to the market and to the media headlines. But low volumes (11) indicate a new period of indecision, and a bearish way out of it is if sellers take the initiative.

When reading a weekly chart bar-by-bar, the situation may not always be obvious. But the more you practice on history, the more ideas you will have about what position to take at one point or another. Cluster charts and useful indicators of the ATAS platform will help you by providing more detail.

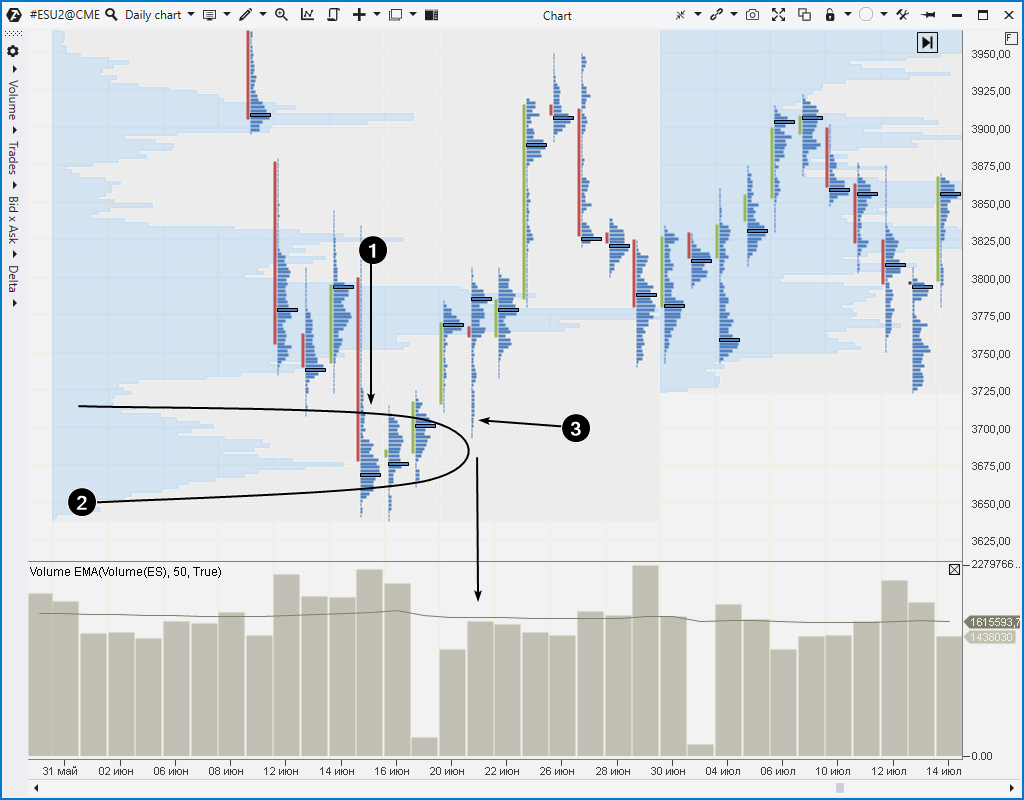

For example:

- A sharp decline and a breakout of the previous low caused panic. But the thickening of the profile at the bottom of the candle suggests that a major trader absorbed the flow of panic selling, created a long position and kept the market from falling.

- The thickening of the profile lasts for several days. An upward exit confirms bullish intentions of the major trader.

- A thin profile at the bottom of a low-volume candle tests the profile’s bulge, which indicates that the market is not interested in a decline.

BAR-BY-BAR ANALYSIS OF THE GOLD FUTURES MARKET

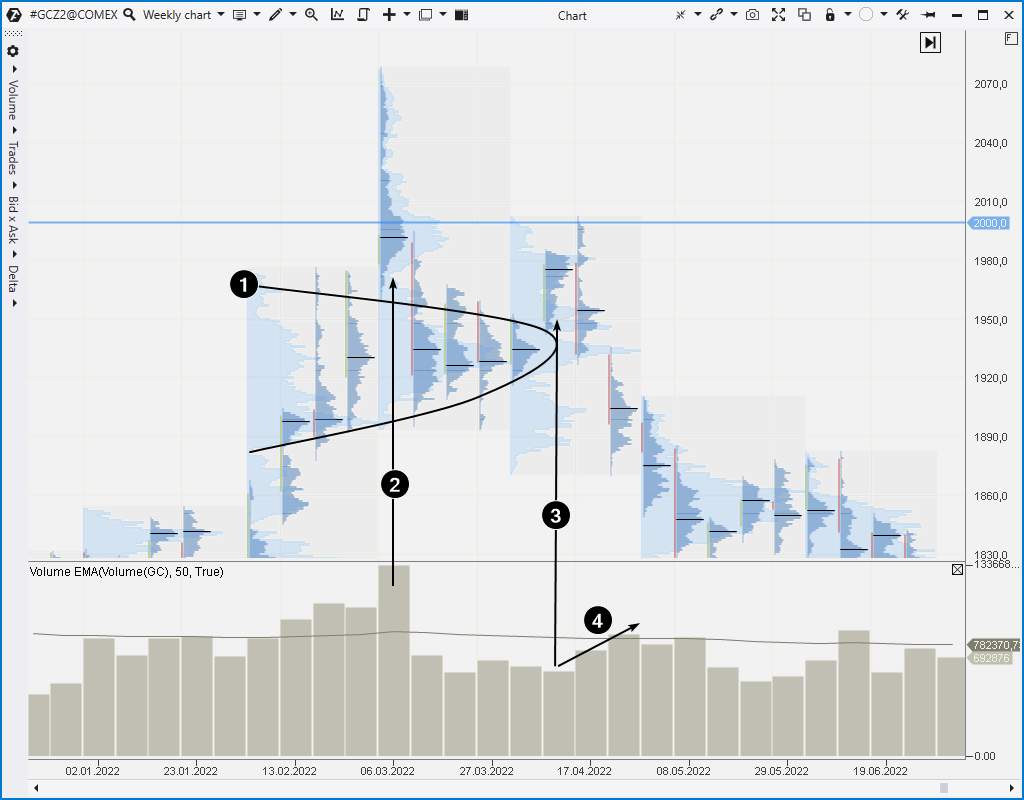

Finally, let’s analyze the situation in the gold market when the price fluctuated around the 2000 psychological level in the spring of 2022.

In the spring of 2022, gold futures quotes rose to the level of 2000. Daily levels of maximum volume and the market profile (1) show that the market equilibrium established around $1,930 per contract (one troy ounce).

A weekly chart shows two attempts to upset this equilibrium.

The first attempt (marked with number 2) is associated with the outbreak of hostilities in Ukraine. Investors were scared because of this news, and the price reached a maximum of $2,070 per contract and even rose a little higher. However, the price soon returned to the 1930 area. The fact that the price was not able to consolidate above the psychological level (as well as the thin profile and high volatility) indicates the extreme emotionality of the market, which, however, did not affect the real intrinsic value of gold.

The second attempt (marked with number 3) occurred on low volume. This is a sign of weak demand. Most likely, major traders were adding to their short positions around 1930 just before the Fed tightened their policy and a period of a strong dollar occurred. The second attempt looks like an upthrust which ends the distribution period and a test of the 2000 level. These signs of weakness confirm the subsequent decline in prices on growing volume (4).

BT

![]()